This day, procure pleasure from the On the Margin e-newsletter on Blockworks.co. The next day to come, procure the news delivered straight to your inbox. Subscribe to the On the Margin e-newsletter.

Welcome to the On the Margin E-newsletter, brought to you by Ben Strack, Casey Wagner and Felix Jauvin. Right here’s what you’ll gain in at the present time’s edition:

- We revisit the Fed’s final economic projections before next week’s FOMC meeting.

- There’s a brand novel name on the Trump place, and heaps crypto fans are fully overjoyed.

- Sources declare a that it’s possible you’ll well presumably additionally factor in launch date for US space ETH ETFs.

Did the Fed real secretly elevate their target?

I’ll be correct. When the FOMC meeting came about final month, I became as soon as caught flat-footed.

Within the days main as a lot as the meeting, it seemed love every economic records level became as soon as missing to the downside, with the climax being a tender Would possibly possibly well presumably CPI print on the day of the June meeting.

Going into the Fed’s hiss launch at 2 pm ET, it felt love a dovish dot position forecast became as soon as a lock.

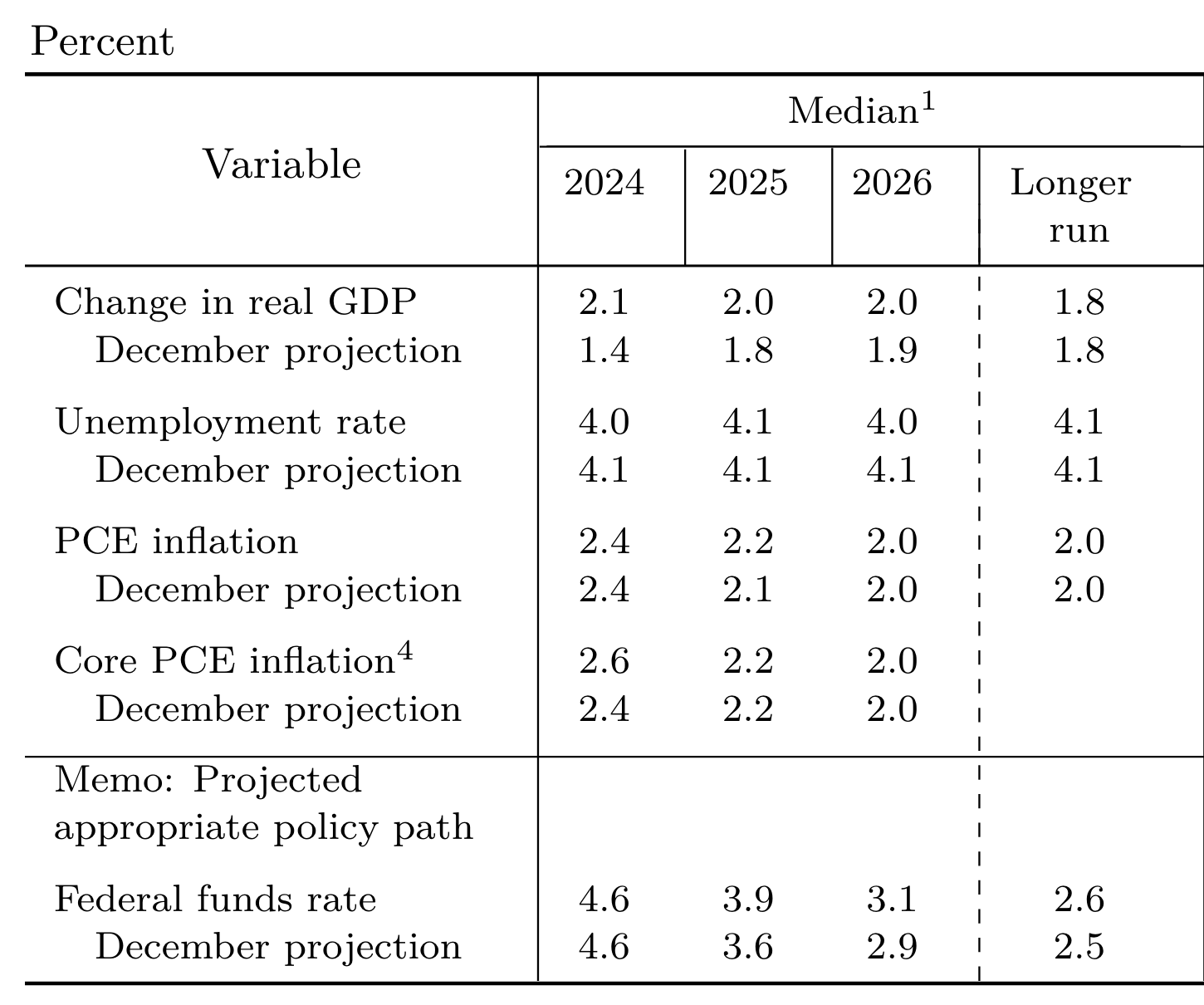

To my surprise, the Abstract of Financial Projections guided to totally one price minimize in 2024, and so they increased their yr-stay forecast for Core PCE to 2.6 from 2.4. On the margin (wink wink, nudge nudge), it became as soon as hawkish.

Within the days following the meeting, it felt to me love there secure been two possibilities:

- The Fed, after being burned in Q1 2024 with a surprise rebound in inflation, desired to procure optionality within the lead-as a lot as the following couple of FOMC conferences but secure been aloof leaning dovish. They real desired to secure the optionality.

- The Fed had made their traditional protection mistake as soon as every other time of getting too hawkish fair at the flip of the slowing economy and had real scheme the path in opposition to a laborious landing.

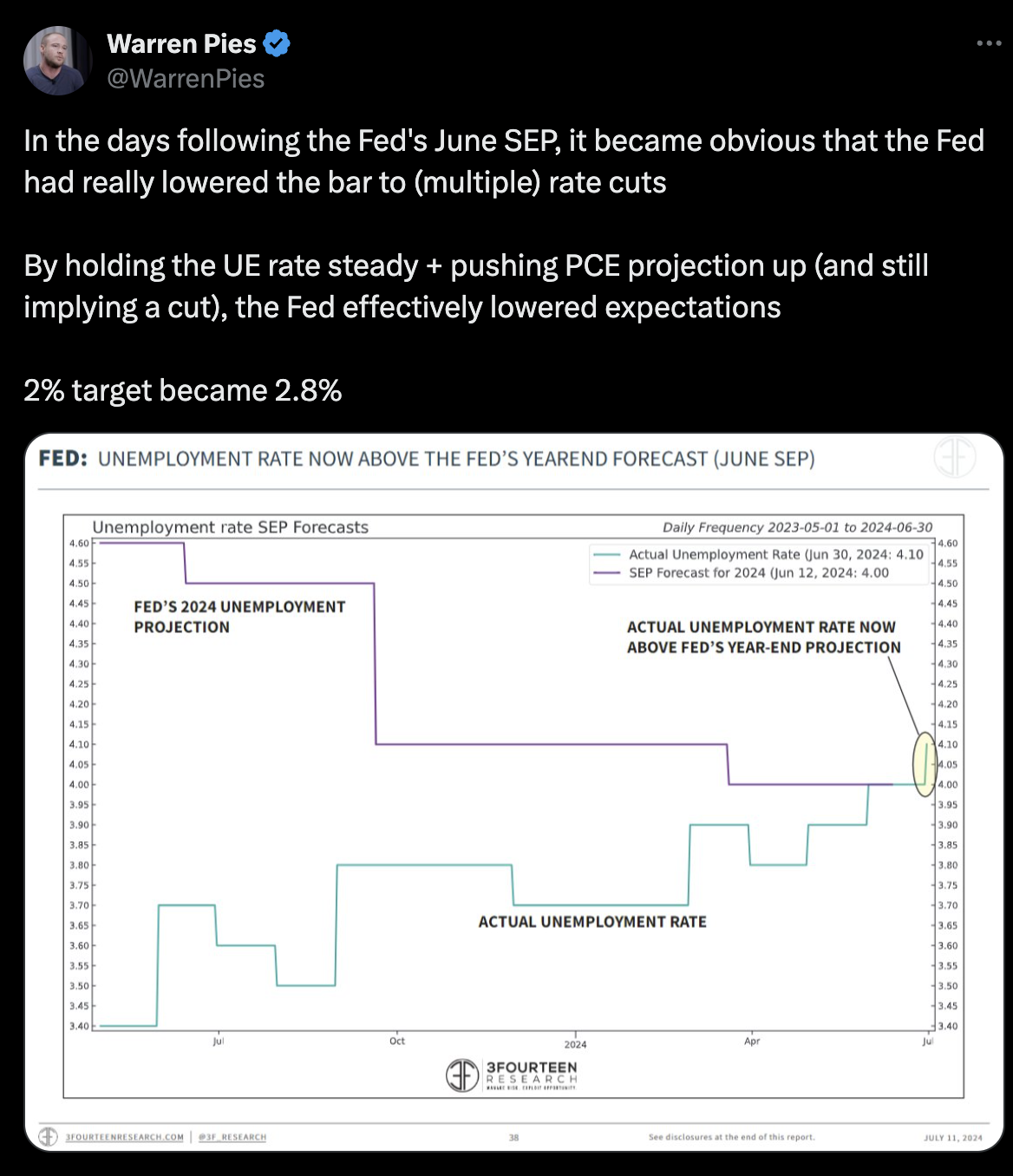

As the weeks went on, I began to realize I had overlooked something. The unemployment price forecast for the stay of this yr had been decreased to where we already secure been: 4%, from 4.1%.

This capability that replace, if June’s unemployment price rose at all, we would straight be above the Fed’s yr-stay forecast. And that’s precisely what came about — it printed at 4.1%.

Finally, circling wait on to the expose day, now we secure inflation prints which might possibly possibly be missing to the downside and unemployment price prints above the Fed’s forecast. This aggregate lines issues up completely for the Fed to prick back rates in September.

This mechanical sport of central banking chess became as soon as difficult. On the opposite hand it felt love they had bet every thing on a single dot position update, and that seemed volatile. Nonetheless, the sunshine bulb truly went off as soon as I chanced on an diagnosis from Warren Pies (now not too lengthy within the past an On the Margin podcast visitor). He talked about the next:

Put merely, it invent of appears to be like love the Fed real tweaked their summary of enterprise projections (SEP) to up the inflation target to 2.8% with out explicitly admitting it. Now, that’s a gambit charge making a bet the house on.

— Felix Jauvin

13,000

The approximate collection of collectors which secure bought Mt Gox repayments in BTC or bitcoin money, in response to a Tuesday filing.

Some behold these repayments as bearish for BTC given that those receiving funds might possibly well opt to promote, riding BTC decrease. Galaxy Digital’s Alex Thorn doesn’t basically aquire into that memoir.

Mt Gox aloof holds nearly $9 billion charge of BTC, in response to Arkham Intelligence records, despite involving billions of bucks charge of the asset this morning to diversified wallets.

You’re employed!

Ragged President Donald Trump bought the Republican nomination the day gone by and launched his running mate: Ohio Senator JD Vance.

Vance, author of 2016 memoir Hillbilly Elegy and a archaic vocal critic of Trump, obtained his US Senate seat in 2022 on a legit-crypto platform. He advocated in opposition to President Biden’s infrastructure bill, which incorporated novel tax reporting requirements for crypto exchanges. Vance additionally in 2022 cited Canadian government efforts to freeze and shut monetary institution accounts as a motive for “why crypto is taking off.”

Vance, alongside Sen. Thom Tillis, R-N.C., despatched a letter to SEC Chair Gary Gensler in January after the regulator’s X yarn prematurely said the agency had approved bitcoin ETFs. Gensler well-liked at the time the yarn had been “compromised.”

Vance and Tillis referred to the breach as “unacceptable” and a “extensive error.”

A enterprise capitalist, Vance’s crypto holdings are huge. The senator had between $100,000 and $250,000 of BTC held at Coinbase as of December 2022, federal disclosures expose.

Of the four finalists who made Trump’s vice president shortlist, Vance is the youngest (by nearly two a protracted time). In real Apprentice vogue, the archaic president summoned every VP hopeful to Milwaukee before removing them from the running one after the other.

Would possibly possibly well presumably aloof Trump get the election, Ohio Gov. Mike DeWine would must appoint a replacement for Vance’s Senate seat. DeWine’s fully parameters are to gain someone “real” and “qualified.”

Given his Republican position, he is anticipated to make a selection a fellow GOP member. A obvious election for the seat, whereby the appointed senator might possibly well additionally or might possibly well additionally now not inch, would then be held in 2026.

We can investigate cross-check how (and if) the crypto conversation continues for the Trump advertising and marketing campaign within the months main as a lot as the election.

— Casey Wagner

ETH ETFs secure that it’s possible you’ll well presumably additionally factor in launch date, sources articulate

Fund companies submitted revised filings for their planned US space ether ETFs final week and eagerly awaited next steps from the SEC.

These secure reach, sources uncover Blockworks.

The securities regulator has asked issuers to put up closing registration statements by Wednesday, in response to 2 folk shut to the filings. The disclosure paperwork are anticipated to snort expenses for the funds and all other facts now not previously disclosed.

Issuers are then scheme to demand for those paperwork to trail “effective,” which is anticipated by next Monday. That might possibly possibly scheme up a doable launch date of July 23, the sources added.

An SEC spokesperson said the agency doesn’t observation on individual filings.

July 23 is precisely two months after Would possibly possibly well presumably 23 — the day the SEC approved 19b-4 proposals by the exchanges on which the ETH funds would replace.

A separate SEC unit — its Division of Corporation Finance — became as soon as tasked with working with issuers to finalize disclosure paperwork before they’re going to additionally launch.

We’ve talked about trail at the side of the poke expectations for the merchandise (lower than BTC funds, but nothing to sneeze at).

Customers will be ready to settle from ETH funds by BlackRock, Fidelity, VanEck, Grayscale, 21Shares, Bitwise, Franklin Templeton and Invesco/Galaxy.

And it appears to be like love we might possibly well additionally know the whole charge beneficial properties of those offerings by about 5:30 pm ET Wednesday, though a lot of-foundation-level variations might possibly well additionally now not imply worthy.

US space crypto ETFs secure been, for a while, some mystical stay blueprint which might possibly possibly be now coming to fruition. BTC funds started procuring and selling in January, and half a yr later, we’re about to secure ETH offerings.

So the checkered flag for this checklist course of is at the ready, and then every other inch (for ETH ETF resources) will launch.

It form of jogs my reminiscence of that Semisonic lyric:

“Closing time. Each novel starting comes from every other starting’s stay.”

— Ben Strack

Bulletin Board

- Bitcoin, after falling from roughly $65,000 to $63,000 within hours of the Mt Gox pockets switch this morning, became as soon as hovering around $64,550 as of two pm ET. Ether’s place became as soon as about $3,460 within the within the meantime.

- Essentially the most widespread advertising and marketing campaign finance paperwork expose the Trump advertising and marketing campaign has bought about $3 million in crypto donations — largely in BTC and ETH. The PACs which bought the funds promptly converted the a strategy of digital resources into USDC, the disclosures declare.

- US retail gross sales records came in stronger than anticipated on Tuesday, boosting stocks and bolstering hopes of a Fed price minimize within the descend.