The continuing contention between Dogecoin (DOGE) and Solana (SOL) is heating up, fueled by contemporary market trends and data. Each cryptocurrencies maintain considered good points, nonetheless the demand remains: which one will present better returns?

Be taught also: Analyst: Dogecoin’s Reign as Meme Coin King is Ending

Dogecoin, regularly brushed aside as simply a meme coin, has confirmed a fashioned upward trajectory in contemporary weeks. Solana, known for its tempo and scalability, has been more unstable, with elevated highs and lower lows.

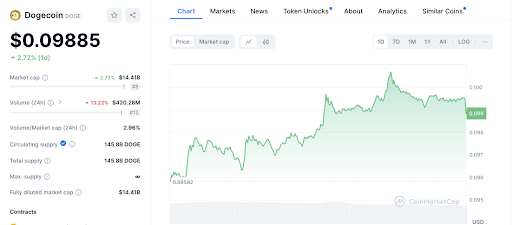

Over the past week, Dogecoin has experienced a slack upward thrust. As of this writing, DOGE has appreciated by 4.03% within the leisure 24 hours, reaching a impress of $0.09957, in accordance with Coinmarketcap. This amplify has met resistance on the $0.100 level, suggesting additional good points may perchance be not easy.

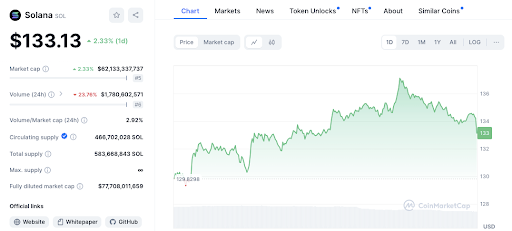

Solana also seen a 3.64% boost, reaching $134.31. It too confronted resistance at $136, main to a limited pullback.

DOGE’s contemporary impress motion reveals a fashioned climb, nonetheless it faces resistance on the psychological barrier of $0.100. The worth has pulled back from this point several times, indicating a battle to interrupt by.

Make stronger for DOGE looks to be solid around $0.095, where buying curiosity has been neatly-known. Nonetheless, a 9.54% drop in buying and selling volume means that the upward motion may perchance lack momentum. This decline in volume, in particular around resistance, indicators potential difficulties in surpassing the $0.100 designate with out a new inflow of traders.

Be taught also: Solana Meme Cash Face Market Headwinds

Solana’s upward hasten has also encountered resistance at $136, adopted by a pullback. Make stronger for SOL is stable around $130, where the worth has rebounded.

A predominant 21.60% decrease in buying and selling volume raises concerns about the sustainability of Solana’s contemporary good points. This drop in volume, in particular shut to resistance, means that SOL may perchance face challenges in pushing past the $136 level unless unusual buying curiosity materializes.

Technical indicators provide additional insights. The 1-week RSI for DOGE is at 43.41, nearing oversold stipulations nonetheless not rather there yet. This implies that while DOGE will be drawing shut a point where buying stress may perchance amplify, it hasn’t reached an oversold order. The 1-week MACD for DOGE, buying and selling below the signal line, implies potential immediate-term downward stress.

In distinction, Solana’s 1-week RSI is 48.12, indicating a fair space without signs of being overbought or oversold. The 1-week MACD for Solana will likely be below the signal line, suggesting some downward stress within the immediate term.

Disclaimer: The info presented on this text is for informational and academic functions handiest. The article does not constitute financial advice or advice of any kind. Coin Edition is to not blame for any losses incurred as a results of the utilization of sigh, merchandise, or companies mentioned. Readers are told to exercise warning before taking any motion connected to the company.