Whereas Bitcoin strikes sideways, Ethereum continues its upward push. At this level, while investors had been questioning how the market would switch, Coinshares published its weekly cryptocurrency characterize.

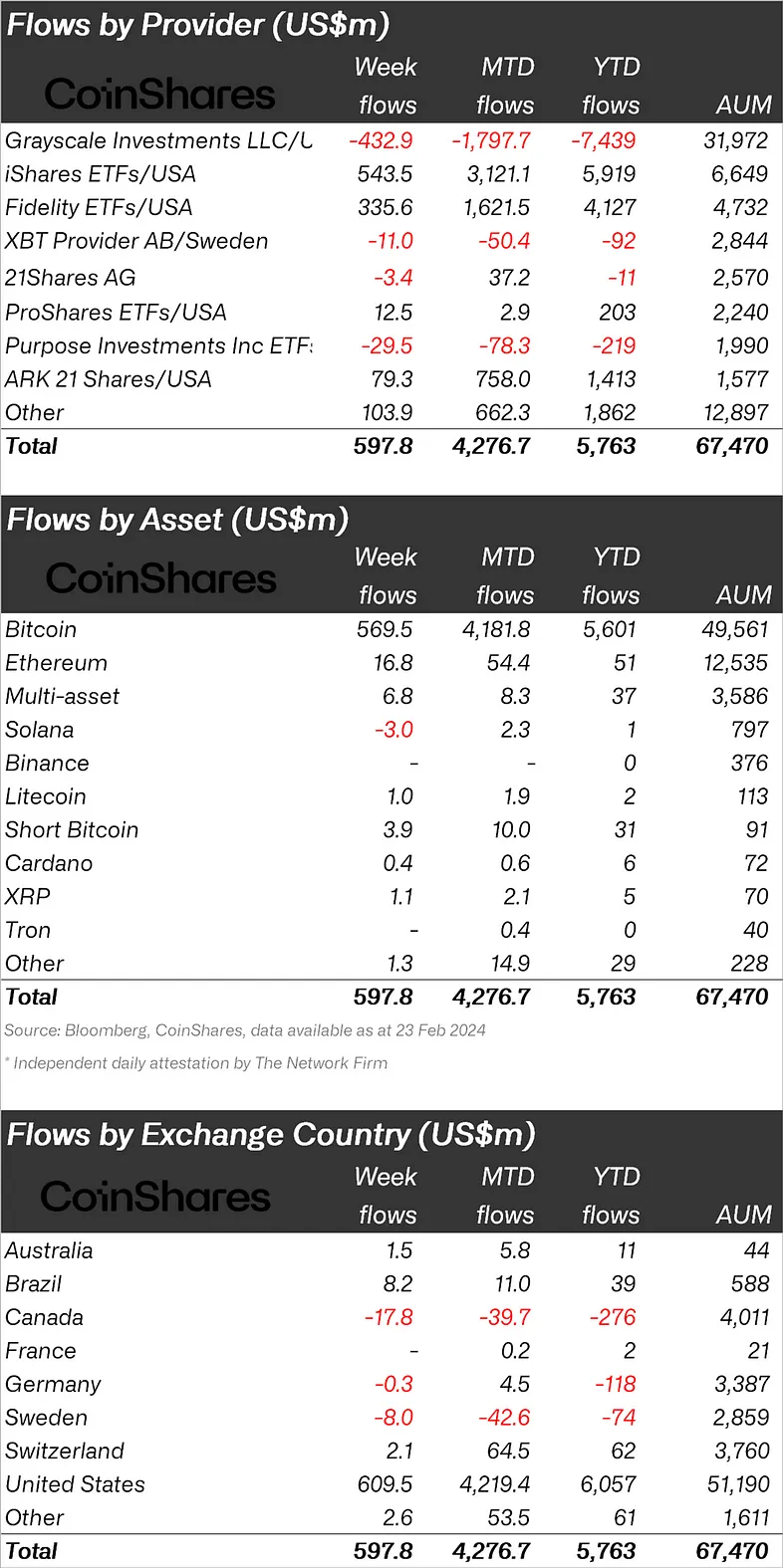

Declaring that it experienced an influx of $598 million into cryptocurrency funding merchandise excellent week, Coinshares acknowledged that the inflows continued and it used to be the fourth consecutive week.

When taking a hold at crypto funds personally, it used to be seen that most of fund inflows had been in Bitcoin.

BTC experienced inflows of $569 million, representing over 90% of all inflows, while the excellent altcoin, Ethereum (ETH), saw inflows of $16.8 million.

There used to be an influx of $3.9 million in the Bitcoin Immediate fund, which used to be listed to the decline of BTC.

Once we survey at other altcoins, Litecoin (LTC) experienced an influx of 1.0 million bucks and XRP experienced an influx of 1.1 million bucks; Solana (SOL) experienced a $3.0 million exit.

“Bitcoin saw inflows of $570 million excellent week, with three hundred and sixty five days-to-date inflows reaching $5.6 billion, nonetheless fresh mark will enhance hold ended in diminutive inflows into short Bitcoin positions, totaling $3.9 million.

Ethereum saw inflows of $17 million excellent week, while Chainlink and XRP saw inflows of $1.8 million and $1.1 million respectively. Most traditional outages at Solana likely impacted sentiment and indirectly resulted in an outflow of $3 million.”

When taking a hold at regional fund inflows and outflows, it used to be seen that the USA ranked first with an influx of 609 million bucks.

After the USA, Brazil ranked 2d with 8.2 million bucks.

In opposition to those inflows, Canada experienced an outflow of 17.8 million bucks.

*Right here’s now now not funding recommendation.