Ethereum (ETH) tag is exhibiting each certain and detrimental signals, with the latter coming from investors.

The certain sentiment, then as soon as more, comes from the market, which hints on the acceptable stipulations for accumulation.

Ethereum Merchants Maintain an Various

Following Ethereum’s tag plunge, along with the remainder of the market, a wave of dismay space in. The 8.3% plunge within the final 24 hours vastly impacted investors as they moved to promote.

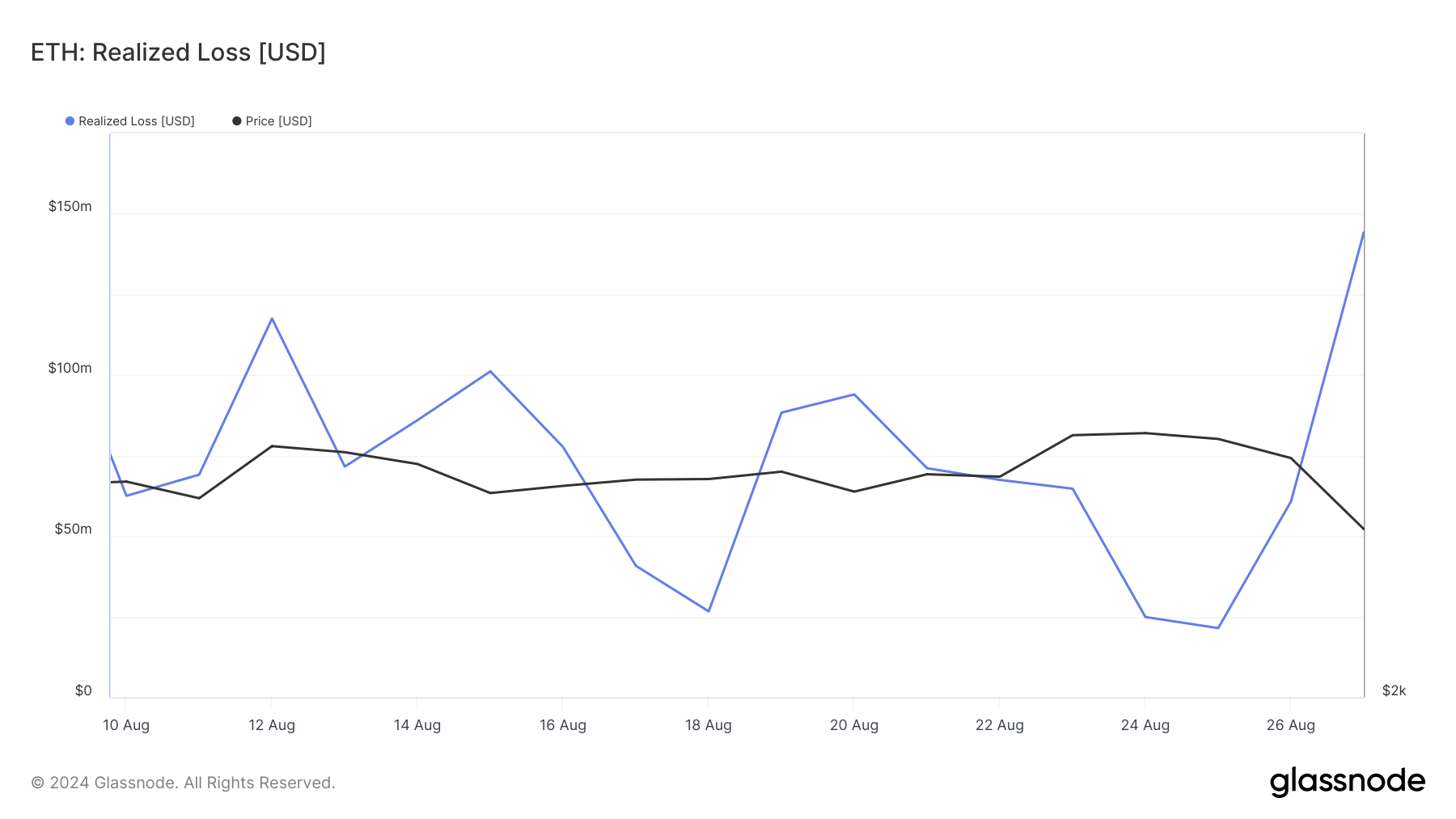

In line with the Realized Loss Indicator, over $144 million worth of ETH used to be sold interior a day. The indicator measures the general losses coming up from the ETH sold within the final 24 hours.

This try used to be to not get dangle of beneficial properties however to offset losses, and because it looks, investors unruffled faced losses.

This dismay selling, then as soon as more, would not encapsulate the sentiment of the broader market. The $144 million losses symbolize supreme 0.65% of ETH’s 24-hour buying and selling quantity of $22.03 billion.

Be taught extra: Easy programs to Make investments in Ethereum ETFs?

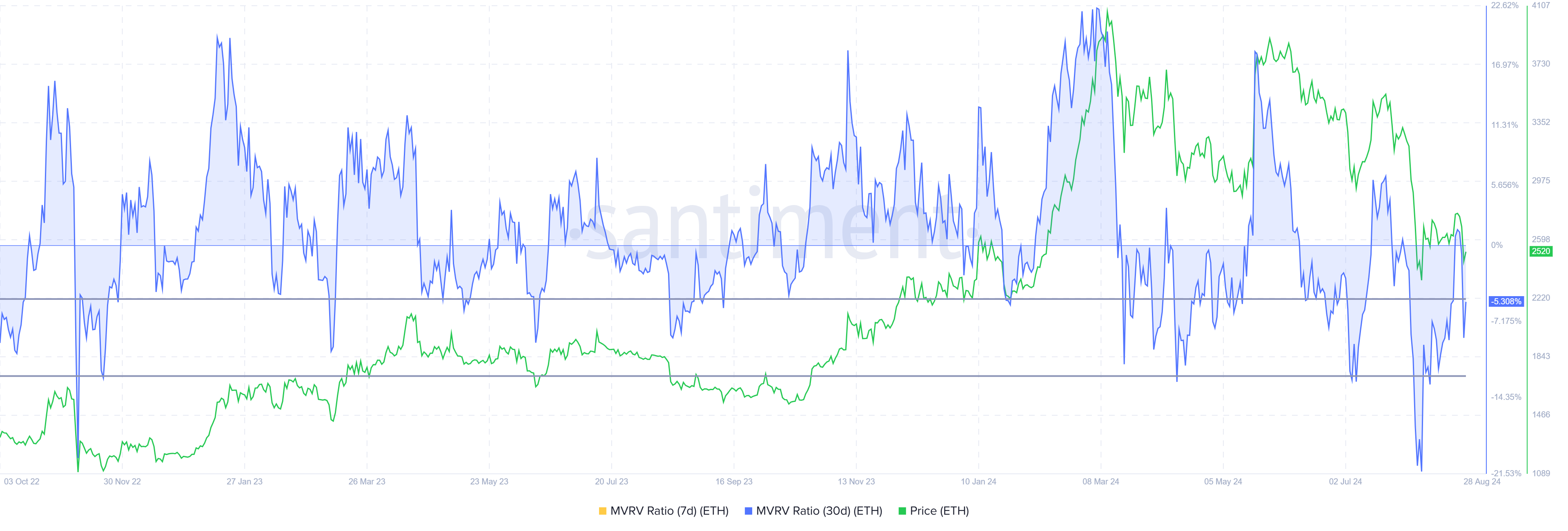

Truly, this drawdown used to be extra of a bullish keep than a bearish one, as famed by the Market Worth to Realized Worth (MVRV) ratio. The MVRV ratio assesses investor profit and loss for the duration of the indicator’s dimension.

For the time being, Ethereum’s 30-day MVRV stands at -5.3%, indicating losses and that you just’d also mediate of hunting for stress. Merchants who sold their ETH within the past month within the within the meantime are dealing with 5% losses, which also can lead to a commerce in sentiment.

Traditionally, ETH MVRV between -5% and -12% most frequently signals the launch of rallies and recoveries, marking it as an accumulation replacement zone. Thus, Ethereum’s tag might maybe well screen a reversal if the attempting to search out stress kicks in.

ETH Designate Prediction: Barrier Up Ahead

Ethereum’s tag is within the within the meantime at $2,525 after falling by the helps of $2,681 and $2,546. These levels web provided a solid cushion for ETH, combating drawdowns for the duration of August.

In the final 12 hours on my own, ETH has recovered by 2.7%, bringing it closer to the make stronger of $2,546. As soon as examined as make stronger, this can enable a upward push beyond $2,681 and characteristic ETH heading within the correct path to continue getting better the 30% losses of the July atomize after reclaiming $3,000.

Be taught extra: Ethereum (ETH) Designate Prediction 2024/2025/2030

On the replacement hand, since ETH has fastidiously examined the region between $2,681 and $2,546 as a consolidation zone, it might maybe well be repeated. This might maybe extend the recovery and intensify dismay selling, invalidating the bullish thesis.