The Sandbox (SAND) imprint climbed to $0.27 within the course of early buying and selling this day. Nonetheless, with 98% of its holders within the intervening time in losses, the token may well face one other imprint tumble.

300 and sixty five days-to-date (YTD), SAND’s imprint has fallen by 56.22%. If this decline continues, the cryptocurrency may well attain its lowest imprint viewed within the course of the 2022 endure market.

The Sandbox Continues to Face Tricky Instances

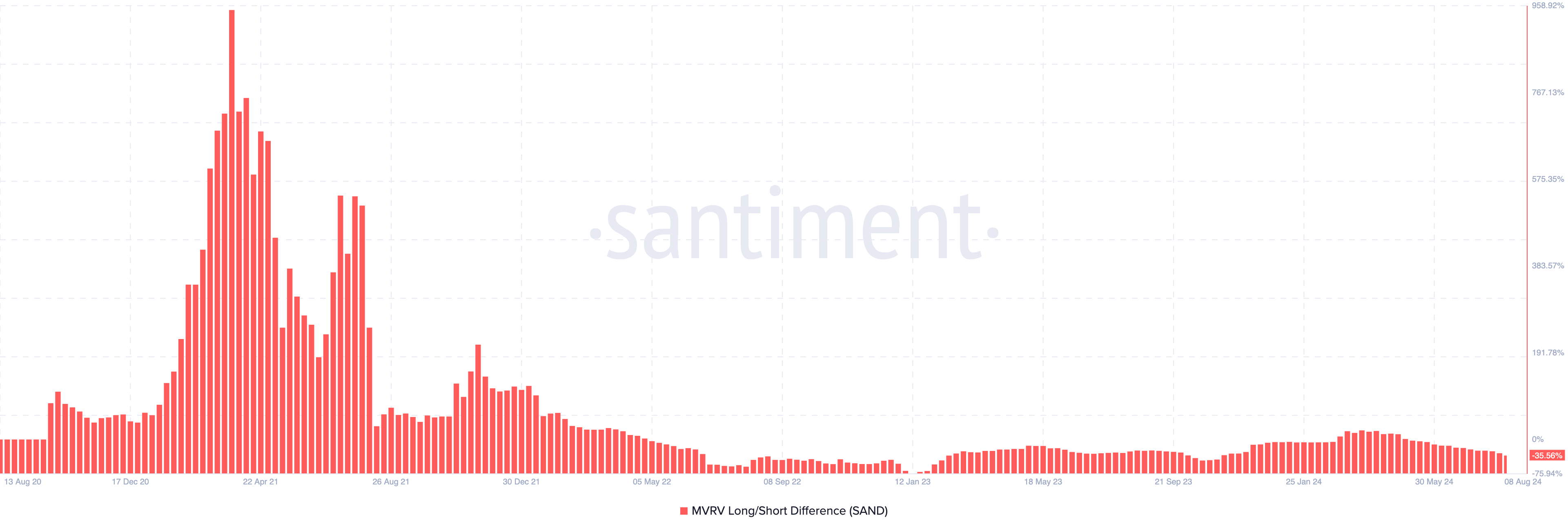

The Sandbox imprint has risen by about 6% over the last seven days. Nonetheless, on-chain data exhibits the Market Value to Realized Value (MVRV) Lengthy/Instant Distinction is -35.56%. This metric, which tracks market profitability, is very most indispensable for figuring out endure and bull phases.

Negative values screen that temporary holders would realize more earnings than prolonged-term holders within the event that they bought on the present imprint. Conversely, trot values point out that prolonged-term holders would realize more earnings within the event that they bought.

Pondering the above, the MVRV Lengthy/Instant Distinction also captures the head of a bull inch and when a cryptocurrency is heading against a endure market. Historically, SAND enters a endure cycle when the metric is between -40.74% and -75.26%.

Read more: What Is The Sandbox (SAND)?

This conclusion depends on the metric’s behavior within the course of the 2022 bull market, which in the end resulted in a fall down in crypto costs. If SAND’s imprint fails to compose a notable soar, profitability will lower, potentially pushing the token into a endure section.

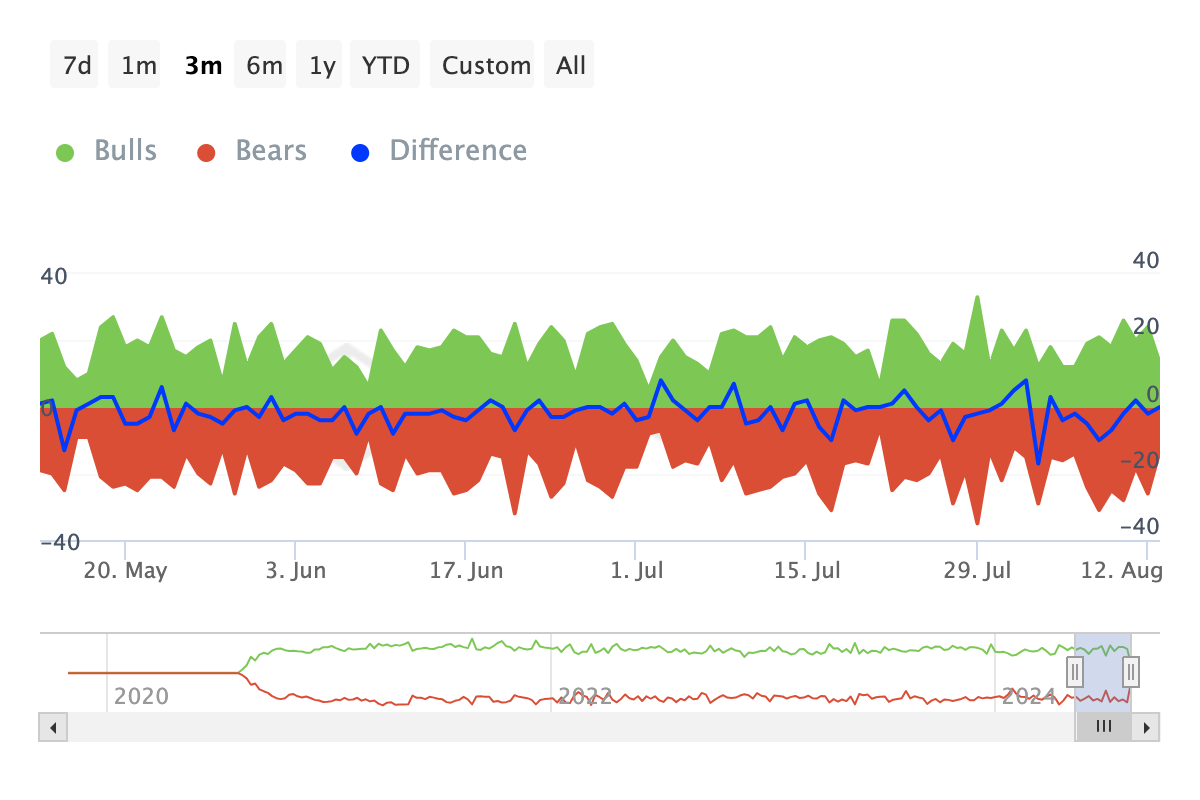

One other indicator supporting this outlook is the Bulls and Bears Indicator. This instrument tracks whether or no longer the head 1% of buying and selling volume participants are hunting for or selling.

Bulls are these hunting for 1% of the buying and selling volume, while bears are these selling the identical volume. An amplify in bulls relative to bears is an efficient signal that may well discover upward stress on the associated fee.

Within the past seven days, SAND has viewed 28 more bears than bulls, indicating that the majority of traders lack self belief within the token’s prospects.

SAND Impress Prediction: Help Brings Higher Misfortune

Technical prognosis, supported by indications on SAND’s on daily basis chart, also aligns with the signs on-chain. As an illustration, the Balance of Energy (BoP) has dropped to -0.64. This imprint-based entirely indicator evaluates the final energy of traders and sellers available within the market.

If the Balance of Energy (BoP) oscillates above the zero line, it implies that traders are stronger than sellers. Nonetheless, since it’s within the intervening time below the zero line, this means that the cryptocurrency is below endure market dominance.

Can also simply unexcited sellers preserve preserve an eye on, SAND’s recent upswing may well per chance be fast-lived. Meanwhile, the Fibonacci retracement phases provide perception into doubtless imprint aspects the token may well attain.

Read more: The Sandbox (SAND) Impress Prediction 2024/2025/2030

If selling stress increases, SAND’s imprint may well tumble to $0.20. Alternatively, with strong bullish motion, the token may well are attempting to retest the $0.30 level.