An educated, Ergag Crypto, has predicted that XRP will alternate at $10.4 when Bitcoin hits $80,000 if the correlation facet between the 2 resources touches $0.00013.

XRPL’s native token XRP will likely be on its practically a staggering 1,750% surge, as prognosis from educated Ergag Crypto is now in play. XRP can even hit $10.4 if Bitcoin makes a 25% trip to $80,000.

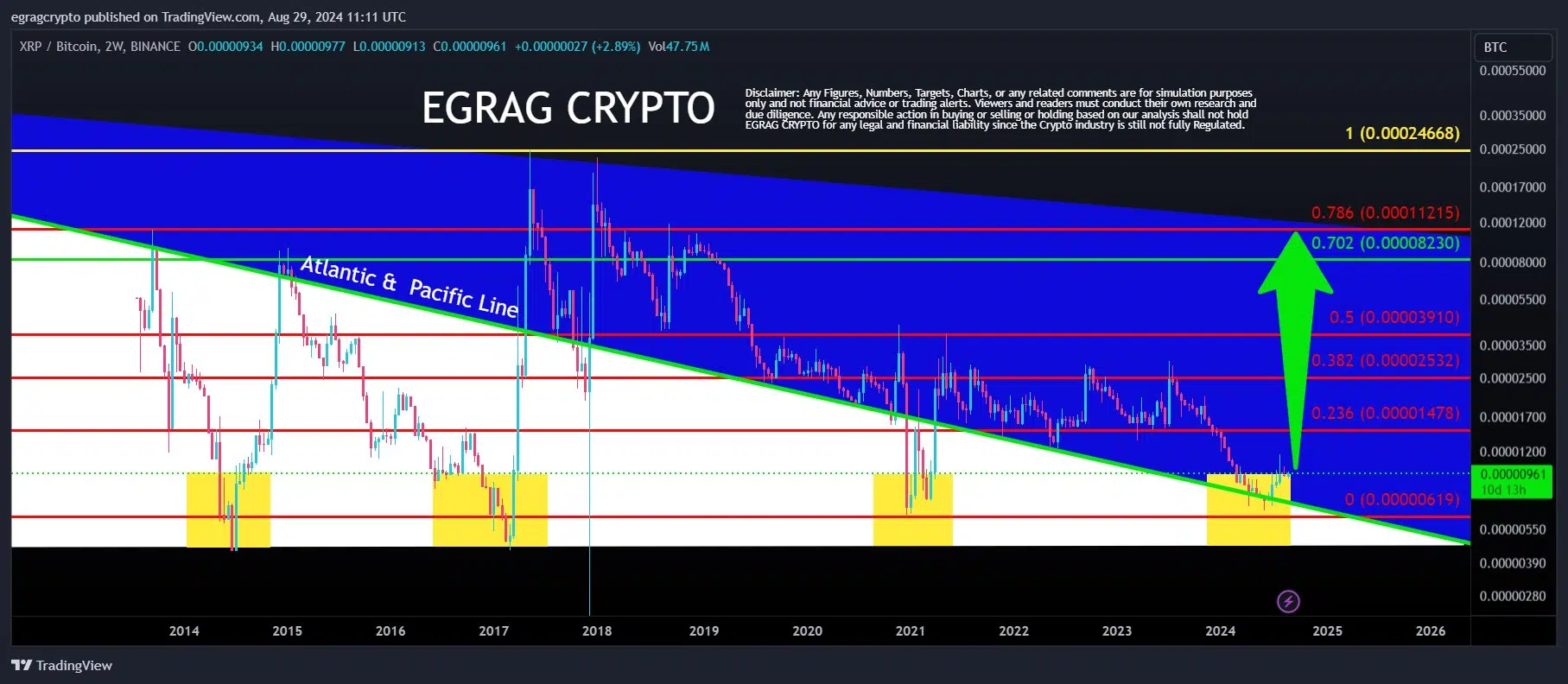

In a tweet on Thursday, Ergag Crypto pointed to an Atlantic and Pacific line prognosis he earlier made a few label correlation between XRP and Bitcoin. Based fully on the analyst, the macro-glimpse has fashioned a bottoming building, and XRP’s label will explode quickly.

Furthermore, the crypto analyst renowned that he sees XRP making cheap growth on his label prediction within the fourth quarter of the year, which spanned between October and December. Bitcoin and XRP are infamous for making explosive label actions during this period.

Breakout Would maybe Watch XRP Hit $27

Ergag Crypto’s Atlantic/Pacific line prognosis also features a label topic by which XRP would hit $27.3. Based fully on the analyst, that used to be the greater target for the chart, and that’s when the correlation facet touched $0.00013. Nonetheless, Bitcoin would deserve to alternate at $210,000 for that to happen.

In his earlier predictions made in Would maybe, Ergag Crypto renowned that XRP/Bitcoin Atlantic and Pacific line mixing would carry two macro-economic targets. The first target used to be $0.000005, whereas the 2nd used to be $0.00013.

For an XRP/Bitcoin correlation target of $0.00013, the analyst called that XRP would alternate at $10.4, $13, $16.25, $19.7, and $27.3 when BTC hits $80,000, $100,000, $125,000, $150,000, and $210,000, respectively.

Despite the indisputable reality that plucky, they are synchronous with an educated who predicted that XRP would hit $10 this cycle. An earlier file confirmed that the analyst based mostly his prognosis on XRP’s doable breakout from a symmetrical triangle, a unfold it has been procuring and selling in since 2021.

XRP confirmed label weak point on Thursday amidst a wider market correction. The asset traded at $0.573 at press time, with a market cap of $32 billion.