- Ethereum ETFs seen get outflows of $23.7 million as Grayscale ETHE flows endured downtrend transfer.

- Ethereum consumers are absorbing the sell stress from capitulated whales and Soar Crypto.

- Ethereum bulls returned to defend key enhance stage as technical indicators signal ETH is staging bullish reversal.

Ethereum (ETH) is up almost 10% on Thursday as consumers fetch the selling stress from capitulated whales and Soar Crypto. In the meantime, ETH technical indicators recommend that ETH has considered a bottom and is staging a bullish reversal.

Daily digest market movers: ETH ETF flows, consumers absorb selling stress

Ethereum ETFs’ get flows became detrimental on Wednesday after recording outflows of $23.7 million. BlackRock’s ETHA, which has led inflows within the past two days, seen zero flows, while Grayscale’s ETHE outflows extra declined to $31.9 million. The total get asset designate of the nine Ethereum ETFs dropped to $6.6 billion.

The get outflow follows the Recent York Stock Alternate (NYSE) submitting to listing and substitute strategies for Bitwise and Grayscale Ethereum ETFs. This comes a pair of days after the Nasdaq filed for a an identical strategies trading for BlackRock’s ETHA.

In the meantime, some whales capitulated following the market dip. Lookonchain reviews that a whale who amassed 14,384 ETH at an common designate of $3,291 between June 22 and August 4 sold all of his holdings on Binance at $2,417 after the market crashed. The transfer seen the whale realize a lack of $12.57 million.

Moreover, Soar Trading, which has been on an ETH selling spree within the past four days, withdrew 32.6 million USDC from Binance after transferring ETH to the substitute. This implies the company would possibly per chance moreover simply luxuriate in already sold the ETH because it appears to be like to be like to unstake its final holdings from Lido.

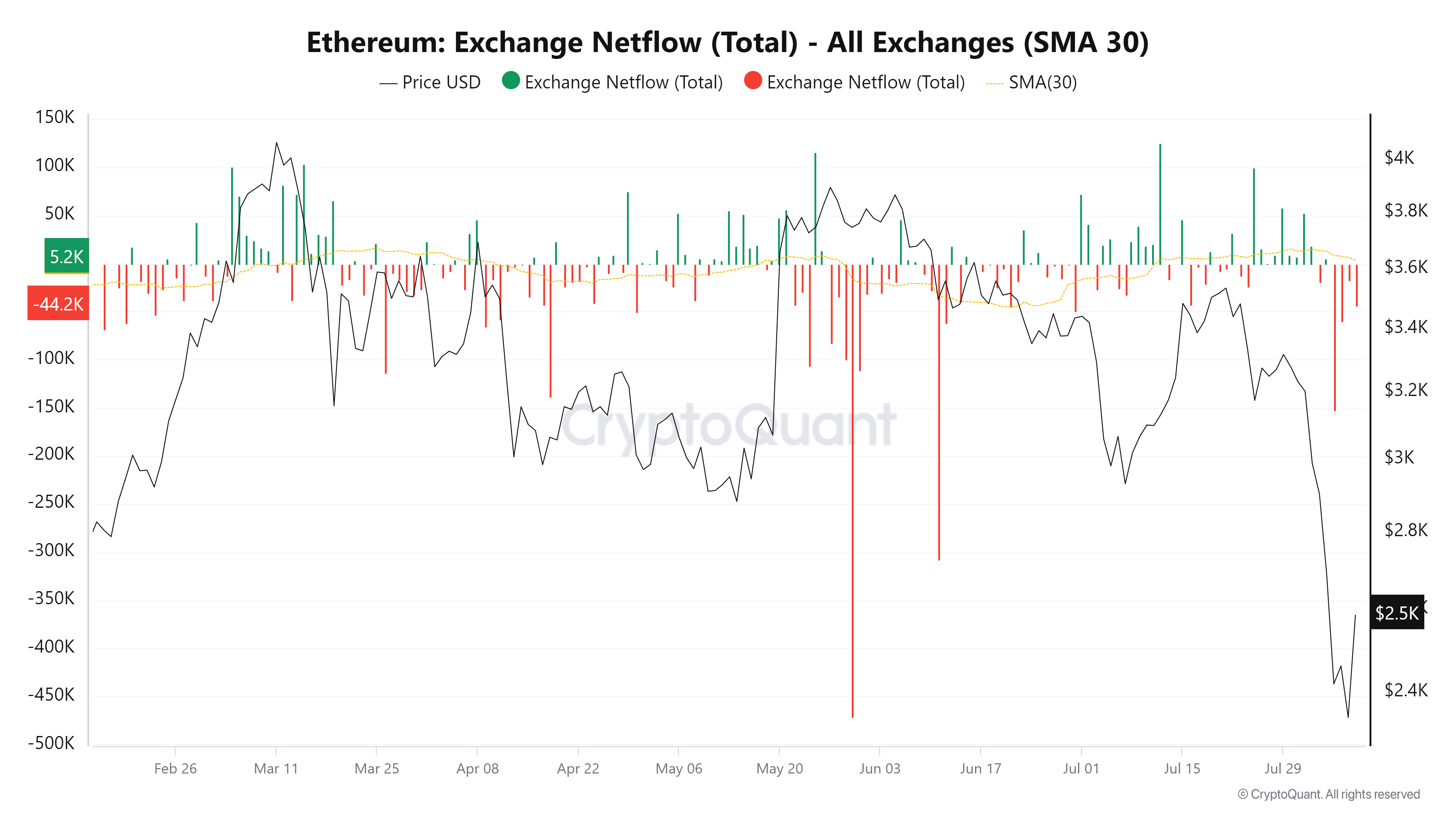

On the opposite hand, consumers seem to be absorbing the selling stress as exchanges luxuriate in endured to skills get ETH outflows within the past four days, in line with CryptoQuant’s information.

ETH Alternate Netflow

The ETH Coinbase Premium Index, which measures the distinction between ETH’s designate in Coinbase Skilled and Binance, has also been above the 0 line. It reached 0.04 on August 6 earlier than declining mildly to 0.03. The index above the 0 line signifies sturdy ETH shopping stress from US traders because the tip altcoin continues convalescing.

ETH technical analysis: Ethereum bulls would possibly per chance moreover abet initiate bullish reversal

Ethereum is trading spherical $2,580, up almost 10% on the day. In the past 24 hours, ETH has considered $55.77 million in liquidations, with long and short liquidations accounting for $34.65 million and $21.12 million, respectively.

Bulls returned to defend the $2,300 designate stage after ETH took a 6% decline on Wednesday. The $2,300 designate is a obligatory enhance stage for ETH, brooding about that 2.12 million addresses luxuriate in amassed 50.08 million ETH spherical this designate, in line with IntoTheBlock’s information.

ETH/USDT Daily chart

ETH’s Relative Strength Index (RSI) has moved from the oversold situation and signifies a bullish reversal because it appears to be like to be like to immoral above its exciting common. The RSI crossing above the yellow exciting common line most often signifies bullish momentum.

The Stochastic Oscillator can be exciting in a route that implies ETH would possibly per chance moreover rally. After indicating a bullish divergence on August 7, when it made a bigger low while ETH’s designate made a decrease low, it has moved away from the oversold situation.

The ETH Long/Rapid Ratio also suggests a an identical transfer, because it has risen to 1.02, indicating that futures traders are changing into bullish.

Consequently, ETH would possibly per chance moreover rally to flip the resistance spherical $2,723. A a success transfer above this stage would possibly per chance moreover discover ETH tackling the resistance spherical $3,368 — spherical which the 50, 100 and 200-day Easy Transferring Averages (SMAs) are taking a discover to converge.

The $2,000 psychological stage would possibly per chance moreover abet as a key enhance on the downside in case of prevailing bearish sentiment. A day-to-day candlestick shut under the $2,000 stage will invalidate the bullish thesis.