PEPE label steadied spherical $0.000079 on Aug 14, reflecting a 31% decline within the first half of August 2024. No topic favorable inclinations worship Grayscale launching tranquil cryptocurrency trusts and the originate of dovish CPI data, on-chain data exhibits a valuable tumble in whale search recordsdata from for PEPE.

PEPE Tag Tumbles 31% in August 2024

PEPE had a tough start to August, reaching a three-month low on August 5. Even supposing the broader crypto market recovered within the second week of August, buoyed by the approval of Solana ETFs in Brazil and Grayscale’s introduction of tranquil crypto asset choices to its U.S.-essentially essentially based customers, PEPE’s rally proved short-lived.

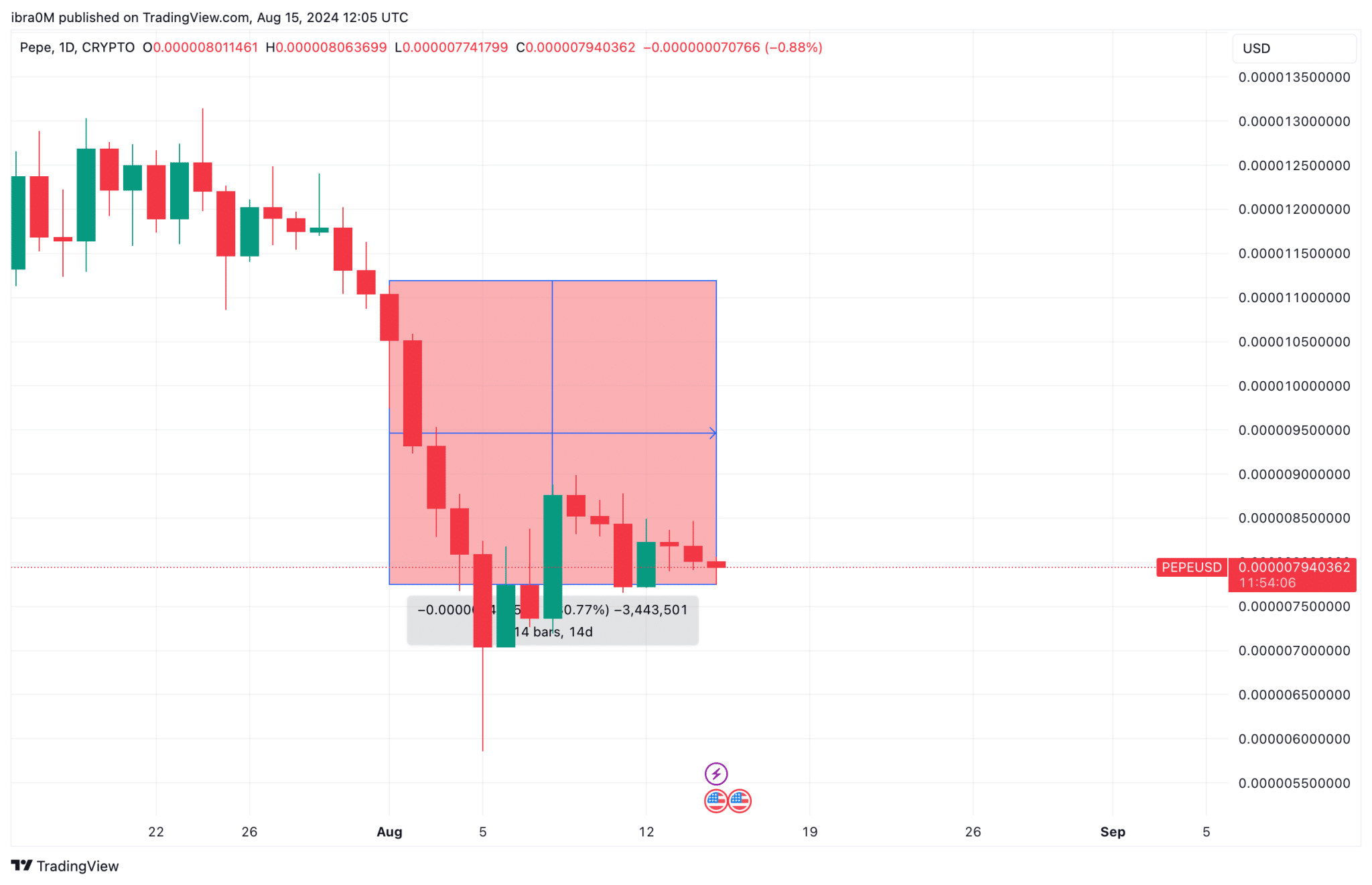

Between August 5 and August 9, PEPE skilled a transient uptrend, but tranquil inclinations display conceal that the rally used to be merely a fraudulent-out.

As shown within the chart above, PEPE has registered losses in every of the closing three trading days. Zooming out, the monthly timeframe shows a 30% loss as of August 15.

The dovish U.S. CPI data originate failed to take care of shut the crypto markets, as merchants in the starting up directed their focal level in direction of the stock markets. As a consequence, crypto markets, including PEPE, stumbled following the CPI data originate on Wednesday, raising concerns of a appealing correction. PEPE’s label has fluctuated within this context, and with whale merchants reducing their search recordsdata from, the cryptocurrency appears to be like poised for extra declines.

Whale Patrons Lacking in Action

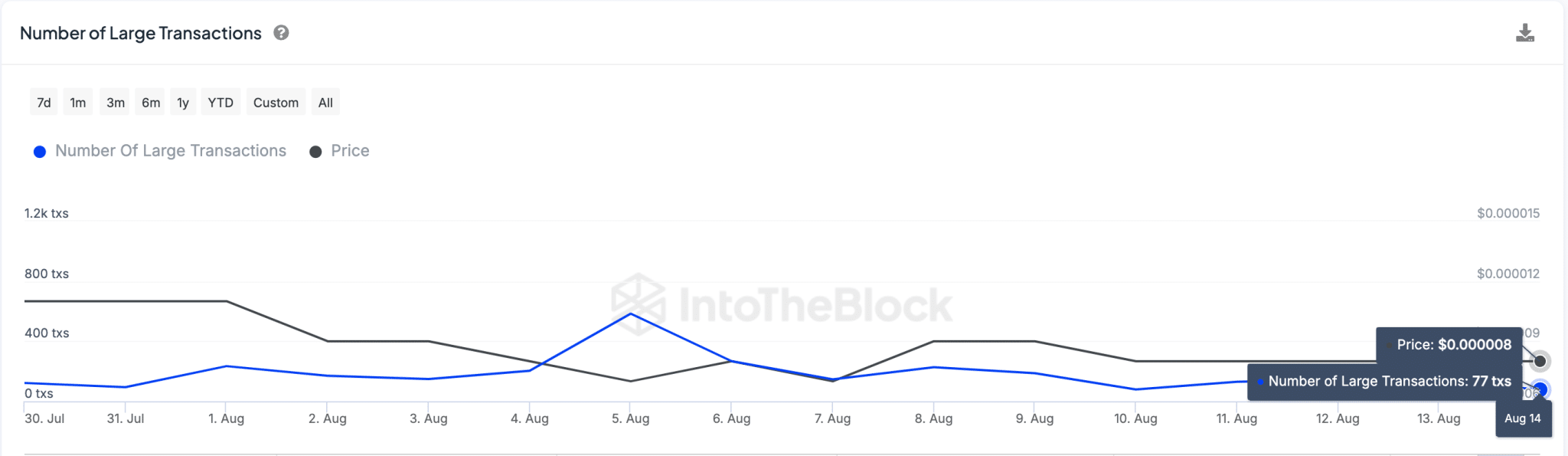

This downward pattern is extra exacerbated by a valuable decline in whale search recordsdata from for PEPE. The different of big transactions, as depicted within the chart above, has plummeted from 544 transactions on August 5 to correct 77 on August 14. This 85% tumble in wide transactions highlights the bearish sentiment amongst valuable merchants.

The decline in whale exercise has severely impacted PEPE’s label and restricted its potential to rebound in tranquil days. If this pattern persists, PEPE could presumably face extra downward stress within the coming days.

PEPE Tag Forecast: Cracks Emerge Around $0.00008 Enhance

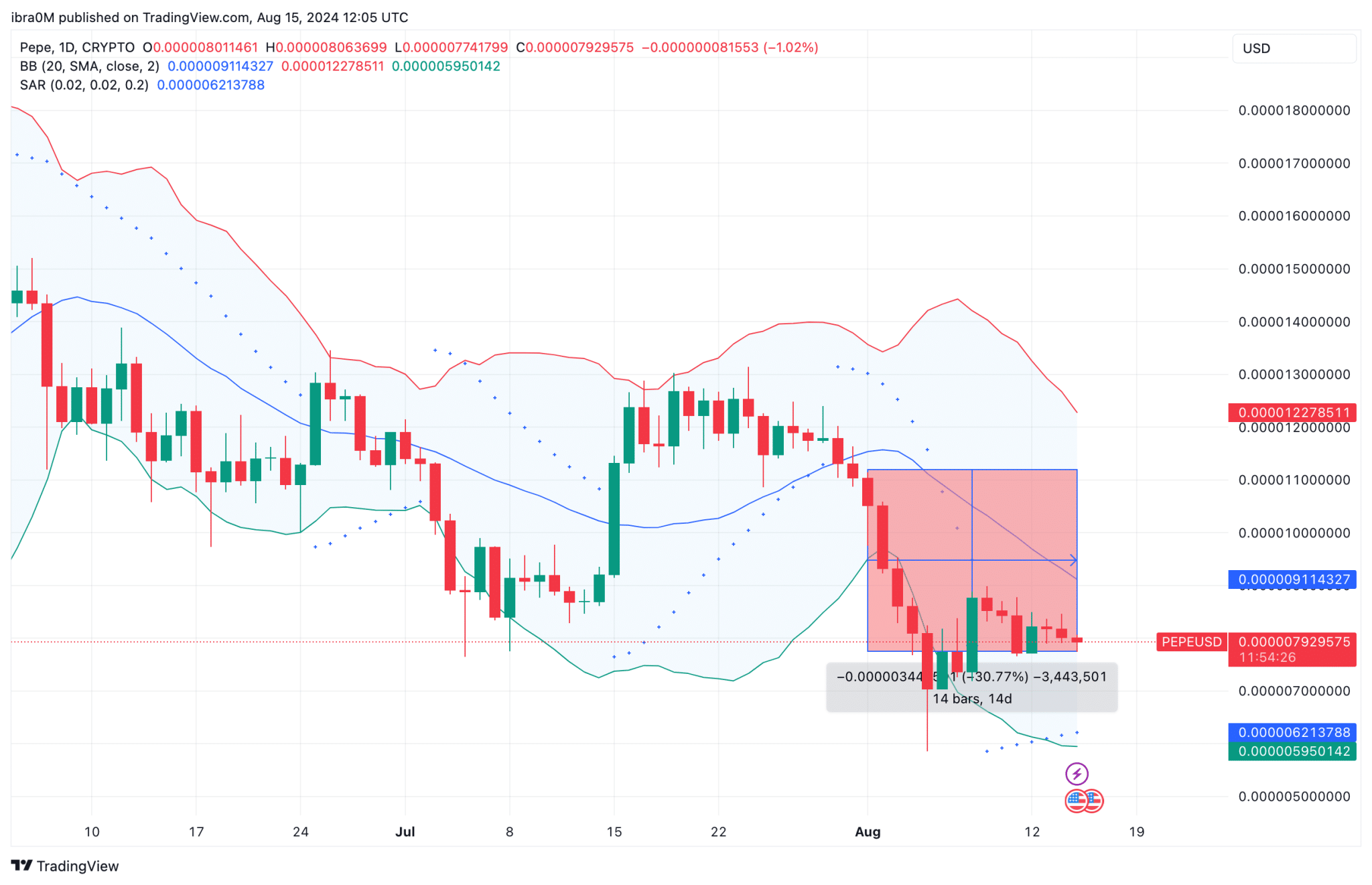

PEPE’s tranquil label action shows valuable cracks spherical the $0.00008 toughen level. The tranquil bearish momentum, coupled with the decline in whale exercise, means that this toughen level is below threat.

As indicated by the Bollinger Bands, PEPE’s label has been trending in direction of the lower band, signaling elevated selling stress. The Parabolic SAR dots bask in also flipped above the price, reinforcing the bearish outlook.

If the $0.00008 toughen level fails to support, PEPE could presumably survey extra declines, with the next key toughen level spherical $0.00006. On the upside, resistance is predicted spherical $0.00009, but with the tranquil market sentiment, a valuable rally appears to be like presumably not. Traders must restful be cautious, as the bearish indicators counsel that PEPE’s label could presumably continue to pattern lower within the strategy term.