Solana (SOL) is experiencing fundamental fluctuations in its rate, pushed by a aggregate of increased network project and broader market downturns. This text will shed gentle on the factors influencing SOL rate and its doable trajectory within the approaching months.

Solana Ticket Diagnosis: Network Exercise Boosts Optimism

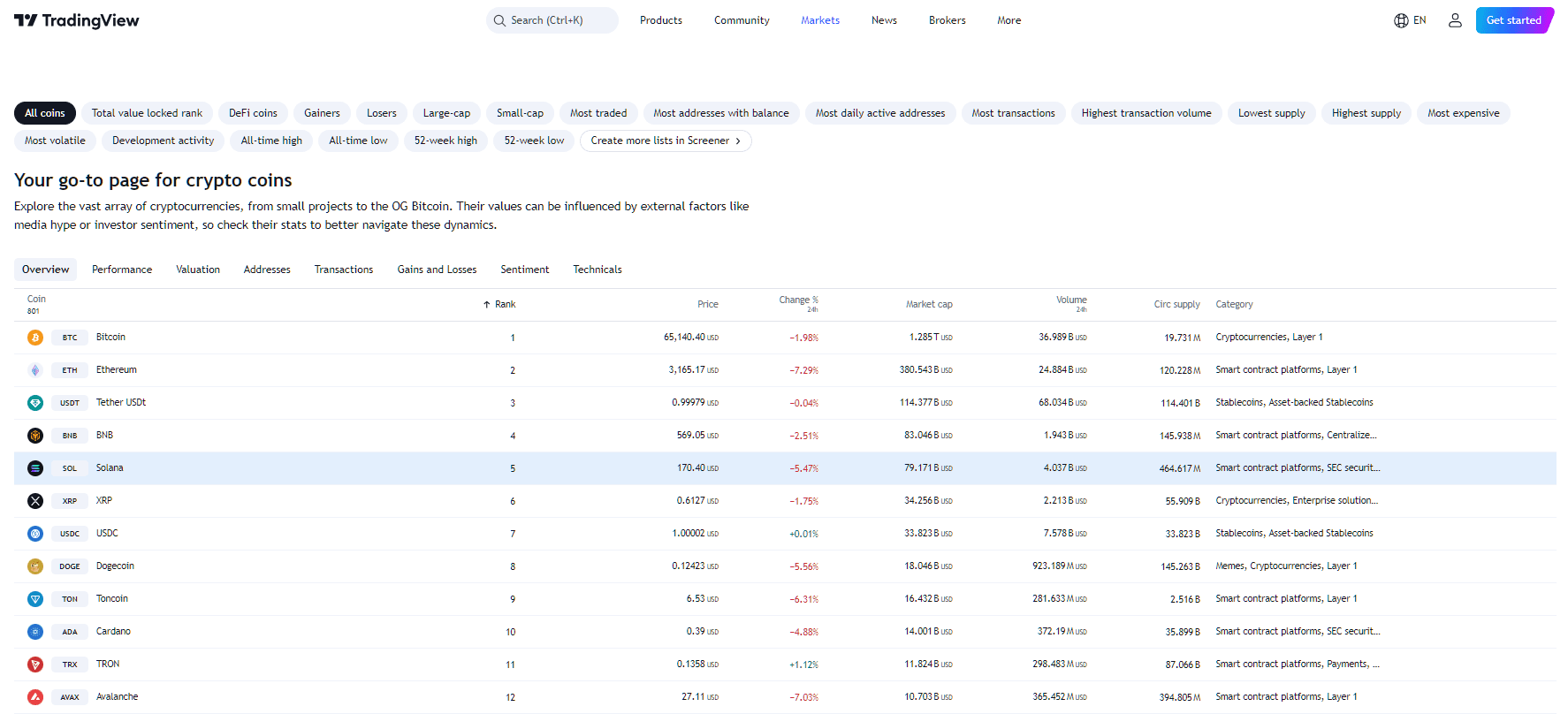

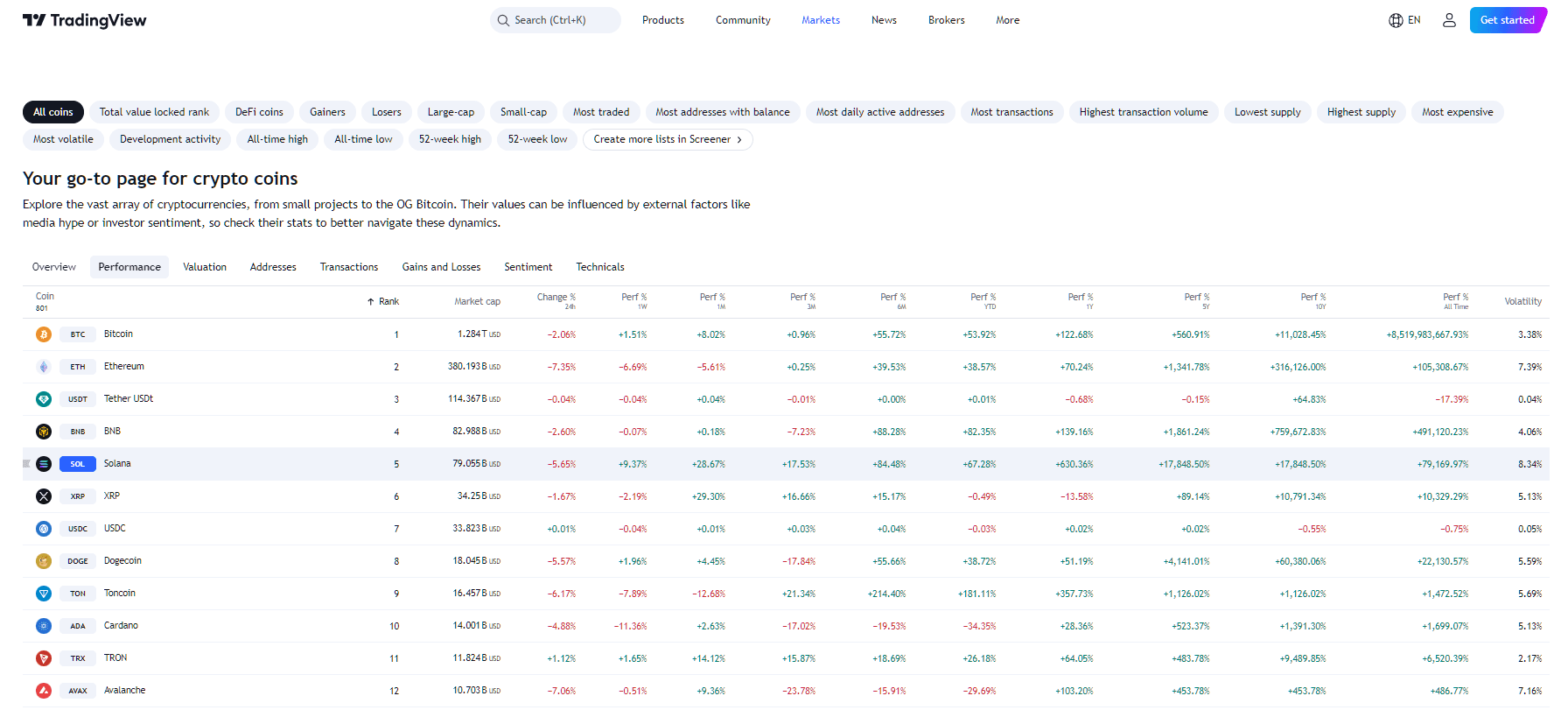

Solana rate is currently shopping and selling round $170, showing a decline of 5,5% within the previous 24 hours. In spite of this correction, SOL rate has witnessed a excellent rally, soaring over 1,634% since January 2023. This surge has been largely attributed to airdrops, namely of meme money, which possess vastly boosted network project and investor self belief in SOL.

The increased network project, mirrored in excessive transaction volumes and total price locked (TVL), underscores the rising relevance of Solana’s trim contracts network. In step with quiet records, Solana’s transaction volume reached $3.68 billion on March 15, up from $15.22 million on January 1, 2023. In an identical diagram, TVL has surged over 2344%, from $210.47 million to $5.145 billion.

Solana Ticket Prediction: Technical Indicators Video show Most likely Positive aspects

Solana rate toddle kinds a rounded bottom pattern, indicating doable for a 47% form. The price has breached the $148 to $155 zone, supported by predominant exponential transferring averages (EMAs). The Relative Strength Index (RSI) is in determined territory at 58, suggesting that bullish momentum could maybe push SOL’s rate above the neckline at $186, potentially reaching $252.

Alternatively, earnings-taking could maybe net page off a pullback, causing SOL to drop below the $150 psychological level. A breach of this assist could maybe glance the rate fall to $135 or even flip the $121 assist into resistance, invalidating the bullish outlook.

Technical indicators existing a blended image. The RSI at 55.40 indicates a transfer in direction of fair territory, while the MACD reveals a bullish crossover. In spite of the adverse market mood, these indicators counsel doable market shifts. Solana’s shopping and selling volume has also viewed an uptick, reaching $4.13 billion in 24 hours, indicating increased project no topic less ask.

If Solana rate fails to withhold the $155 assist, it can maybe chase in direction of $130. Alternatively, if it finds assist and rebounds, instantaneous resistance is at $180. A ruin above this level could maybe signal a pattern reversal, although essentially the most traditional market situations produce this less seemingly.

Solana rate is influenced by a aggregate of accelerating network project and broader market downturns. Whereas technical indicators screen doable beneficial properties, market volatility poses fundamental challenges. Traders will possess to carefully show screen assist and resistance stages to navigate Solana rate movements.