While Bitcoin persisted its recovery in direction of $ 70,000 within the final two weeks after the titillating declines in July, Coinshares printed its weekly cryptocurrency document.

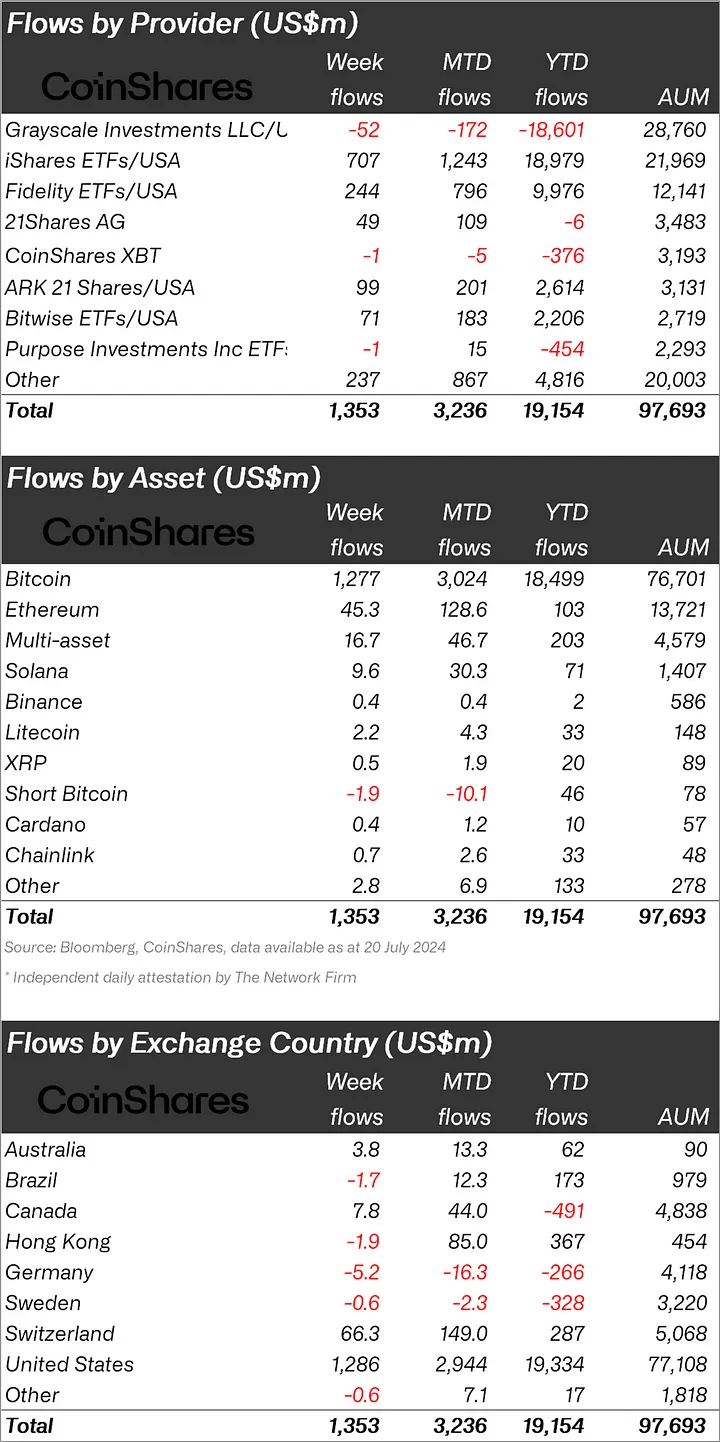

Coinshares, which acknowledged that it experienced $1.354 billion inflows into cryptocurrency funding merchandise final week, said that the inflows are continuing.

“Cryptocurrency funding merchandise enjoy seen further buying for, with $1.35 billion in inflows final week, and the final 3-week wave of inflows reaching $3.2 billion.”

Bitcoin Upward push Expectation Continues!

When looking out at crypto funds for my fragment, it change into seen that virtually all of fund inflows were in Bitcoin.

BTC experienced inflows of $1.27 billion, representing over 90% of all inflows, whereas the biggest altcoin, Ethereum (ETH), saw inflows of $Forty five.3 million.

There change into also an outflow of $1.9 million within the Bitcoin Short fund, which change into listed to the decline of BTC.

As soon as we eye at other altcoins, Solana (SOL) experienced an influx of $9.6 million, Litecoin (LTC) $2.2 million, and XRP $0.5 million.

“While there change into an influx of $1.27 million into Bitcoin final week, the Bitcoin short fund saw an outflow of $1.9 million, with outflows reaching $44 million since March. This highlights the particular sentiment that has persisted since the halving tournament in April.

The outlook for Ethereum looks to enjoy grew to turn out to be a nook, because it saw one other $Forty five million in inflows final week, surpassing Solana as the altcoin with essentially the most inflows yr-to-date (YTD) at $103 million.

Solana also saw total inflows of $9.6 million final week, but has now fallen on the again of Ethereum with $71 million in inflows YTD.

Litecoin change into the correct altcoin as an alternative of ETH and SOL to peek inflows of over $1 million, with $2.2 million final week.”

When looking out at regional fund inflows and outflows, it change into seen that the usa ranked first with an influx of 1.28 billion dollars.

After the usa, Switzerland ranked 2d with 66.3 million dollars.

Against these inflows, Germany got 5.2 million dollars; Hong Kong experienced an outflow of $1.9 million.

*That isn’t funding advice.