Decentralized finance (DeFi) mission Solana (SOL) has obtained consideration for its velocity and scalability. Nonetheless, contemporary analyses non-public published a serious thunder affecting the platform: an alarmingly high payment of failed transactions.

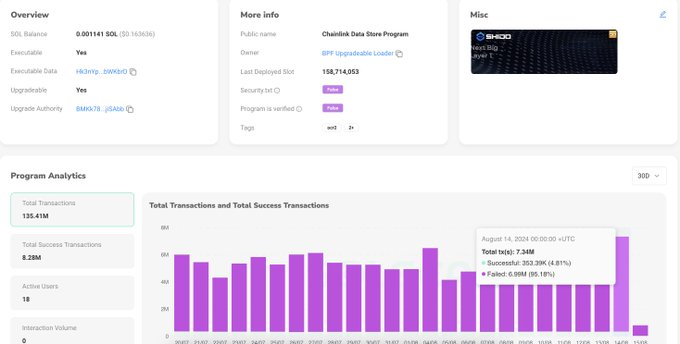

In particular, an broad diagnosis by a Cardano (ADA) developer the utilization of the pseudonym Dave, shared in an X publish on August 19, published that on the subject of 93.89% of all transactions completed by strategy of the Chainlink Records Retailer Program on Solana failed within the final 30 days. This equates to approximately 127.13 million failed transactions when put next to fully 8.28 million worthwhile ones.

What’s placing is the monetary burden these failures impose on users. Per the expert, the sensible payment for a failed transaction stands at 0.000005 SOL, amounting to approximately 635.65 SOL misplaced in total over the last month. Primarily based on SOL valuations on the time of publishing the diagnosis, this interprets to a staggering $91,090.Forty eight. This quantity excludes high-precedence costs, additional inflating users’ costs.

Given this recordsdata, the indispensable query is how the design remains sustainable despite indispensable failures. For Solana, the network infrastructure could well provide the reply, as various these failed transactions stem from spam or arbitrage transactions, the attach on-chain bots flood the network to employ slight inefficiencies for profit.

For these bots, the associated payment of spamming the network is negligible when put next to the aptitude rewards, ensuing in congestion and the next failure of first payment person transactions.

Solana’s congestion woes

Interestingly, Solana’s congestion considerations aren’t unique. The network has grappled with these disorders for a whereas, and contemporary upgrades purpose to cope with them. Introducing choices like QUIC, designed to enhance verbal replace between users and the network’s block leaders, is a step within the steady direction.

Nonetheless, this unique structure has flaws, in particular in limiting connections for the length of high-query lessons. As a consequence, first payment transactions customarily salvage discarded alongside spam, exacerbating person frustration.

Despite these disorders, Solana’s ecosystem continues to thrive. The platform has seen a upward thrust in decentralized alternate (DEX) actions and the starting up of contemporary projects just like the Saga smartphone. Additionally, the network has been central to the meme cryptocurrency pattern, with several smartly-liked money launching on the platform.

Indeed, this pastime in meme money has only within the near past contributed to a indispensable spike within the associated payment of SOL.

SOL impress diagnosis

Solana has skilled indispensable volatility within the short period of time, with the asset trading at $140 as of press time. On the 24-hour chart, this displays a day-to-day lack of about 3.2%, whereas on the weekly timeframe, SOL is down 3%.

In the intervening time, with Solana missing notable catalysts to guide the associated payment, the asset is reliant on the fashioned market trajectory. Amid this breeze, the crypto is focusing on a reclamation of the $150 resistance level.

Disclaimer: The utter on this attach ought to no longer be regarded as funding advice. Investing is speculative. When investing, your capital is at risk.