Bitcoin’s label has yet to fetch well from the recent tumble, consolidating with out a definite indication of its future direction. On the other hand, there are some signs that it goes to tumble further if it’s unable to conquer $60,000 soon.

Recall that the biggest digital asset slumped onerous on Tuesday, shedding from over $63,000 to $58,000, earlier than getting higher a little bit of of to its recent levels of $60,000.

Technical Analysis

By TradingRage

The Day after day Chart

On the day-to-day timeframe, the asset has not too long ago been rejected from the 200-day enthralling common and the $64K resistance level. It has also damaged under $60K and is outwardly on its formulation toward the $56K give a boost to zone.

The RSI has also dropped under 50%, indicating that the momentum is gradually enthralling bearish all over over again. Brooding regarding the recent market construction, a decline toward the $56K level and even the $52K give a boost to zone isn’t not really.

The 4-Hour Chart

The 4-hour chart clearly presentations the recent rejection from the $64K resistance level, because the market has didn’t uncover a robust rally higher. The price is for the time being retesting the $60K zone from the downside, and if it fails to reclaim the level, a tumble toward the $56K zone will doubtless be imminent.

Yet, if it climbs assist above the $60K level, investors will doubtless be optimistic that it goes to over again trudge toward the $64K resistance zone and potentially higher toward $68K within the impending weeks.

On-Chain Analysis

By TradingRage

Bitcoin Funding Rates

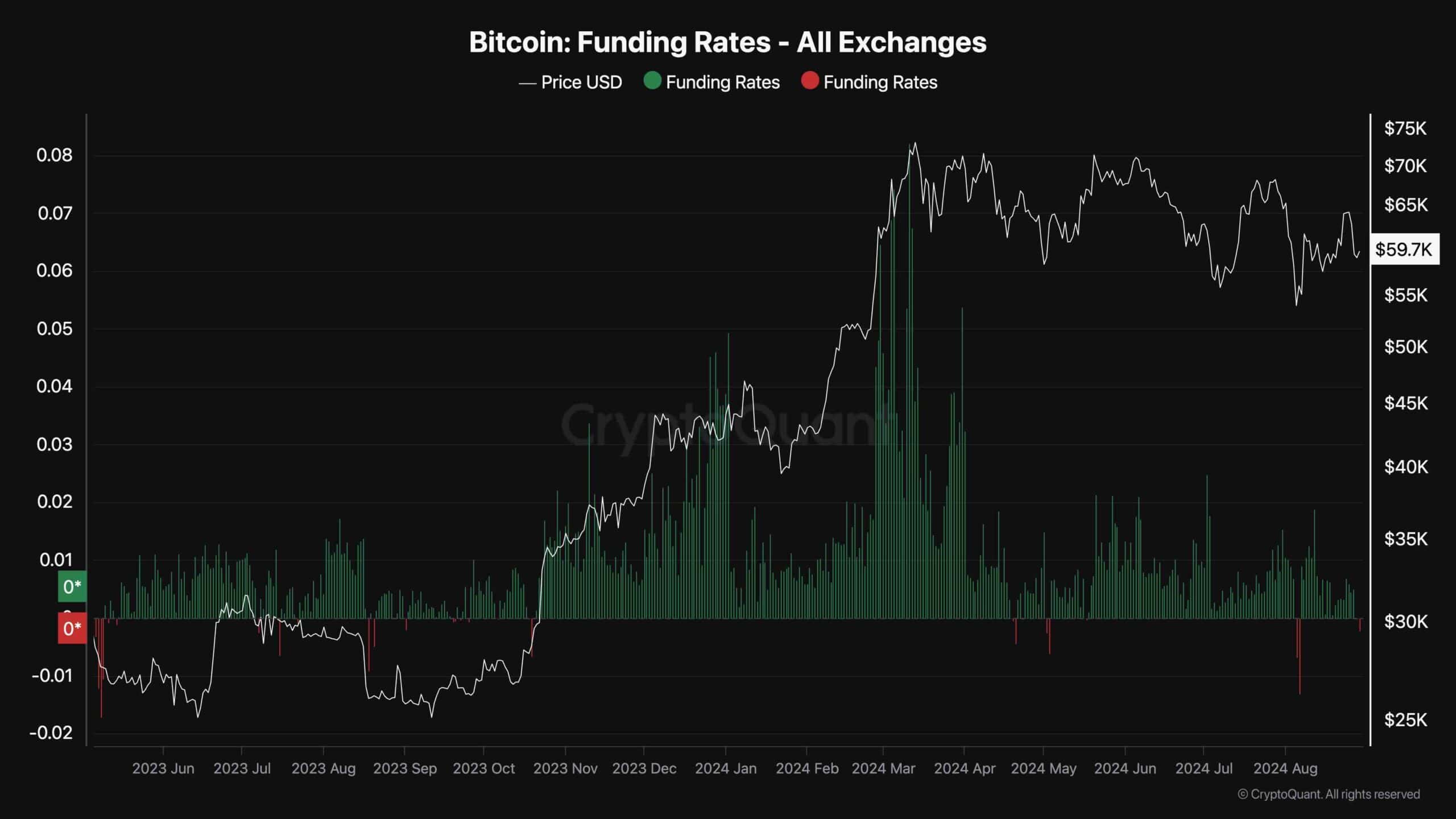

With Bitcoin’s market construction showing willingness for more bearish label circulate, many market contributors enjoy shifted their perspective toward the overall crypto scene. This is also clearly evident within the funding charges metric.

This chart demonstrates the BTC funding charges metric, which measures whether or not the investors or the sellers are executing their futures positions more aggressively. Lumber values veil bullish sentiment, while negative ones inform bearish sentiment.

Because the chart suggests, the Funding Rates provide an explanation for negative values, indicating that the futures market sentiment is now bearish. Whereas this will even be a designate that a label bottom is shut, BTC can unruffled tumble decrease within the quick length of time without enough pickle quiz.