XRP is now trading at $0.55, following weeks of speculation and excitement from traders who anticipated a involving brand upward push. Alternatively, fear and uncertainty force the market, with Bitcoin and most altcoins trading at decrease ranges. This downturn has impacted investor sentiment valid thru the board.

The largest knowledge from Santiment reveals a noticeable substitute within the outlook of XRP holders. The optimism that after drove self belief is now fading, as most traders are sitting on unrealized losses. This shift in sentiment underscores the growing concerns surrounding XRP’s future, notably within the context of broader market challenges. With the market under stress, XRP’s possibilities appear extra and extra extra unsure.

XRP Holders Facing Unrealized Losses

XRP has demonstrated relative strength when put next with other altcoins, losing 13% from its August 24 high of $0.631. Alternatively, this decline has created substantial injure amongst traders, mirroring the broader market’s uncertainty.

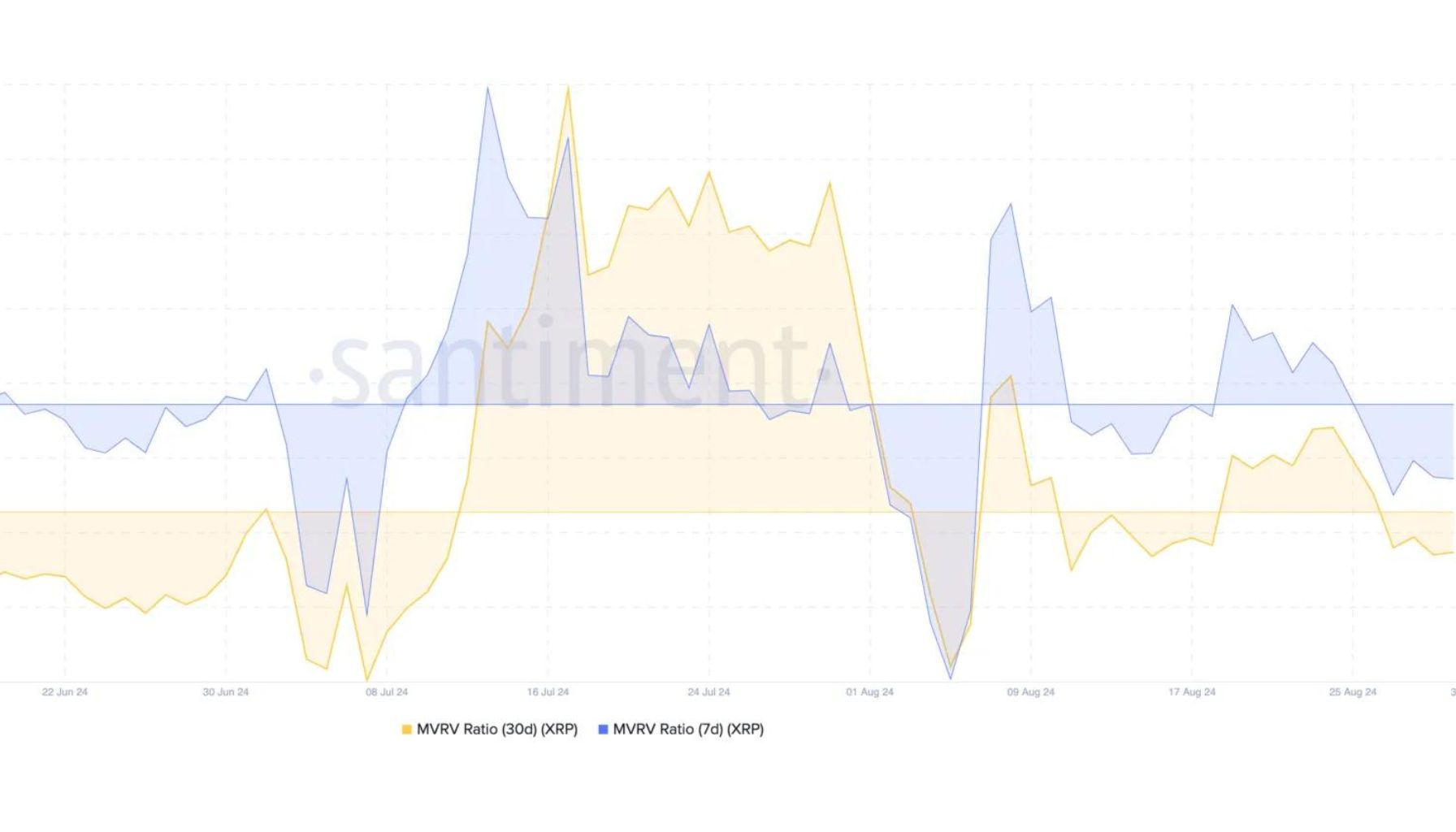

The largest knowledge from Santiment sheds light on the challenge, revealing that both the 30-day and 7-day Market Cost to Realized Cost (MVRV) ratios for XRP maintain became unfavorable. A unfavorable MVRV ratio implies that XRP is for the time being undervalued, that plot that, on common, if all coins were sold at this time brand, most traders would incur a loss.

This shift in MVRV ratios is major, because it means that the massive majority of XRP holders are indubitably liable to realizing unfavorable returns on their investments. The info reflects a broader pattern of investor caution, notably in light of the ongoing market volatility. Whereas XRP’s performance has been rather larger than many other altcoins, the unfavorable MVRV ratios highlight the growing concerns interior the investor neighborhood.

The declining MVRV ratios reduction as a major indicator of market sentiment, suggesting that the optimism surrounding XRP also can simply be waning. Traders are extra and extra extra cautious of the aptitude for extra declines, which would perhaps perhaps perhaps exacerbate losses. Whereas XRP has confirmed resilience, the present market circumstances and unfavorable MVRV ratios counsel that caution is warranted. The arrival days would perhaps be extreme for XRP holders as they navigate this tense market ambiance, weighing the aptitude risks and rewards of holding or selling their resources.

$0.55 Key Strengthen Must Relief For Consolidation

XRP is for the time being trading at $0.559, holding upright above a extreme enhance stage, the day to day 200 transferring common (MA), which sits at $0.5509. This stage is indispensable for hanging forward bullish momentum, because it has acted as a indispensable enhance, giving hope to traders expecting a brand restoration.

If the cost can preserve above this MA, it goes to also simply signal a doable continuation of the uptrend, reassuring bulls. Alternatively, if the cost drops under this key indicator, it would possibly perhaps perhaps trigger a extra decline, pushing the cost toward decrease rely on ranges.

The next major enhance to ogle may perhaps perhaps be round $0.Forty eight, a extreme stage for bulls to shield. Conserving above the 200 MA is indispensable for hanging forward a clear outlook, while a damage under may perhaps perhaps tag elevated selling stress. As XRP navigates thru this pivotal phase, traders and traders are closely monitoring these ranges to evaluate the market’s subsequent route.

Featured image from Dall-E, chart from TradingView