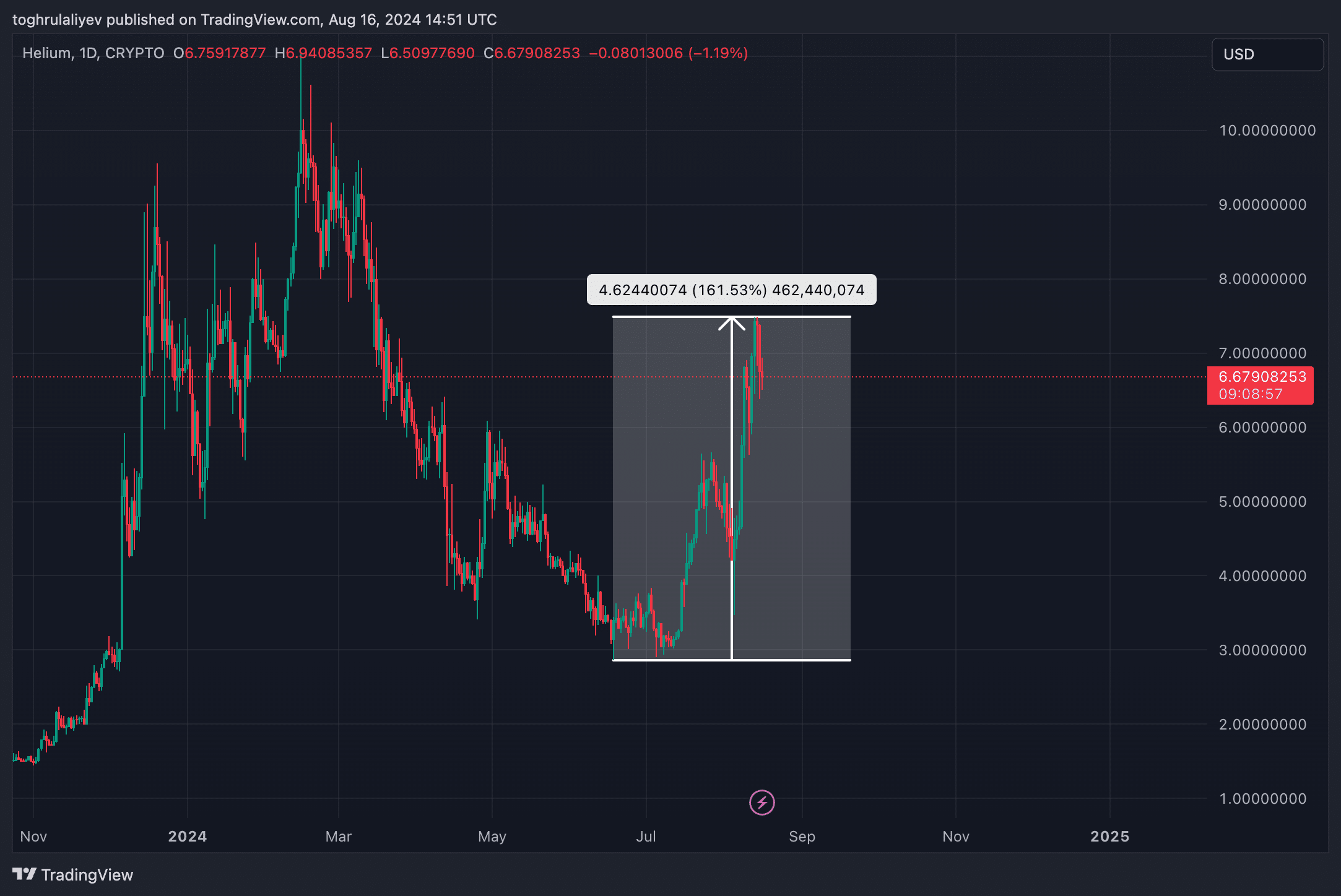

Helium (HNT) has obtained 158.15% since the starting of July, showing a stable upward pattern. The valuable question now is whether or now not or now not HNT will continue its climb or if there shall be a pullback on the horizon.

Table of Contents

While Helium’s (HNT) bullish inch has been spirited, it’s going to also soon flip correct into a disappointment for merchants. The dearth of consolidation or pullback within the path of this rally raises concerns that one shall be on the horizon. Here’s why a pullback could perhaps also be impending.

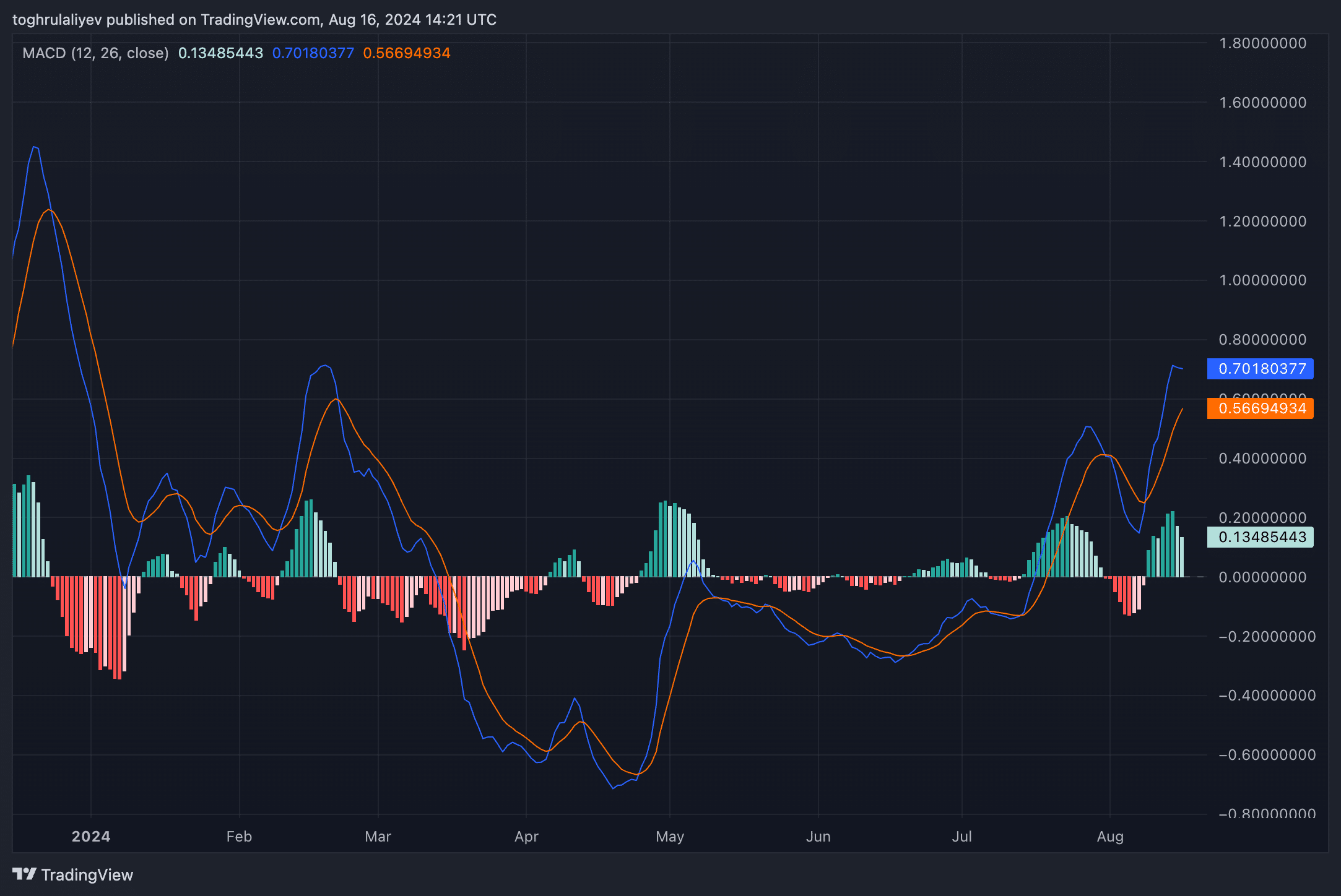

Interesting Life like Convergence Divergence

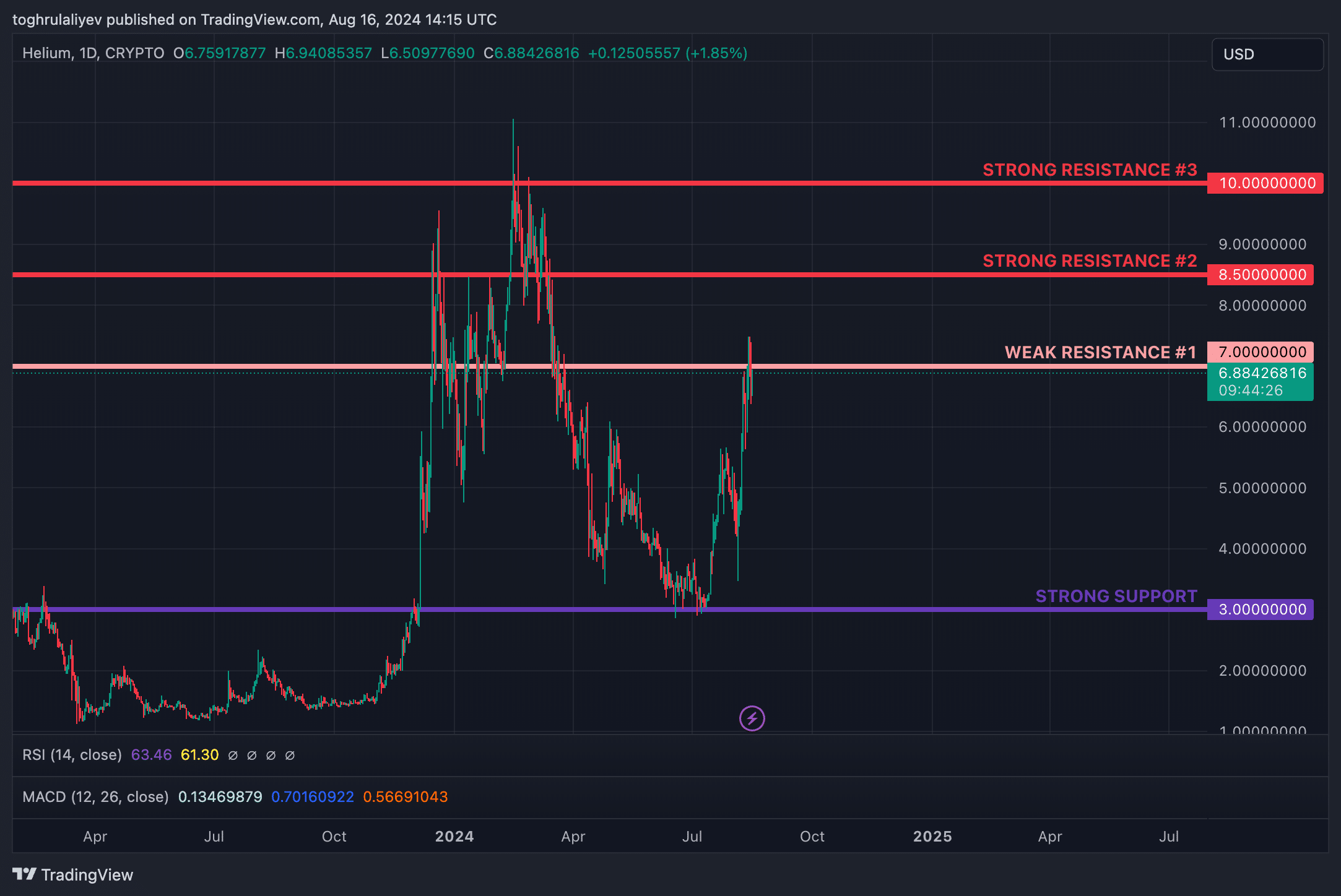

Inspecting the day-to-day Interesting Life like Convergence Divergence (MACD), we leer the histogram shifting from darkish green to mild green, indicating a weakening bullish momentum. The MACD strains are also initiating to converge, suggesting that the unusual uptrend could perhaps also be shedding steam. A capacity bearish crossover could perhaps perhaps signal a reversal in pattern.

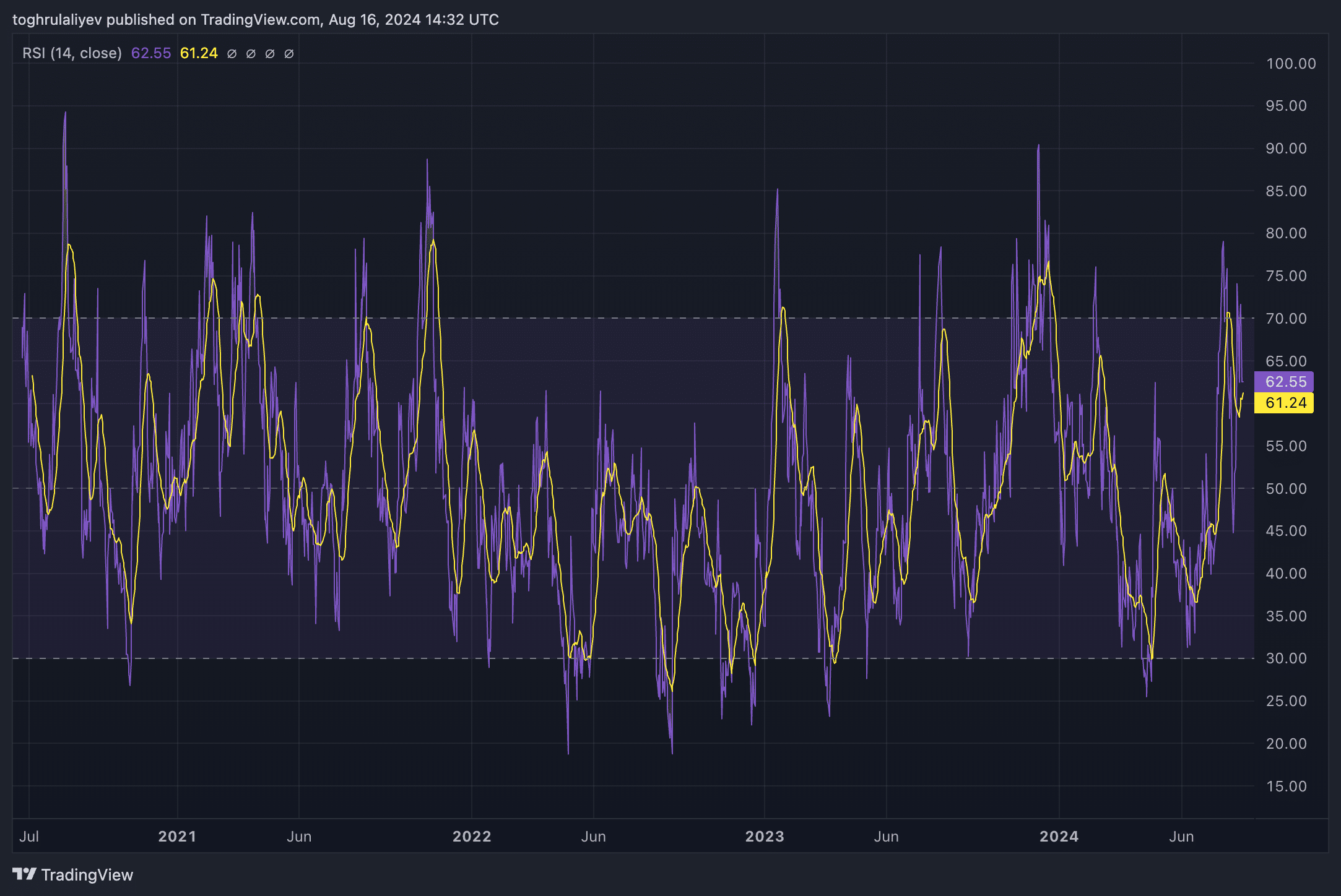

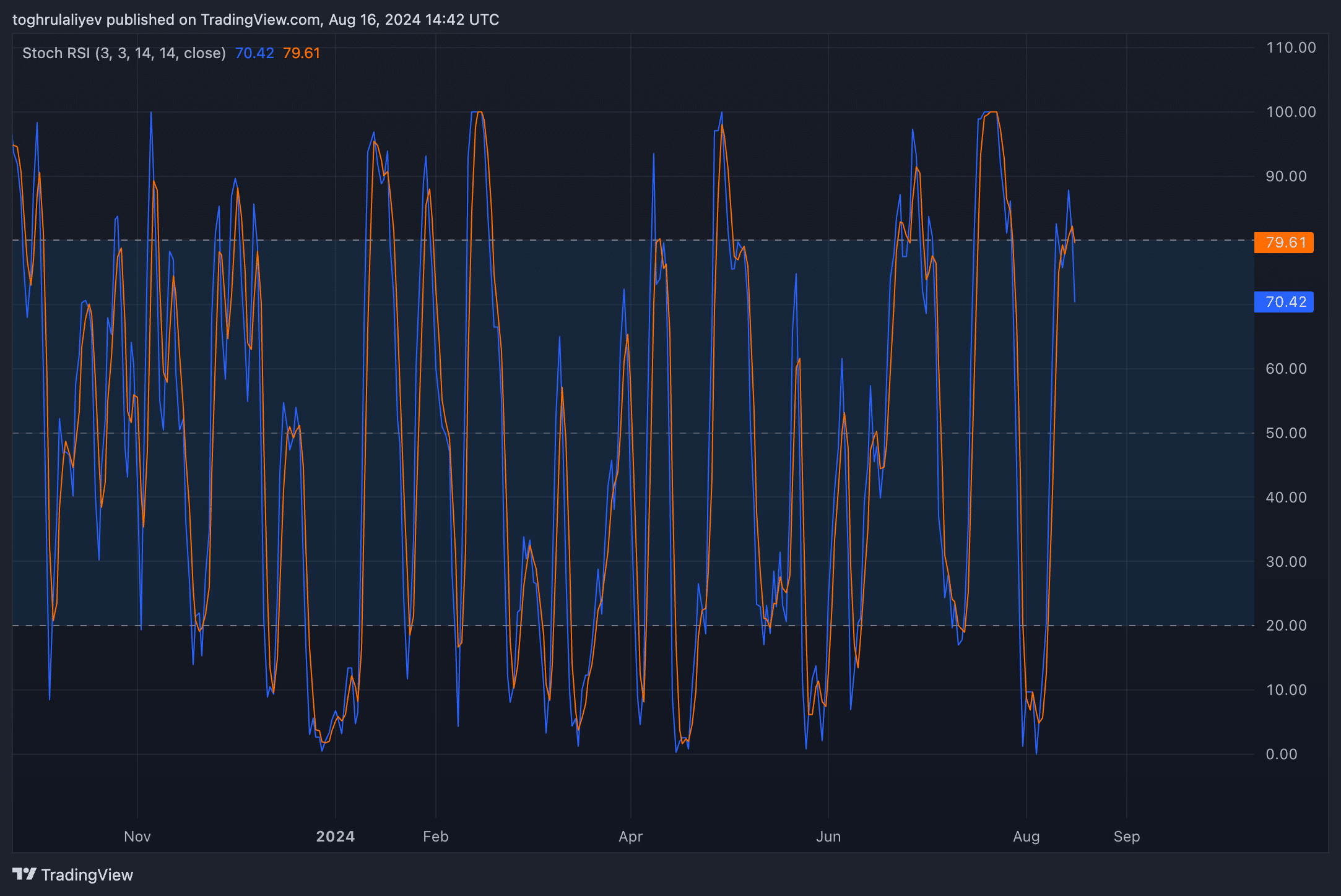

RSI and Stochastic RSI

Both the Relative Strength Index (RSI) and Stochastic RSI are in hyped up territory, with readings above 60. Historically, when RSI and Stochastic RSI have reached 60+ levels, they tend to retreat significantly, usually accompanied by a gripping ticket decline.

Enhance and resistance levels

The unusual ticket action reveals stable resistance levels at $8.5 and $10. These levels have confirmed subtle to surpass or acted as stable red meat up levels within the previous. In the intervening time, the $7 stage serves as a historical house. At the moment, it has acted as resistance, nonetheless its role could perhaps perhaps alternate if HNT breaks above it. If the price fails to damage via $7, a more pronounced downtrend is at possibility of launch.

Fibonacci confluence levels

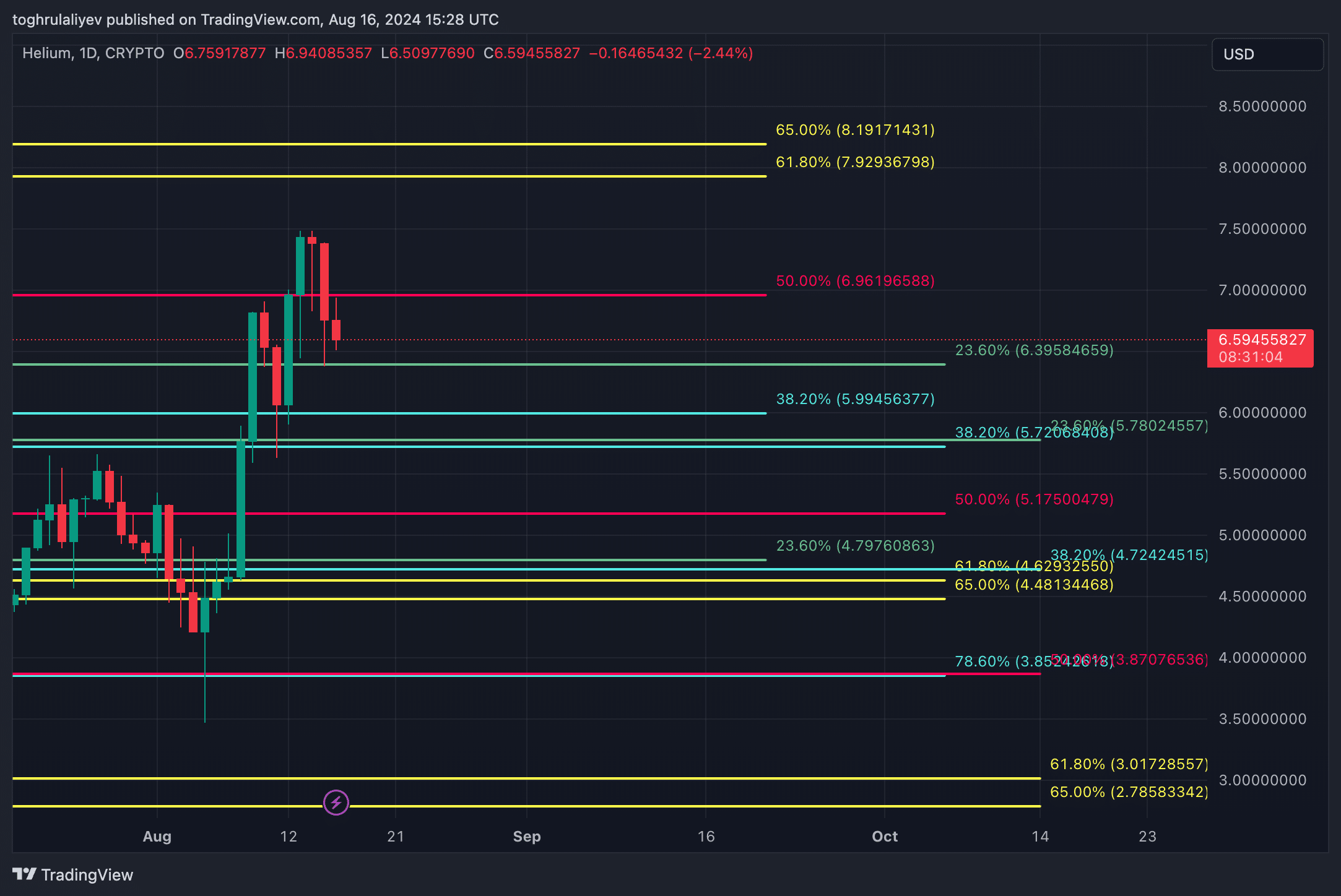

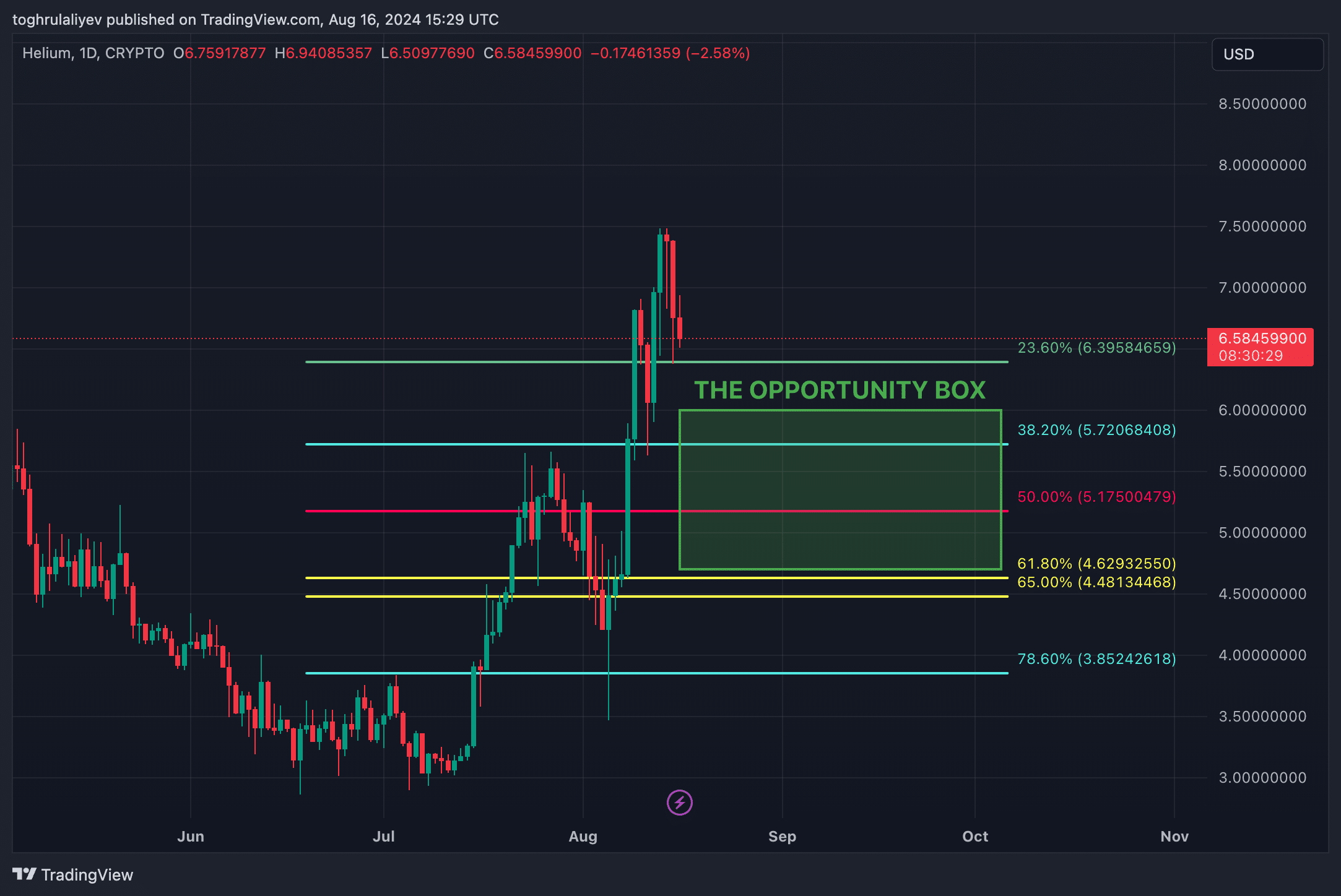

By making utilize of Fibonacci retracement levels from three varied time frames—the preliminary day of buying and selling to the unusual high, the low of June to the unusual high, and the high of March to the low of June—we title more than one confluence levels. These confluence levels are clustered round $6 and $4.7.

The house between $4.7 and $6 kinds what we check with as a “box of opportunity.” This differ presents a capacity target zone for a transient keep, with the expectation that HNT could perhaps perhaps retrace this house if the downtrend continues.

Historical red meat up lies at $3, nonetheless a tumble to this stage looks now not possible except valuable negative occasions occur within the broader market, such as what took reveal with Japan’s shock rate hike and Jump Buying and selling’s promoting spree in unhurried July and early August.

Strategic Considerations

Before initiating a transient keep, it’s valuable to reveal the downtrend. Though the pattern has currently shifted, there’s constantly the probability of a undergo trap. To lessen possibility, we counsel expecting HNT to tumble below $6.3958, which is the 23.6% Fibonacci retracement from the June low to the August high. As soon as HNT breaks below this stage, and it acts as resistance, the shorting opportunity turns into great safer.

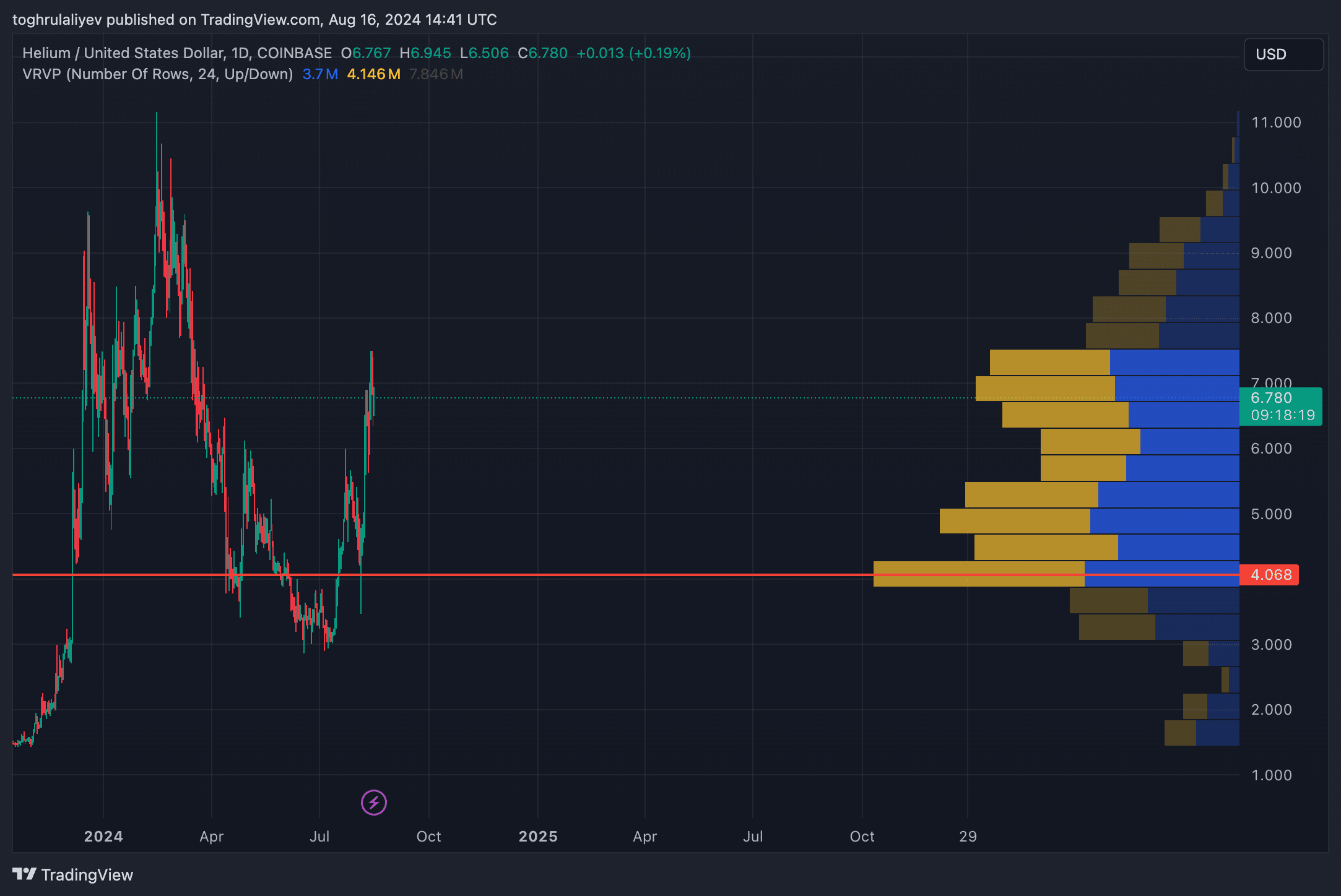

One other ingredient to steal into listing is the Visible Vary Volume Profile, which reveals a historical volume house between $5.5 and $6.5. Costs tend to cross like a flash via such low-volume zones, extra supporting the likelihood of a downward cross. Nonetheless, currently, HNT is interior a high-volume zone, which could perhaps perhaps potentially attend as a consolidation house.

Disclosure: This text would now not represent funding recommendation. The whine and affords featured on this page are for academic applications most appealing.