This day, revel within the On the Margin newsletter on Blockworks.co. The next day, web the information delivered on to your inbox. Subscribe to the On the Margin newsletter.

Welcome to the On the Margin E-newsletter, delivered to you by Casey Wagner and Ben Strack. Right here’s what we veil in at the moment time’s edition:

- Risk-on, threat-off, who is aware of! We fracture down analysts’ solutions on H2.

- The number of suggestions traders can dabble in crypto continues to develop.

- A Binance exec has been detained in Nigeria for months. Right here’s the most up-to-date.

Can H1’s momentum closing?

With the foremost half of of the one year within the rearview mirror, traders are weighing whether or no longer some high-performing resources can put their runs.

Gold is heading within the precise route to beat its 2023 returns, up about 16% one year-to-date. Silver, which ended 2023 within the pink, has been on a high-tail in 2024, rallying 27% since January.

The S&P 500 and Nasdaq Composite indexes, bolstered by huge tech, dangle notched one year-to-date returns of 18% and 22%, respectively.

And, clearly, there’s crypto. Bitcoin and ether, even after a rather lackluster performance over the past quarter, peaceable emerged as winners. BTC is up larger than 45% for the rationale that birth of the one year while ETH has posted a procure of larger than 44%.

The numbers ticket one conclusion: Risk is help, or as a minimal it used to be within the future of the foremost half of of the one year. But some analysts be pleased there is pain in paradise.

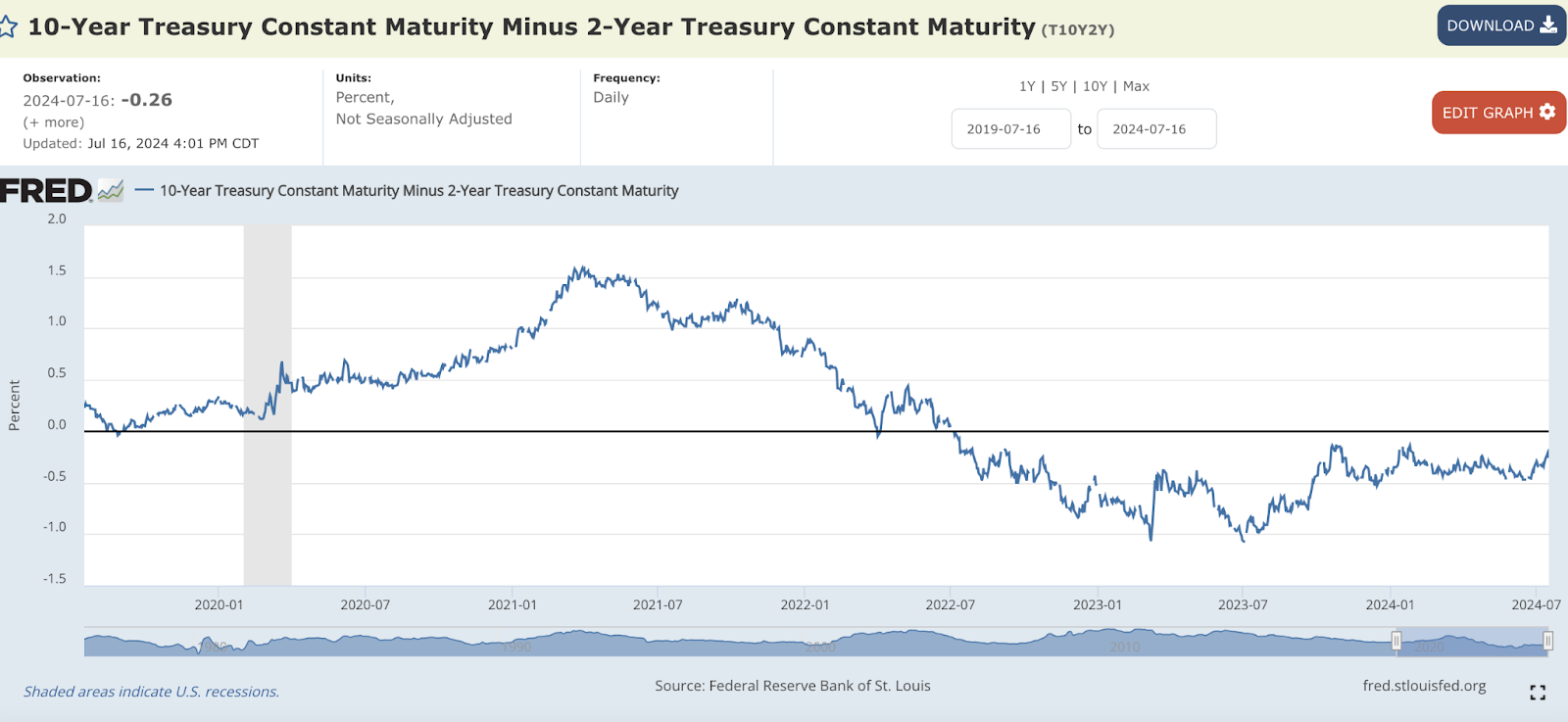

The ten-one year Treasury constant maturity minus the 2-one year (aka 10s-2s), currently spherical -0.26, is transferring in a particular route, Sevens Document founder Tom Essaye acknowledged. This basically isn’t huge for markets.

“The upward thrust in 10s-2s is reinforcing my danger that traders are underappreciating the industrial risks facing this market within the arrival quarters and in its set are viewing the realm through positively-tinted glasses,” Essaye acknowledged. “I very essential hope they are upright.”

10s-2s fling particular when 2-one year Treasurys drop lickety-split for the rationale that market expects aggressive price cuts from the Fed, which is what’s going down now. Markets love this. But, the Fed lowers charges when they web focused on slowing economic enhance, which, Essaye says, the market is currently underestimating.

Translation: Risk-on could presumably be over.

For crypto, analysts exclaim key factors constructing will most certainly be regulatory concerns (even supposing the SEC closing two foremost investigations into Hiro Programs and Paxos used to be undoubtedly particular), the upcoming US election and macro cases. Inflation looks to be to be reducing, the Fed is at risk of kick off its price chopping schedule within the autumn, however enhance remains a wildcard.

I haven’t heard the term “digital gold” thrown spherical lots lately, however it undoubtedly’s worth noting that the treasured metal is hitting all-time highs upright now. It’s no longer the craziest thought that traders could presumably also prefer to park some capital in a single other safe harbor: bitcoin.

Or is that an oxymoron? Properly, BlackRock CEO Larry Fink doesn’t be pleased it’s.

Bitcoin is “an instrument you put money into if you’re extra scared, an instrument you put money into if you suspect your nation is debasing its forex,” he acknowledged on CNBC closing week.

As for ether, there’s a presumably colossal tailwind constructing: the originate of ETH space ETFs, which could presumably also hit the market as quickly as subsequent week and lift in heaps of capital. As we previously reported, Globe 3 Capital’s Jeff Embry says a recent ETH all-time excessive above $4,800 is in checklist.

— Casey Wagner

-12.2%

This number represents the quarter-over-quarter drop in crypto space shopping and selling volume on centralized exchanges, according to a present CoinGecko file.

These Q2 volumes amounted to $3.4 trillion, following volumes totaling $2 trillion in March by myself (a month in which bitcoin hit a recent all-time excessive over $73,000). BTC is shopping and selling about 12% lower than that peak at the moment time.

The dip in centralized substitute space volumes used to be countered by a upward thrust on DEXs, which rose by nearly 16% from Q1 to Q2, the information shows. The expand to $370 billion within the future of the April-June period used to be driven by a surge in memecoins and airdrops, CoinGecko notes.

Extra crypto funds fling live

With US space ether ETFs anticipated to hit the market very quickly, other crypto funds originate within the period in-between.

Grayscale Investments is one among these space to lift an ETH ETF to market after changing its bitcoin believe to an ETF earlier this one year. This day, even though, the crypto-focused asset supervisor unveiled its Decentralized AI Fund, on hand to permitted traders.

The fund’s very most attention-grabbing holdings are procedure (NEAR), filecoin (FIL) and render (RNDR). It additionally currently invests in livepeer (LPT) and bittensor (TAO).

Grayscale notes these tokens — early in their style cycle — signify “specialised alternatives” traders can consist of in a varied crypto portfolio. The firm adds on its plot that each and every of its merchandise goes through a four-stage existence cycle “with the closing goal of uplisting the product to an ETF.”

Many dipping their toes into crypto first digest bitcoin, with ether in most cases being the next asset they gravitate to. This traces up with the gap crypto ETF alternatives on hand (and almost today to be supplied) within the US.

Fund companies appear to video display solana as the third asset in phrases of investor seek data from, given present filings to originate space ETFs defending SOL.

Hashdex closing month filed for a US fund that could presumably put each and every BTC and ETH. Down the dual carriageway, analysts dangle acknowledged they request US ETFs defending a basket of crypto resources to play a essential position in crypto investing.

Also on Wednesday (for these that prefer crypto equities and leverage), asset supervisor Direxion debuted two funds that look each day investments outcomes equating to 200%, or 100% of the inverse, of performance of the Solactive Disbursed Ledger & Decentralized Price Tech Index.

With tickers LMBO and REKT, the funds present “focused exposure for traders to order their temporary conviction on companies building the long mosey of a crypto-driven, decentralized economic system,” Direxion Managing Director Edward Egilinsky acknowledged in an announcement.

The bottom line: The suggestions to web crypto exposure (and the styles of resources wrapped in structured merchandise) proceed to expand, bringing a broader space of traders into the mix.

— Ben Strack

Detained Binance exec in declining health, says family

Tigran Gambaryan, the head of industrial crime compliance at Binance who has been detained in Nigeria since February, appeared in court Tuesday. The be pleased adjourned the hearing till October.

Gambaryan, according to reports from Nigeria, appeared on Tuesday in a wheelchair. A herniated disc in his help has left him in intense pain and pain walking, his family acknowledged. He has been held within the Kuje prison, a notoriously unhealthy facility, since April.

Gambaryan returned to Nigeria in February after making a consult with the month prior, in which officials reportedly asked the corporate to give up spherical $150 million of crypto internal two days. He used to be later charged, alongside with Binance, with tax evasion and money laundering.

Adjourning Tuesday’s hearing to October is a disappointing final result for Gambaryan and his family, who dangle acknowledged his health has persisted to claim no since his arrest.

US lawmakers visited Gambaryan, a outdated IRS agent, in June. Rep. French Hill. R-Ark., chair of the Home Subcommittee on Digital Resources and vocal crypto supporter, made the day out alongside with Rep. Chrissy Houlahan, D-Penn.

”We now dangle a role force in Congress that is on Americans wrongfully detained out of the country, or held hostage. Clearly in our observe, Tigran suits in that camp,” Hill acknowledged in a video message following the consult with. “We need him home and we are going to let Binance, his employer, cope with the Nigerians.”

The predict remains as to why Gambaryan returned to Nigeria in February after the alleged bribe strive in January. Binance CEO Richard Teng acknowledged in a May per chance per chance just weblog post that the crew had grown “extra and further concerned” about the safety of Binance pros in Nigeria.

“We, clearly, declined the price seek data from by strategy of our counsel, no longer viewing it to be a precise settlement supply,” Teng added.

— Casey Wagner

Bulletin Board

- The SEC asked issuers looking out for to originate space ether ETFs to put up their finalized registration statements (S-1s and S-3s) by the tip of at the moment time, americans shut to the filings urged Blockworks. We request to know the price each and every fund will fee once these documents are in, closing one among the few closing questions about this job.

- Grunt Road is having a stare to web extra alive to by settling funds on the blockchain, Bloomberg reported Wednesday. The custodial huge launched a digital finance unit in June 2021 and has labeled asset tokenization a “essential opportunity.” It extra lately partnered with Galaxy Digital to originate “the next skills of digital asset-based mostly completely suggestions.”

- The slate of US space bitcoin ETFs notched procure inflows of $423 million on Tuesday, Farside Investors data shows. It used to be the very very most attention-grabbing influx total in a single day since June 5. The category has welcomed larger than $1 billion of investor capital to its coffers within the closing three shopping and selling days by myself.

A quick ticket: Ben is doing his civic duty and serving on a jury, so his contributions will most certainly be restricted within the procedure-term. Horror no longer! We’ll retain the allege coming and scrutinize ahead to welcoming him help quickly.