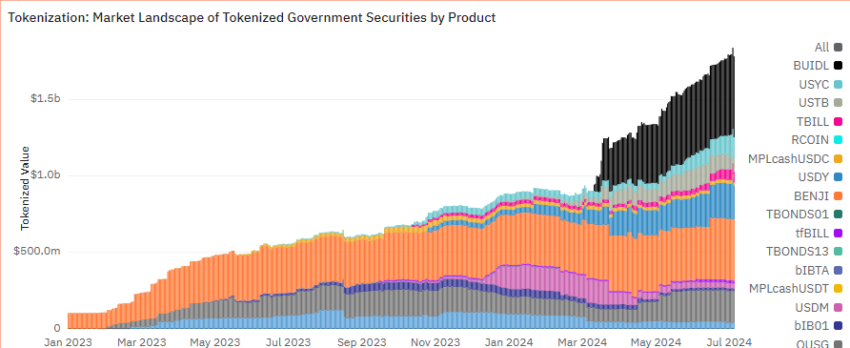

The tokenized US Treasury market is gearing up for vital enhance. Analyst Tom Wan from 21.co predicts that this segment would possibly possibly possibly reach $3 billion by the high of 2024.

This enhance is fueled by a strategic shift in opposition to true-world asset (RWA) tokenization contained in the decentralized finance (DeFi) ecosystem.

Arbitrum and MakerDAO Lead the Cost in Tokenized Treasury Allocations

In line with Wan, decentralized independent organizations (DAOs) and DeFi initiatives looking out for diversification and steadiness of their treasuries will largely drive this anticipated surge. By integrating tokenized US Treasuries, these entities procedure to access menace-free yields whereas staying contained in the blockchain ecosystem.

“With the maturity of tokenized US Treasuries, over 15 merchandise on [Ethereum Virtual Machine] EVM chains, and shut to $2 billion [assets under management] AUM, DAO is starting up to consist of yield-bearing merchandise admire BUIDL, USTB, USDY, and USDM in its treasury. We would positively gaze this pattern proceed in the long jog,” he wrote on his X (Twitter).

Be taught extra: What is Tokenization on Blockchain?

Recent moves by eminent DAOs to allocate massive funds into tokenized treasuries exemplify this pattern. In June, the Arbitrum STEP Committee in fact handy diversifying 35 million ARB tokens ($27 million) from the Arbitrum DAO Treasury into six chosen tokenized treasury merchandise. These merchandise consist of Ondo Finance’s USDY, BlackRock’s BUIDL, Superstate’s USTB, Mountain USDM, OpenEden’s TBILL, and Backed Finance’s bIB01.

Additionally, MakerDAO proposed the Spark Tokenization Gigantic Prix competition closing week, dwelling to open on August 12, 2024. The competition objectives to onboard up to $1 billion of tokenized resources, focusing on quick-time length US Treasury Payments and same merchandise.

Be taught extra: What is The Impact of Proper World Asset (RWA) Tokenization?

This year, the tokenized US treasury market has skilled unheard of enhance. 21.co’s records unearths an prolong from $592.63 million to $1.78 billion year-to-date in the tokenized treasury market price. This 200% enhance showcases the market’s doable as DeFi initiatives and DAOs increasingly extra flip to tokenized US Treasuries.