Toncoin designate saw a modest recovery on August 23, climbing 3.5% to alternate above $6.60. This manufacture follows a rough birth to the week, the attach the cryptocurrency skilled a 9.5% tumble. Nevertheless, diminishing Toncoin network exercise suggests that this recovery could simply be short-lived, with the aptitude for added declines.

Toncoin Patrons Describe Indicators of Fatigue

As the cryptocurrency market recovered from the August 5 atomize, Toncoin, alongside with Litecoin and XRP, fleet became high gainers. While XRP’s rally became once fueled by a positive court ruling within the Ripple vs. SEC case, Toncoin designate benefited from Russia’s new laws legalizing crypto mining on August 8, which also equipped a defend shut to assorted Proof-of-Work (PoW) coins like Litecoin and Bitcoin.

Given Toncoin’s vital ties to the Russian market, the cryptocurrency outperformed both Bitcoin and Litecoin. After a volatile birth to the month, Toncoin designate dipped to a three-month low of $4.78 on August 5. Nevertheless, a spellbinding forty eight% recovery pushed it help to $7.10 by August 19. As of August 23, Toncoin’s designate is maintaining at $6.60, reflecting a 3.5% impression larger over the previous 24 hours. Despite this short-time frame manufacture, the market appears to be like to be entering a consolidation portion.

The present consolidation suggests that many short-time frame traders, who sold Toncoin correct thru the early August dip, are in actuality cashing in on their earnings. Toncoin designate slipped under $6.50 on August 22, following four consecutive days of losses, marking a 9.5% retracement since August 18.

The shortcoming to interrupt previous the $7.50 resistance level has dampened bullish momentum. Without contemporary bullish drivers, Toncoin costs could maybe face extra downward stress within the upcoming days.

Toncoin Network Train Plummets 40%

The present Toncoin designate surge became once largely pushed by speculative traders capitalizing on bullish data from Russia’s crypto mining legalization. Nevertheless, on-chain data finds a vital tumble in Toncoin network exercise, which could maybe limit extra designate gains.

The Network Costs metric presents necessary insights into investor habits in accordance with market conditions. Though bulls led the Toncoin designate to a forty eight% rebound from August 5 lows, the focus has shifted towards speculative trading, reducing fundamental network engagement.

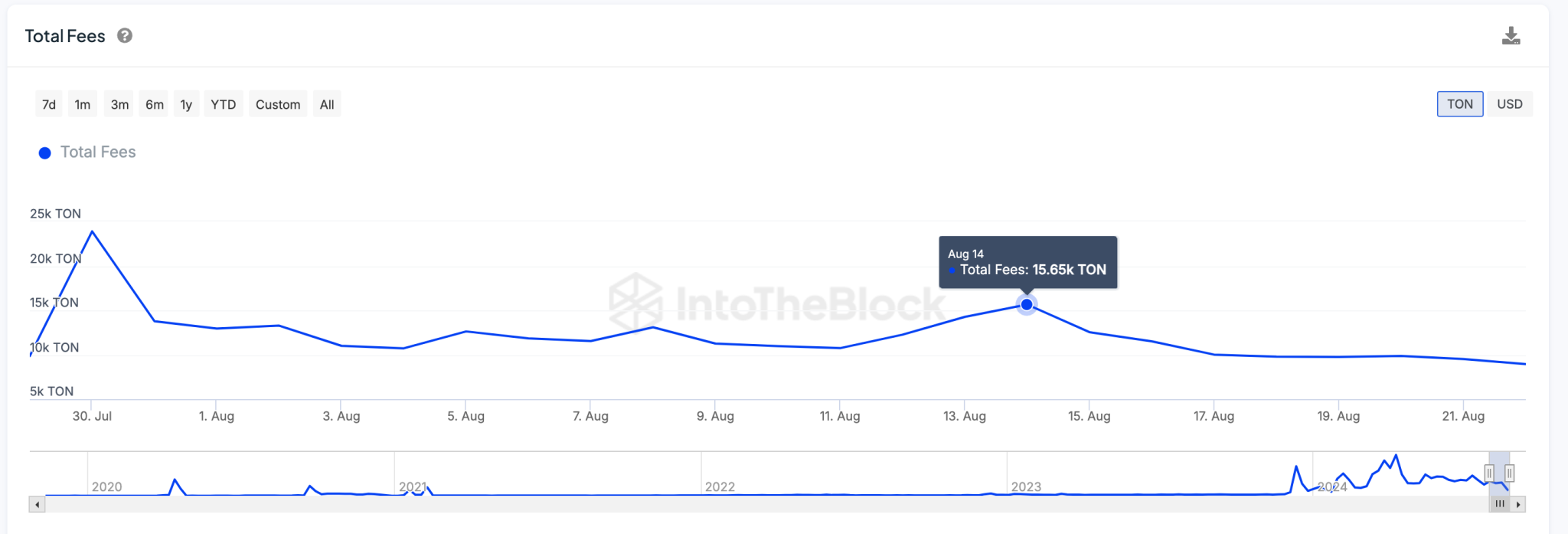

Between August 14 and August 21, Toncoin network charges decreased sharply from 15,650 TON to 9,500 TON, a 40% tumble. This decline in network charges, which reflects financial exercise on the Toncoin network, raises two fundamental considerations.

First, it signifies decreased transaction volumes, which could simply signal declining interest amongst traders. Historically, such declines in network exercise hold on the total preceded fundamental designate corrections, as decreased network engagement most continuously correlates with lower seek data from for the asset. 2d, the decline could maybe counsel that speculative traders are exiting their positions, doubtlessly main to increased selling stress.

TON Tag Prediction: Extra Downside Doable

The technical outlook for Toncoin designate suggests attainable extra declines, with the attainable for retesting the $6 reinforce level. Technical indicators expose a bearish pattern, with the Relative Energy Index (RSI) at a neutral 50.60, exhibiting a lack of vital momentum in both route.

Toncoin designate faces vital resistance at the $7.50 level. Failure to breach this resistance could maybe attach off extra selling, pushing the value toward the $6.37 reinforce. A spoil under this level could maybe explore Toncoin designate falling extra, with $6.00 serving as a necessary reinforce zone.

In conclusion, the Toncoin designate could simply wrestle to defend its present gains amid declining network exercise and a lack of new bullish catalysts. Without renewed shopping for interest, a retest of the $6 reinforce level appears to be like seemingly within the short time frame.