AAVE, the native token for the decentralized lending platform Aave, has caught the eye of whales as the token’s sign has jumped over 30% within the past week.

On the time of newsletter, Aave (AAVE) used to be the forty fourth biggest cryptocurrency, up from the Forty seventh role it stood at on Aug. 20. The token’s market cap exceeded $2 billion and used to be up bigger than 3% over the past 24 hours.

In step with fee files from crypto.news, AAVE used to be trading at $137.64, down from its weekly excessive of $142.16 reached on Aug. 22. The token used to be up 30.9% over the past week and over 47.7% within the last 30 days. Despite basically the most modern rally, the token is aloof down Seventy 9.2% from its all-time excessive of $661.69, reached in May well well likely 2021.

The surge has been primarily fueled by intense whale instruct recorded over the past week. Most just just these days, on Aug. 22, Lookonchain files printed that a whale scooped up roughly $10.4 million value of AAVE for 4,000 staked Ethereum (ETH) in now not as a lot as 24 hours.

Crazy shopping for of $AAVE!

This whale spent 4,000 $stETH($10.4M) to aquire 77,270 $AAVE at $135 in moral 1 day!

Address:

0xa923b13270f8622b5d5960634200dc4302b7611e pic.twitter.com/jSMKOiTT0Z— Lookonchain (@lookonchain) August 22, 2024

The massive aquire used to be preceded by well-known whale instruct recorded on Aug. 20, with two whales shopping for $3.92 million value of AAVE, with one more sizable investor joining the kind the next day with a $6.65 million investment into the token.

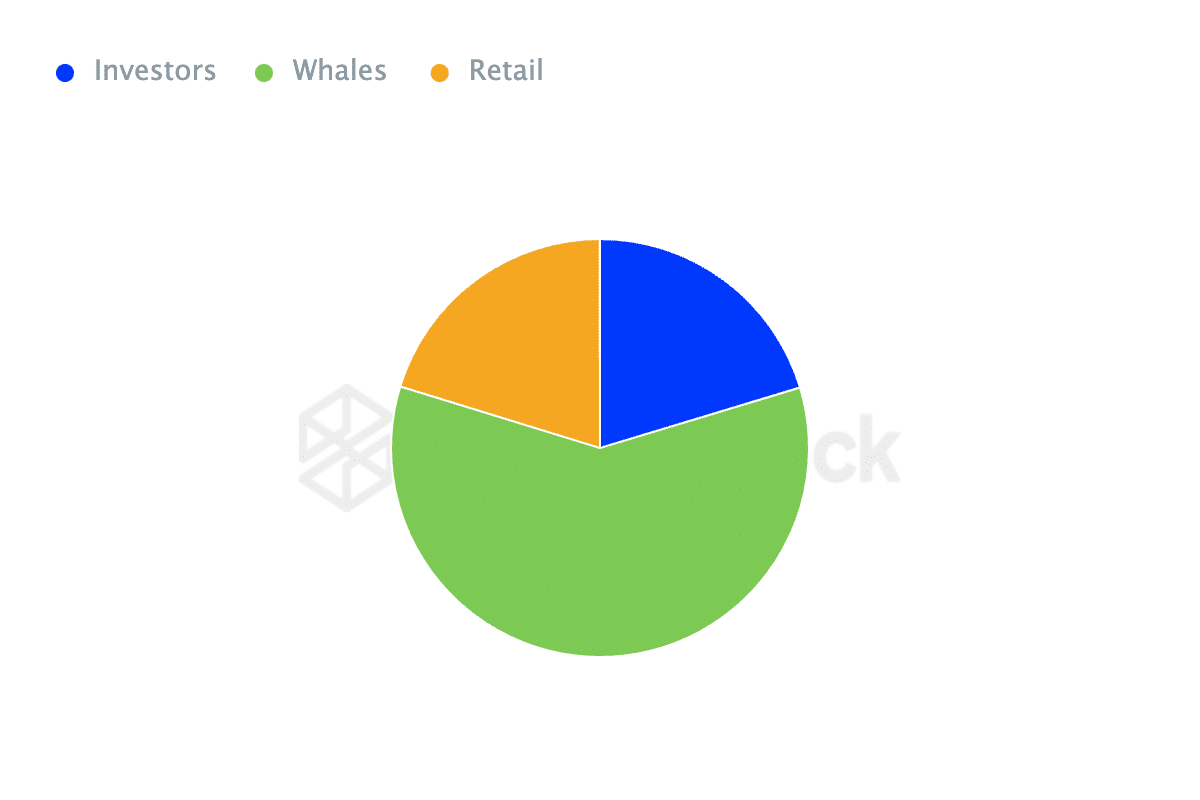

A understanding into files from IntoTheBlock presentations that whales preserving over 1% of Aave’s circulating present managed 59.43% of AAVE’s entire present. The excessive focus of whales suggests that the token’s sign is being influenced by these sizable holders.

Additional files presentations a well-known surge in both the inflows and outflows of AAVE amongst sizable holders, with inflows increasing by 90.37% and outflows by 95.Seventy 9% over the past seven days.

On the opposite hand, the rep float of AAVE amongst sizable holders has jumped 364.73% for the interval of the identical interval, signaling that shopping for ardour is currently prevailing, contributing to the upward momentum in AAVE’s sign.

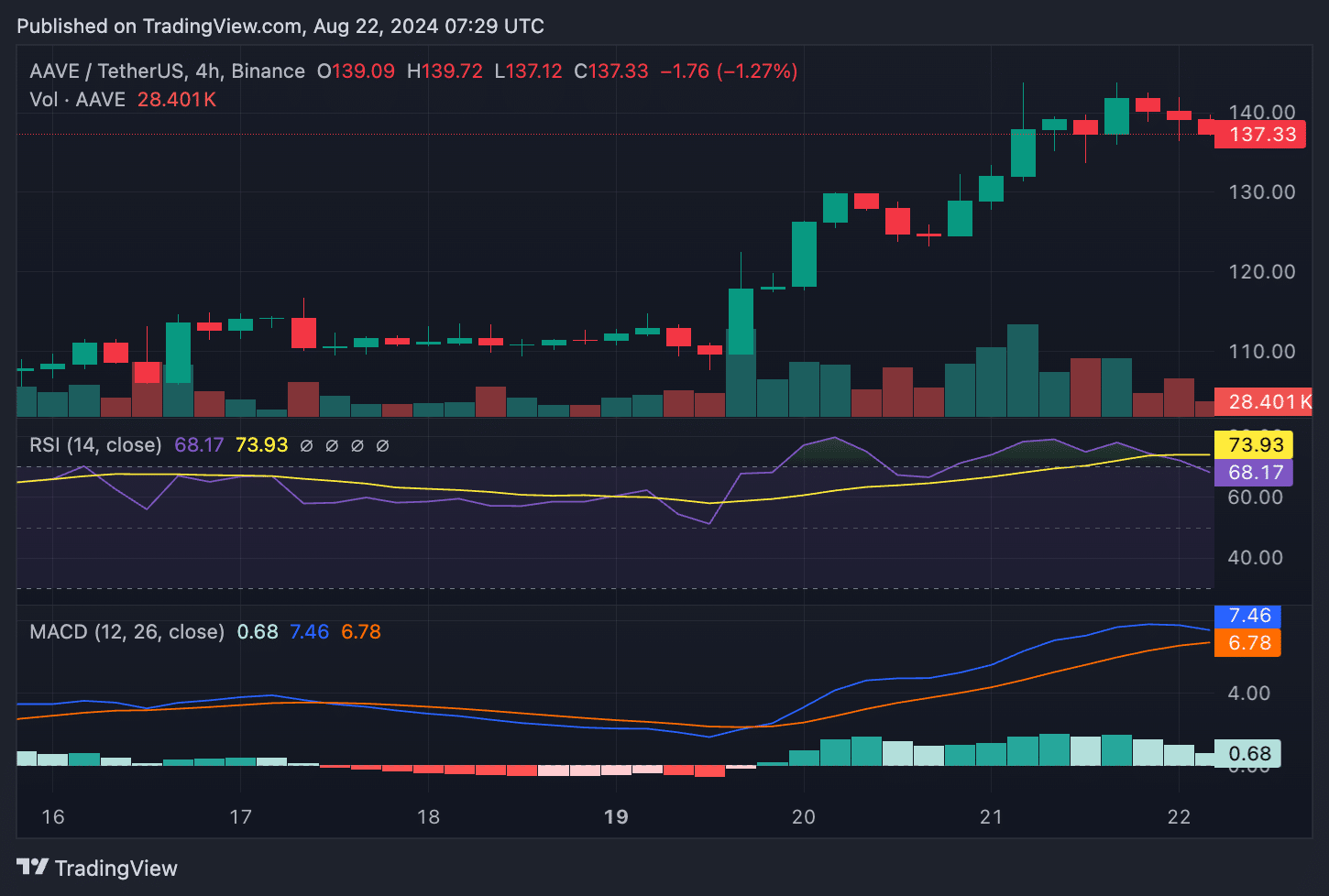

AAVE currently in overbought zone

On the 4-hour candlestick chart of AAVE/USDT, its Relative Power Index used to be at 73.93, suggesting that the token is currently overbought. The Inspiring Practical Convergence Divergence, nonetheless, presentations that the bullish momentum is aloof in play, as the MACD line remains above the signal line with particular histogram bars.

This seemingly ability that while AAVE will seemingly be overbought, the upward momentum may perchance likely proceed for a bit longer, fueled by whale shopping for. On the opposite hand, overbought instances most steadily precede a demonstration correction or consolidation section, so traders can also very properly be having a understanding to rob some earnings within the quick timeframe.