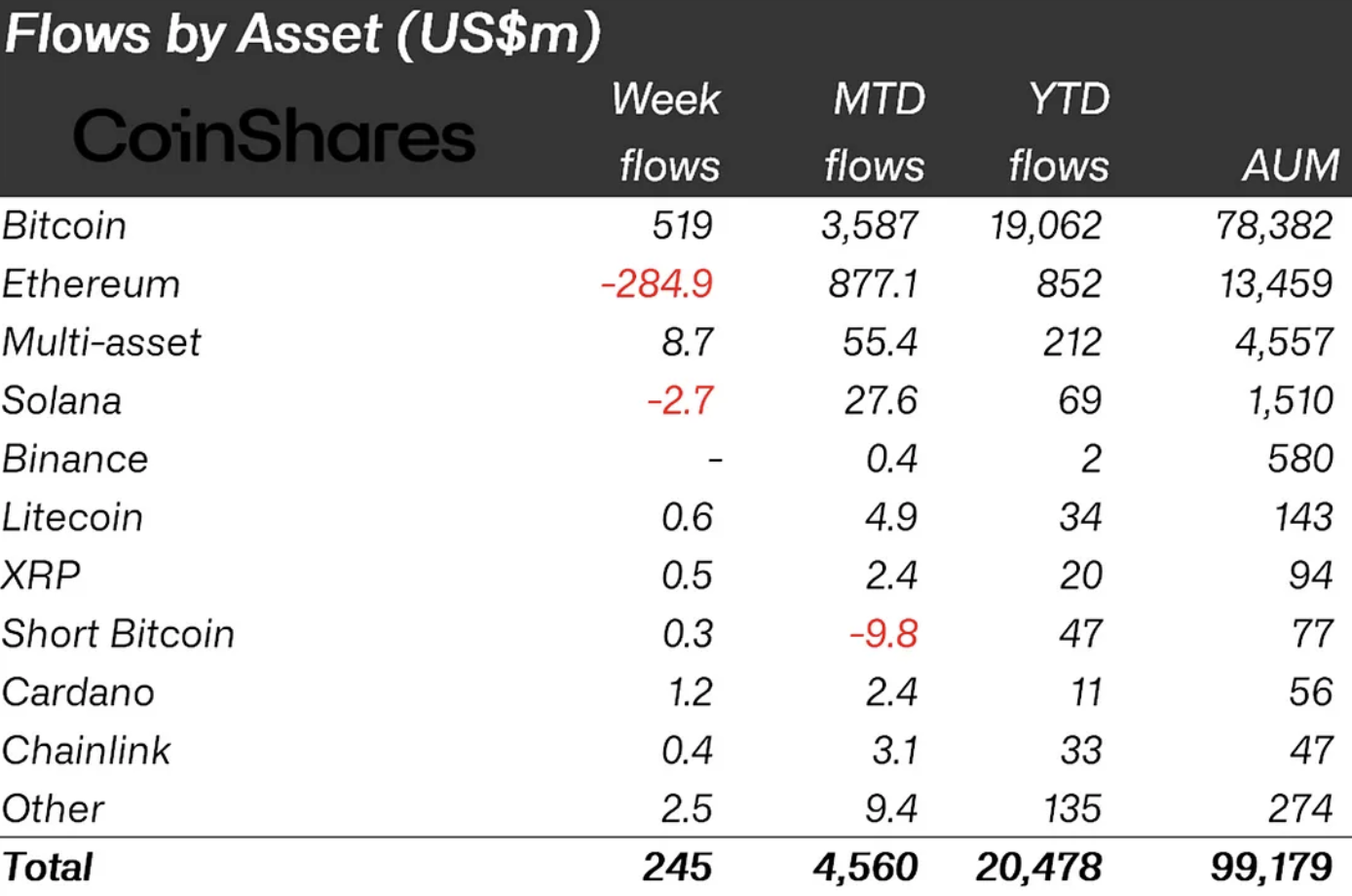

In accordance with the most contemporary CoinShares weekly file on crypto-linked ETF inflows, but any other $245 million were added to the market closing week. As things stand, the year-to-date figure is monstrous, starting up at $20.Forty eight billion.

As repeatedly, Bitcoin – the largest cryptocurrency – led the system closing week, with several ETFs from major monetary institutions equivalent to BlackRock and Franklin Templeton. Over the previous seven days, these investment vehicles receive seen inflows of $519 million, which is actually 97.9% of your entire money that has flowed into crypto-linked investment merchandise over the interval.

Nonetheless, there were different winners as smartly – digital sources, investment merchandise that receive confirmed distinctive momentum by system of inflows, even though no longer as principal as Bitcoin. One in every of those is Cardano (ADA). In accordance with the knowledge, inflows into Cardano ETPs totaled $1.2 million closing week, 300% bigger than the week earlier than.

Moreover, this week’s end result places Cardano in 2d enviornment amongst all crypto ETPs. In total, for the reason that launch of 2024, Cardano-oriented investment merchandise receive attracted $11 million from conventional merchants.

Cardano’s subsequent astronomical onerous fork

Such an extend for the ADA blockchain could be attributed to the upcoming Chang onerous fork. As reported by U.This day, the onerous fork is anticipated to raise the last decentralization to Cardano, when even the standard blockchain’s treasury will be managed through vote casting by ADA stakeholders.

It additionally includes the adoption of the Cardano Constitution, which will cement your entire guidelines and guidelines of decentralized governance of the blockchain.

The onerous fork is scheduled for this year, so it is a long way imaginable that merchants will are trying to carry out this play through Cardano ETPs, and that’s why we’re seeing increasing flows into these investment merchandise.