Bitcoin no longer too lengthy ago broke the $67,000 label, hitting a excessive of $67,264 prior to sliding support to $66,915. This surge shows a prime resistance stage at $67,000, nonetheless the tumble in selling rigidity hints at a bullish fashion.

Let’s dig in.

The Ichimoku Cloud shows Bitcoin trading within its boundaries, which blueprint the market has consolidated. There is the aptitude for both an upward or downward breakout.

The conversion line is above the baseline, suggesting bullish momentum. Yet, the cloud forward mixes indicators. It shows instant abet at its lower boundary of $66,704 and resistance on the upper boundary of $67,005

The 50-period transferring average is at $66,704.69, while the 200-period MA is at $65,615. The impress staying above these MAs also indicates a bullish market. The OBV indicator stands at 8.726K.

This decline blueprint making an strive to search out rigidity has stabilized a shrimp bit, and it happens when there is profit-taking or a transient cease in a bull speed. To substantiate continued upward trudge, a rise in OBV will doubtless be critical.

The MACD though tells a assorted legend, with its line at 35.76, while the signal line is at 42.19. The histogram is detrimental, exhibiting a cost of -6.44. Right here’s a bearish crossover, so the bears are aloof around and would perhaps catch essential.

Bitcoin’s recent strive and harmful $67,000 confronted selling rigidity, exhibiting stable resistance. The impress above key transferring averages and contained in the Ichimoku Cloud capabilities to possible consolidation prior to a decisive stagger.

Toughen phases are obvious at $66,704 (50 MA and cloud lower boundary) and stronger abet at $65,615 (200 MA). Rapid resistance stands at $67,005 (cloud upper boundary) and a prime resistance around $67,000.

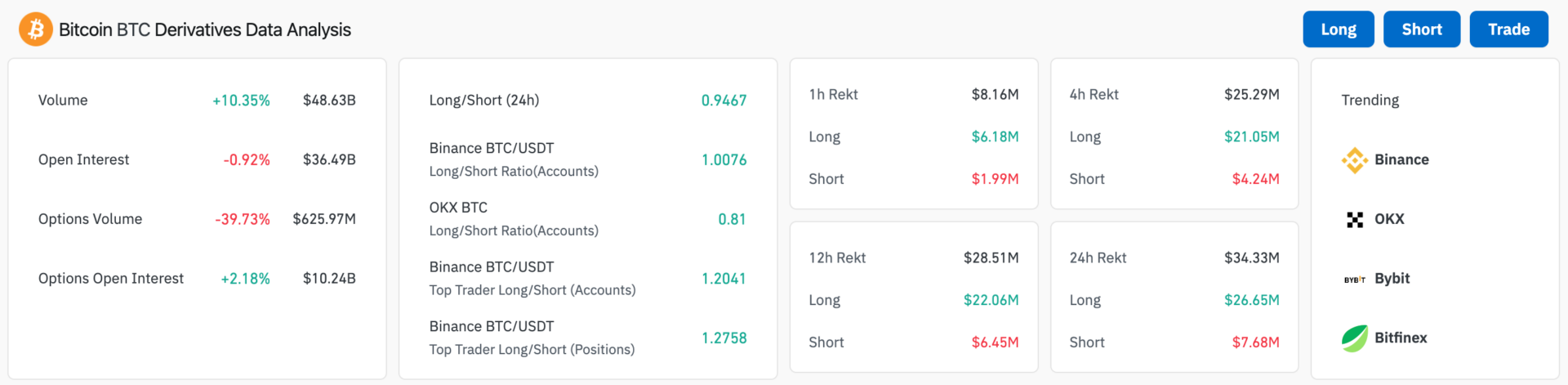

The trading quantity for Bitcoin derivatives has spiked by 10.35%, reaching $48.6 billion. This lift shows heightened trading process and fervour in Bitcoin derivatives.

On the opposite hand, delivery ardour has decreased a shrimp bit by 0.92%, standing at $36.49 billion. This blueprint that glossy positions are being opened, nonetheless existing positions are being closed at a elevated price.

The lengthy/rapid ratios provide a snapshot of market sentiment. The general lengthy/rapid ratio for the last 24 hours is 0.9467, exhibiting a little tilt in direction of rapid positions.

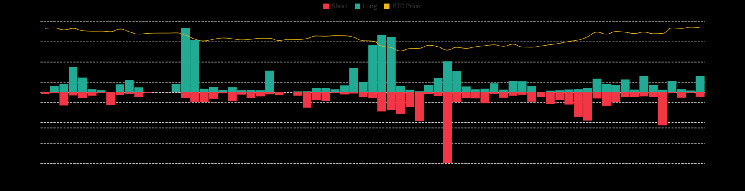

Liquidations had been massive. Within the previous hour, entire liquidations had been $8.16 million, with $6.18 million in lengthy positions and $1.ninety nine million in transient positions.

Over the last four hours, entire liquidations are $25.29 million, with $21.05 million in lengthy positions and $4.24 million in transient positions.

Within the previous 12 hours, liquidations stand at $28.51 million, with $22.06 million in lengthy positions and $6.45 million in transient positions.

The full liquidations in the previous 24 hours are $34.33 million, with $26.65 million in lengthy positions and $7.68 million in transient positions.