These days, revel in the On the Margin newsletter on Blockworks.co. The next day to come to come, procure the info delivered straight away to your inbox. Subscribe to the On the Margin newsletter.

Welcome to the On the Margin E-newsletter, brought to you by Ben Strack, Casey Wagner and Felix Jauvin. Right here’s what you’ll earn in this day’s model:

- We read between the lines of the day before this day’s Fed assembly.

- As crypto gets political, an industry CEO expects Democrats to soon charm to the industry.

- SEC Commissioner Worth Uyeda doubles down on his pro-crypto stance.

The very best FOMC takeaways

What’s change into a conventional sequence occurred again the day before this day at some level of the FOMC assembly.

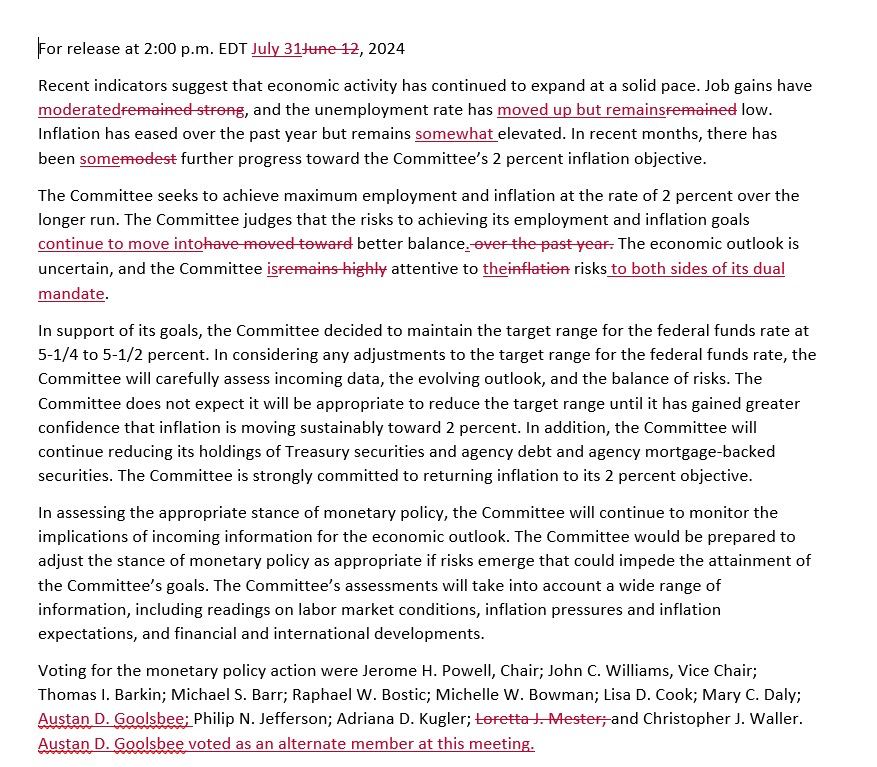

First we procure the FOMC assertion, which has diminutive or no novel data. Some on-the-margin changes to the assertion are below, but in most cases it used to be inside expectations and supplied no value of forward steering:

Many were purchasing for some steering from Powell on whether or no longer the market’s pricing of a reduce on the September assembly used to be warranted or no longer. When requested about that, Powell leaned on ready remarks that shall be summarized delight in this: As prolonged as nothing queer happens between now and September, we’re going to be in a position to presumably reduce.

That is, needless to tell, paraphrasing and gets rid of the total esoteric start-ended Fed discuss we’re conversant in. But while you boil it down, that’s the core of the premise: September is on, barring something else crazy.

With the exception of guiding a September reduce, we got about a reasonably about a attention-grabbing insights:

- Powell in comparison this day’s labor market to that of 2019. That is something I’ve been hooked in to too as we come what I’d call a “normalization reduce” in September. That is expounded to messaging Powell passe in 2019 to reduce around it being a “mid-cycle adjustment.”

- The Fed chair characterized the economy as neither slowing, nor overheating. Quite, he considered it as in a considerably stable equilibrium reveal.

- Powell made it determined the Fed board is of the same opinion we are confidently in restrictive territory and have been for a whereas. That is well-known in working out what drives the Fed response characteristic as many argue the neutral price — a baseline for deriving restrictiveness — is secularly greater now.

- Indirectly, there used to be a stern emphasis on the dual mandate of the Fed being in design more stable steadiness. Responding to a seek data from from the WSJ’s Slash Timiraos, Powell admitted he would be fascinating to ease to verify the labor market doesn’t additional loosen — even if it meant sacrificing about a basis choices of inflation.

Overall, this used to be a considerably neutral FOMC assertion and a dovish press conference. The fact that Powell had ready remarks ready to trip to manual the market in direction of a September price reduce actually says it all.

— Felix Jauvin

$18 million

The catch inflows for the Grayscale Bitcoin Mini Belief (BTC) at some level of its first day of shopping and selling Wednesday.

The cheapest-in-category drag-off of GBTC — with a 0.15% price — launched the day before this day with roughly $1.8 billion in resources.

Though a modest movement figure (all in favour of $17.7 billion has entered US self-discipline BTC funds since January), the Grayscale Bitcoin Mini Belief used to be one of staunch two such ETFs to notch inflows on the day. The reasonably about a used to be BlackRock’s iShares Bitcoin Belief (IBIT), which reeled in $21 million.

Take a look at out Blockworks’ Q&A with Grayscale managing director John Hoffman.

Galaxy’s Novogratz ‘hopeful’ VP Harris shall be pro-crypto

We know where Trump appears to stand on crypto. At the least publicly, and for now.

Though Kamala Harris — self-discipline to be his challenger in the November election — has no longer explicitly shared a stance on the matter, Galaxy Digital CEO Mike Novogratz expects she’s going to soon.

“I’m barely definite, and hopeful, that nominee Harris … goes to soon assemble feedback that display shroud she’s from San Francisco — the land of innovation — and that she needs to be a respectable-innovation, pro-crypto president,” Novogratz stated at some level of his company’s Thursday earnings call.

Republican politicians have historically been more outspoken than Democrats in supporting the crypto industry, especially this election cycle. There used to be some bipartisan development, though, with a spread of Dems joining colleagues all around the aisle in voting to approve a design to invalidate the SEC’s Employees Accounting Bulletin 121, along with the FIT21 Act.

“If we procure the Democrats to trip where I possess they’re going … now we’ve bought each aspects, and we would also also be much less frightened about Washington and more frightened about prosecuting our industry,” Novogratz stated.

Outside of politics, the macro backdrop looks self-discipline to abet BTC and crypto more broadly, the executive argued.

The Federal Reserve opted to preserve hobby rates precise on Wednesday, though the overwhelming expectation is for it to reduce rates in September. Decrease hobby rates have in most cases been ethical for “risk-on” resources delight in BTC.

There’s furthermore the total nationwide debt misfortune. No matter it no longer too prolonged ago surpassing $35 trillion, Novogratz identified the inability of discuss by Harris or Trump to reduce spending and reduce the deficit.

“Except that paradigm shifts — and it’s interesting to take into yarn it transferring — bitcoin as a retailer of trace and bitcoin as digital gold goes to have a luminous charm to investors around the realm,” Novogratz stated.

— Ben Strack

SEC’s Uyeda says US needs to step it up

SEC Commissioner Worth Uyeda doubled down on his crypto stance this week, telling the crowd at a Capitol Fable occasion in DC: “We’re some distance, some distance on the benefit of the curve on crypto.”

The unusual come is too disjointed to allow for industry people to succeed, Uyeda stated. Despite the indisputable truth that token issuers were ready to “come in and register” as securities, he added, they would face roadblocks. That’s because non-brokers, which most crypto exchanges are labeled as this day, can not facilitate shopping and selling.

The feedback shouldn’t come as a shock, as Uyeda has consistently dissented from his colleagues and their come to regulating the industry. Closing month, he expressed frustration with President Joe Biden’s veto of Joint Option 109, which sought to overturn the SEC’s SAB 121 steering.

“Issuing SAB 121 by regulatory edict reasonably than rulemaking below the Administrative Design Act successfully avoids judicial evaluate, which undercuts our blueprint of assessments and balances against an overreaching administrative reveal,” Uyeda stated. “The veto of H.J. Res. 109 used to be unhappy. SAB 121 needs to be withdrawn.”

Uyeda and fellow crypto-friendly Commissioner Hester Peirce earn themselves in an attention-grabbing reveal forward of the 2024 presidential election.

Old President Donald Trump has promised, if elected, to “fire” SEC Chair Gary Gensler “on day one.” That would also be a suppose unusual licensed pointers would doubtless prohibit him from gratifying. What Trump would possibly presumably per chance also live, per factual consultants, is replace Gensler with a weird commissioner — leaving him in the agency but stripping him of his leadership characteristic.

But, incandescent Trump, I wouldn’t be shocked if he tries to take a look at the bounds of his executive energy must still he earn and fireside Gensler outright. For certain, here is all hypothetical for now.

— Casey Wagner

Bulletin Board

- After managing to preserve in the inexperienced for about a hours after the day before this day’s FOMC assembly, bitcoin dipped in a single day to below $65,000. The crypto asset used to be shopping and selling at roughly $62,275 at 2 pm ET — down terminate to 5% from 24 hours prior.

- Prediction markets are the total rage, per Binance’s novel H1 story. Total trace locked on prediction market platforms is up greater than 200% twelve months to this level, the compare reveals.

- The On the Margin crew sends our neatly needs to WSJ reporter Evan Gershkovich and his family. Evan, who has been imprisoned in Russia for over a twelve months, used to be freed Thursday as piece of an define East-West prisoner swap. Welcome home, Evan!