Chainlink (LINK) has witnessed a surge in accumulation within the past 12 hours, as evidenced by its rising momentum indicators.

This has prompted income-taking tell among some each day traders who beget since recorded earnings on their transactions.

Chainlink Traders Document Earnings

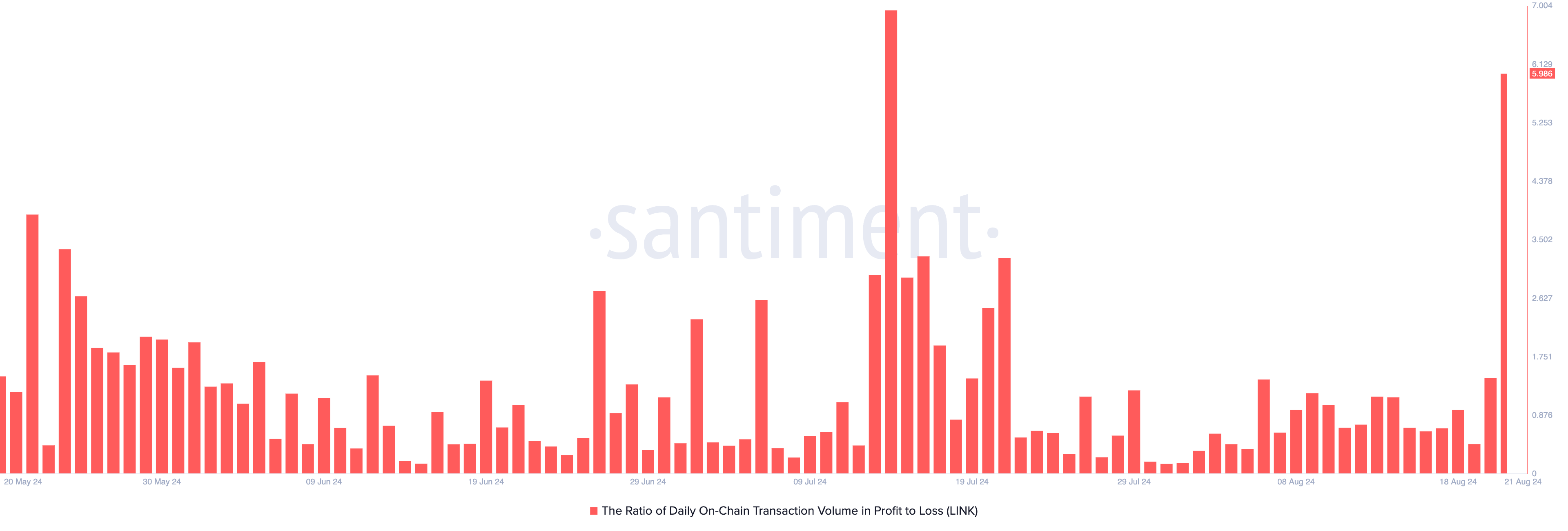

An outline of LINK’s each day transaction volume in income to loss finds that the ratio within the meanwhile sits at its best possible since July 14. Per Santiment’s files, it is far 5.98 on Tuesday.

This implies that for every LINK transaction that has ended in a loss at the present time, 5.98 transactions beget returned a income. This implies that LINK traders beget recorded extra earnings than they’ve seen losses.

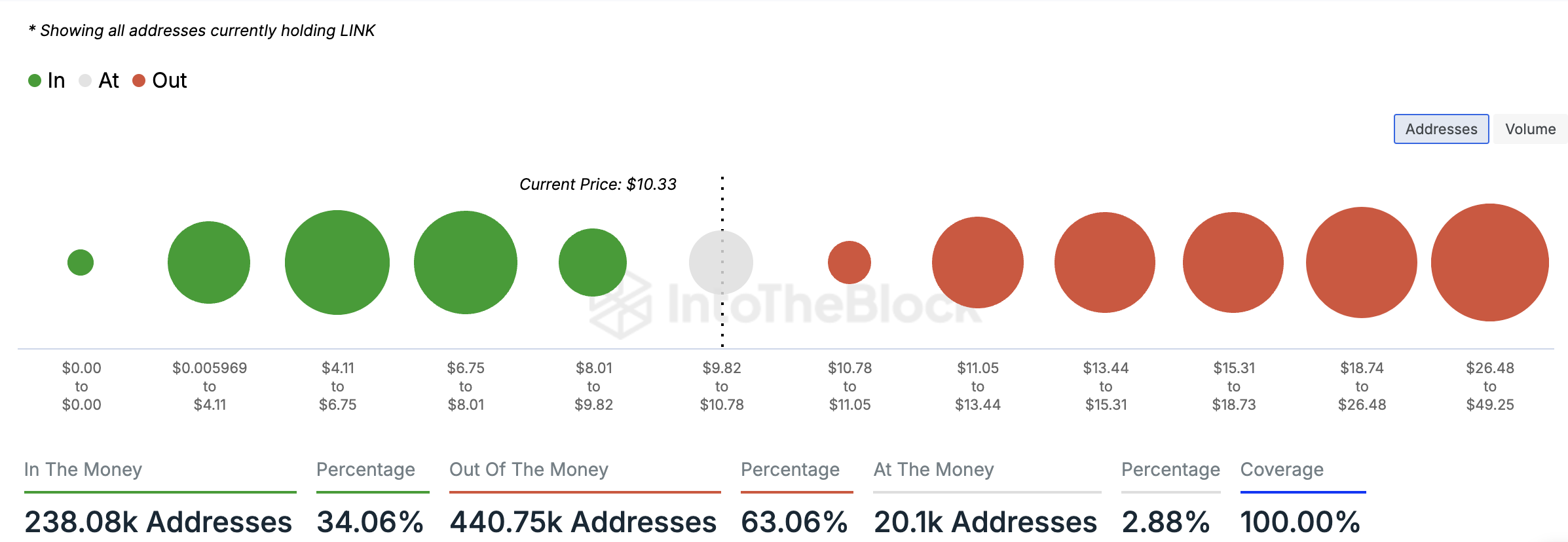

Despite this, a peep at LINK’s financial statistics finds that many of its holders are “out of the cash.” An deal with is taken into story out of the cash if the most modern market label of an asset is lower than the modern cost at which the deal with purchased (or got) the tokens it within the meanwhile holds.

Read extra: Chainlink (LINK) Tag Prediction 2024/2025/2030

In accordance to IntoTheBlock, 441,000 addresses, which invent up 63.06% of all LINK holders, take a seat on unrealized losses. Conversely, 238,000 addresses, representing 34% of all LINK holders, possess their tokens at a income.

LINK Tag Prediction: LINK Chases Extra Highs

As mentioned earlier, LINK’s rising momentum indicator reflects increased accumulation throughout the last 12 hours. For the time being, the altcoin’s Chaikin Money Float (CMF) is in an uptrend, sitting above the zero line at 0.05.

The CMF measures the rush with the circulation of cash into and out of an asset. When it remains above zero, it signifies a liquidity influx, in most cases seen as a precursor to cost growth.

Furthermore, LINK’s Transferring Moderate Convergence/Divergence (MACD) setup implies that attempting to acquire tension exceeds selling tell. The MACD line (blue) is positioned above the signal line (orange), signaling bullish momentum.

The MACD measures adjustments in label trend, direction, and momentum. When the MACD line is above the signal line, it means that the asset is experiencing bullish momentum and rising attempting to acquire tension.

Read extra: Chainlink (LINK) Tag Prediction 2024/2025/2030

If LINK accumulation persists, its label will climb to $11.57. Alternatively, if selling tension positive aspects momentum, this most modern reverses, and the altcoin’s cost might maybe well maybe objective topple to $8.08.