Cardano (ADA) used to be among the standout performers in the 2021 bull market, nonetheless it no doubt has struggled to attain significant trace gains in the fresh cycle.

In overall, such underperformance would perchance per chance consequence in a mass sell-off as holders lose self assurance. Surprisingly, though, many ADA holders seem like taking a decided manner.

No Giving Up on Cardano, Holders Data Reveals

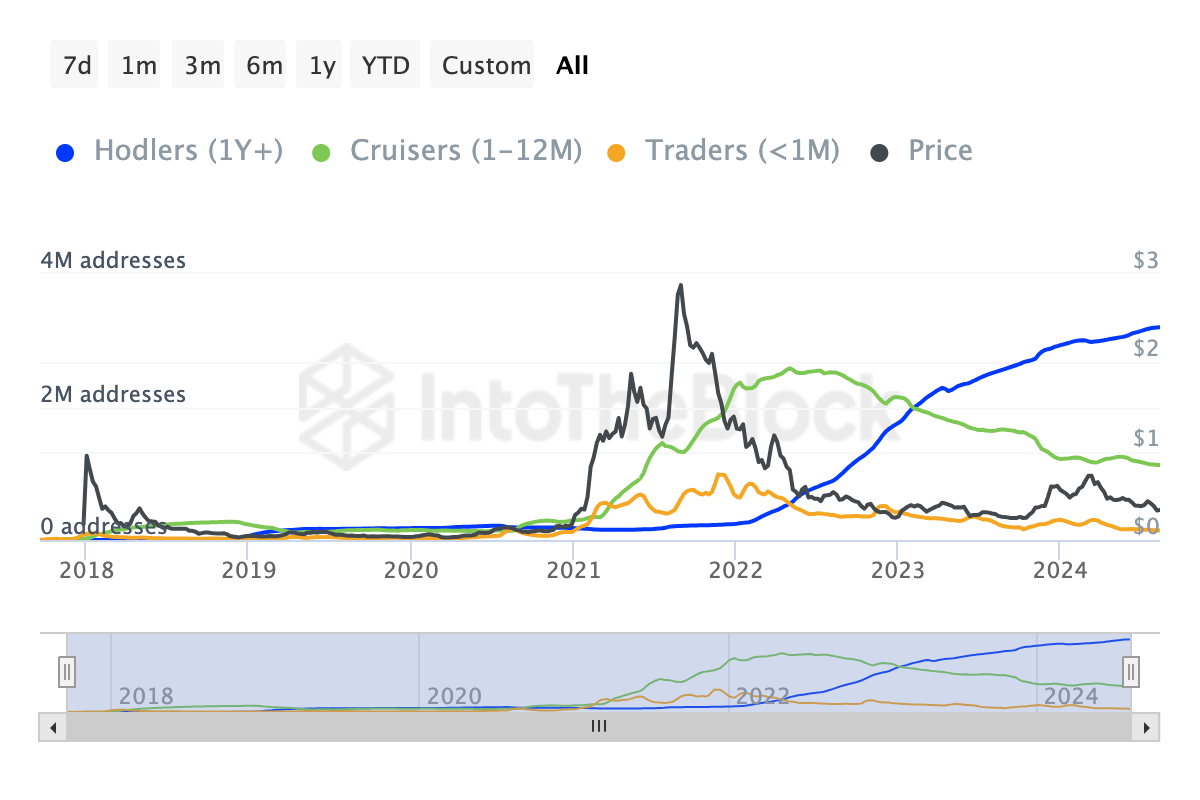

Data from the Steadiness by Time Held metric reveals that the resolution of prolonged-term Cardano (ADA) holders has hit an all-time excessive of 3.2 million. These prolonged-term holders have a tendency to be folks that bear held ADA for no longer lower than one one year.

Historically, holder numbers are inclined to narrate no as a bull market peaks. As an instance, after ADA’s trace soared to $3.10 in September 2021, the resolution of holders dropped, reflecting profit-taking at some level of the market’s high.

Nonetheless, by January 2023, this trend reversed as the resolution of prolonged-term holders began to produce better again, hinting at the early stages of a brand fresh bull cycle. Since then, ADA’s trace has climbed from $0.26, temporarily reaching a high of $0.70, as these committed holders maintained their positions in anticipation of additional utter.

While ADA’s trace lately dipped to $0.33, the produce better in the resolution of holders suggests optimism for a seemingly rebound. Nonetheless, this cycle has unfolded otherwise from the closing. In 2021, Cardano skilled an explosive rally at some level of altcoin season, nonetheless this time, altcoins haven’t delivered the same performance, despite excessive expectations.

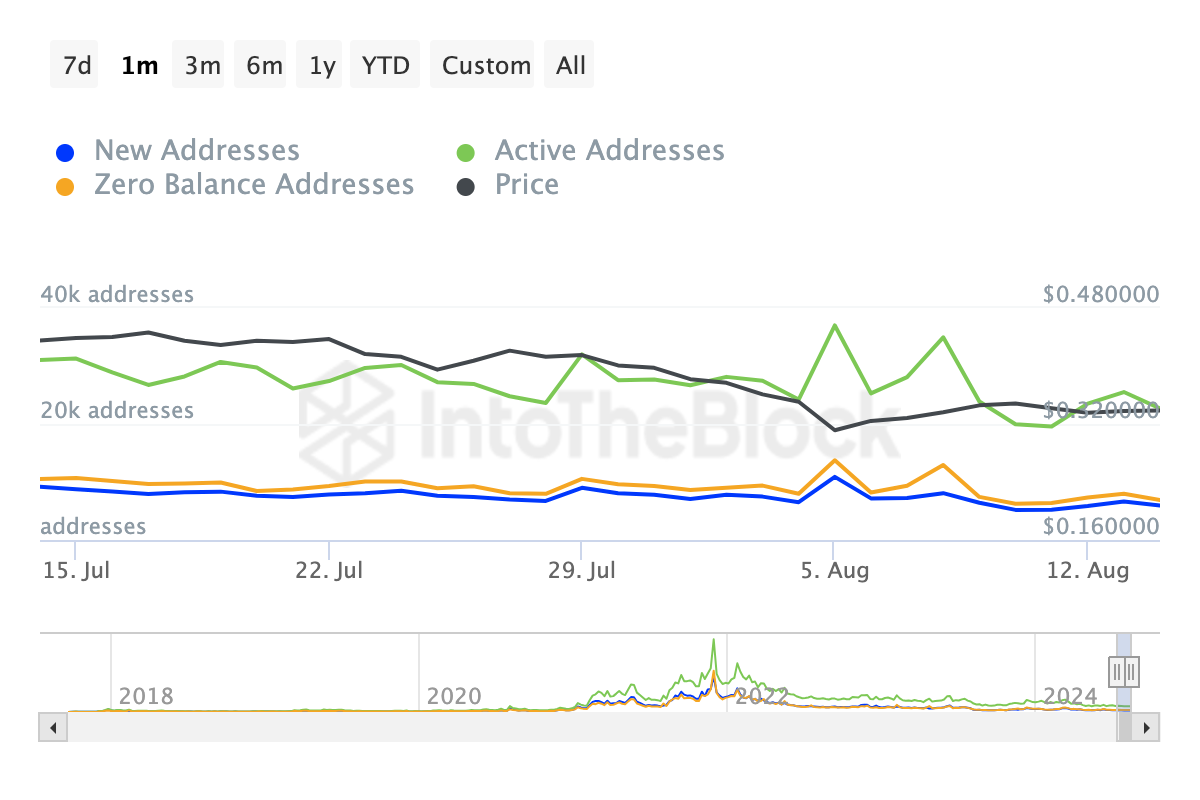

Additionally, Cardano has been trailing in the encourage of Solana (SOL) in attracting fresh customers. Both ADA and SOL were standout performers in the outdated bull market, nonetheless this cycle, Solana has drawn extra fresh market participants.

No topic this preliminary success, Solana has viewed a decline in fresh, full of life, and nil-balance addresses over the final month, indicating waning self assurance in its short-term prospects.

Learn extra: How To Stake Cardano (ADA)

Must the quantity proceed to narrate no, ADA’s seemingly recovery will be hindered. Nonetheless, furthermore it is compulsory to bear in mind assorted on-chain and technical indicators to bear in mind the value forecast.

ADA Designate Prediction: Rally Probably, But No longer Here But

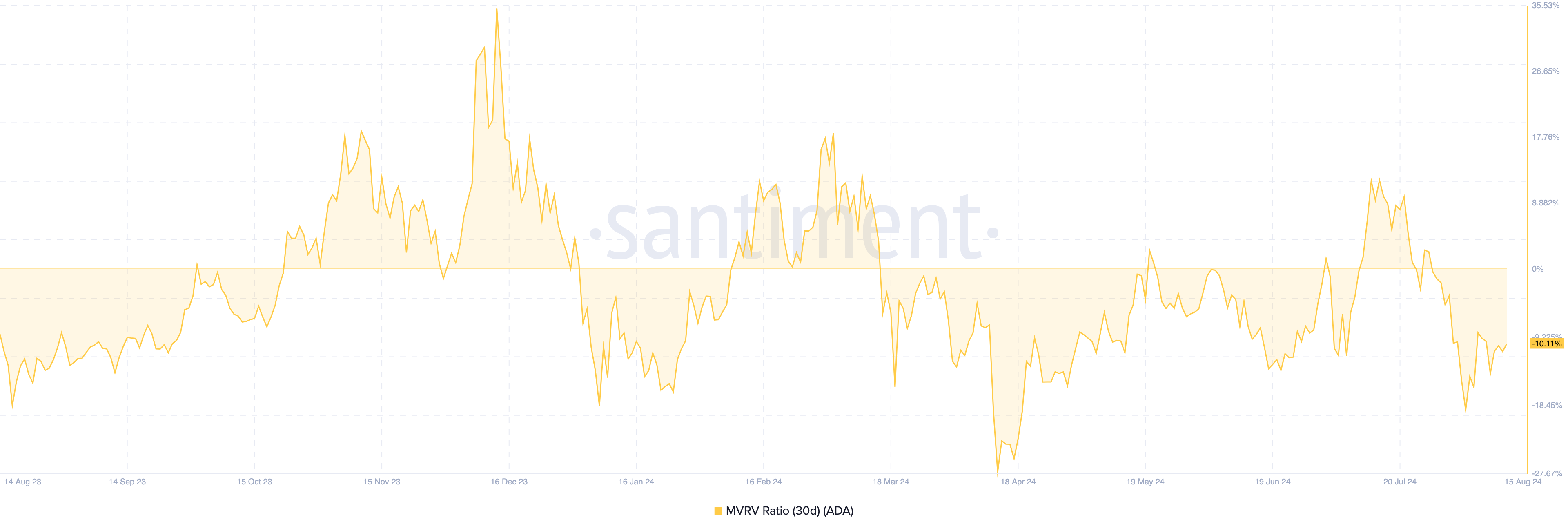

To assess the token’s future seemingly, BeInCrypto examines the Market Payment to Realized Payment (MVRV) ratio. This ratio reveals the relationship between an asset’s contemporary trace and the value at which it used to be acquired.

The increased the ratio, the extra holders are interesting to sell due to increased unrealized earnings. Nonetheless, a lower suggests a rise in unrealized earnings. In this occasion, holders will be unwilling to sell as they’d per chance merely think that the token is undervalued.

At press time, ADA’s 30-day MVRV ratio is -10.11%, that means that if all holders sell at the fresh trace, the real looking return will be losses. Nonetheless, due to the stipulations mentioned above, this will even merely no longer happen.

Historically, ADA trace bounces when the MVRV ratio is between -7.66% and -27.32 %. Subsequently, while the value can peaceful lower, it’s undervalued and would perchance per chance merely pump later on.

From a short-term perspective, ADA formed a bearish pennant between mid-July and early August. This pattern is characterised by a appealing trace plunge followed by consolidation within a symmetrical triangle on the day after day chart.

While symmetrical triangles can signal both bullish or bearish moves, the Relative Strength Index (RSI) for the time being sits at 39.55, suggesting that bearish momentum persists. With the RSI under 40, ADA is more likely to face continued downward stress unless market stipulations shift in prefer of merchants.

If this trend continues in the impending days, ADA’s trace would perchance per chance merely plunge to $0.31. Nonetheless, a surge in procuring for stress can trade the cryptocurrency’s stipulations.

Learn extra: Cardano (ADA) Designate Prediction 2024/2025/2030

If this occurs, ADA’s trace would perchance per chance merely reach $0.37. If accumulation intensifies with excessive trading volumes, the token would perchance per chance well rally additional, potentially reaching its contemporary native excessive of $0.forty five.