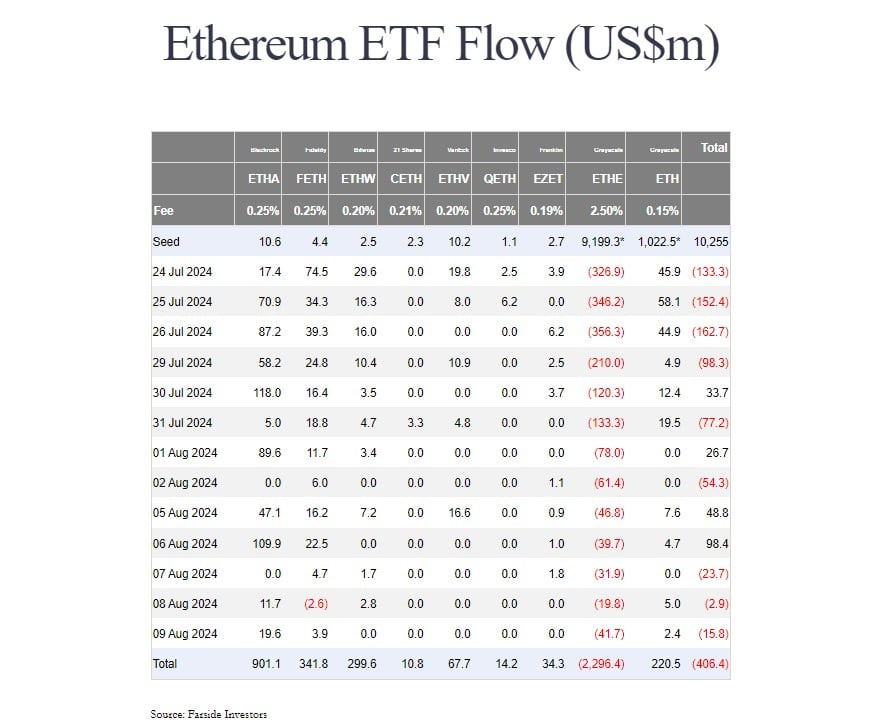

BlackRock’s Ethereum alternate-traded fund (ETF), the iShares Ethereum Belief, may perchance well perchance turn out to be the first US space Ethereum fund to hit $1 billion in derive inflows. The ETF, purchasing and selling beneath the ETHA ticker, has logged around $901 million in derive capital appropriate three weeks after its initiate and is well heading in the appropriate direction to invent the milestone, Farside Traders’ information reveals.

Nate Geraci, the president of The ETF Store, is confident that ETHA will attain $1 billion in inflows this week, including that it is one of many raze six most winning ETF launches of the One year.

iShares Ethereum ETF has taken in $900+mil in < 3 weeks…

Gorgeous noteworthy a lock to hit *$1bil* this week IMO.

As talked about previously, ETHA already top 6 initiate of 2024 (4 of 5 others are space btc ETFs).

— Nate Geraci (@NateGeraci) August 12, 2024

BlackRock’s fund that provides bid publicity to Bitcoin (BTC), the iShares Bitcoin Belief or IBIT, used to be the first space Bitcoin ETF to attain $1 billion in inflows. Thanks to fixed, massive inflows, it took the ETF most productive four days to pass the trace.

BlackRock’s ETF information indicates a slower accumulation rate for Ethereum when when put next with Bitcoin. The assign a query to for Ethereum ETFs, whereas growing, has no longer but matched the extent of hobby viewed in Bitcoin ETFs. On the change hand, it’s no longer fully unexpected.

Martin Leinweber, Director of Digital Asset Analysis & Technique at MarketVector Indexes, previously talked about that he anticipated extra modest inflows into Ethereum ETFs when when put next with the sizable inflows viewed with Bitcoin ETFs, which have attracted billions in a handy e-book a rough whereas.

Eric Balchunas, the well-liked Bloomberg ETF analyst, estimated that the assign a query to for space Ethereum ETFs may perchance well perchance very well be around 15% to 20% of what is viewed in Bitcoin ETFs. His projection came after the landmark approval of these merchandise in Might perchance perchance.

BlackRock’s ETHA would be the quickest-growing space Ethereum ETF but Grayscale’s competing fund, the Grayscale Ethereum ETF (ETHE), nonetheless dominates managed resources with out reference to tolerating almost $2.3 billion of outflows because it used to be transformed from a have faith.

ETHE at this time holds $4,9 billion price of Bitcoin whereas ETHA has over $761 million in resources beneath administration (AUM). With the most modern accumulation tempo, ETHA may perchance well perchance soon surpass ETHA in AUM.

There’s a chance that ETHA may perchance well perchance top the Ethereum ETF market but extra observations are major, seriously when Grayscale has already equipped its Ethereum Mini Belief.

The streak-off used to be seeded with 10% of the have faith’s holdings and now has $935 million in AUM. Despite fixed capital into the low-rate fund, its derive inflows are nonetheless modest when when put next with BlackRock’s ETHA inflows.

BlackRock’s IBIT has outpaced Grayscale’s Bitcoin ETF (GBTC) to turn out to be the largest space Bitcoin fund by advance of Bitcoin holdings. As of this day, the fund holds roughly 348,000 BTC, valued at around $21 billion.