In the 2nd quarter of 2024, the cryptocurrency market exhibited a nuanced mix of emerging narratives and foremost imprint shifts. Despite a 14.4% dip in the whole crypto market cap, ending the quarter at $2.43 trillion, a lot of sectors, comparable to meme money, genuine-world sources (RWA), synthetic intelligence (AI), and decentralized physical infrastructure networks (DePin), stood out.

Despite Bitcoin halvings, the market efficiency has been unhappy in Q2 2024. Finest a particular sectors come by mighty positive aspects.

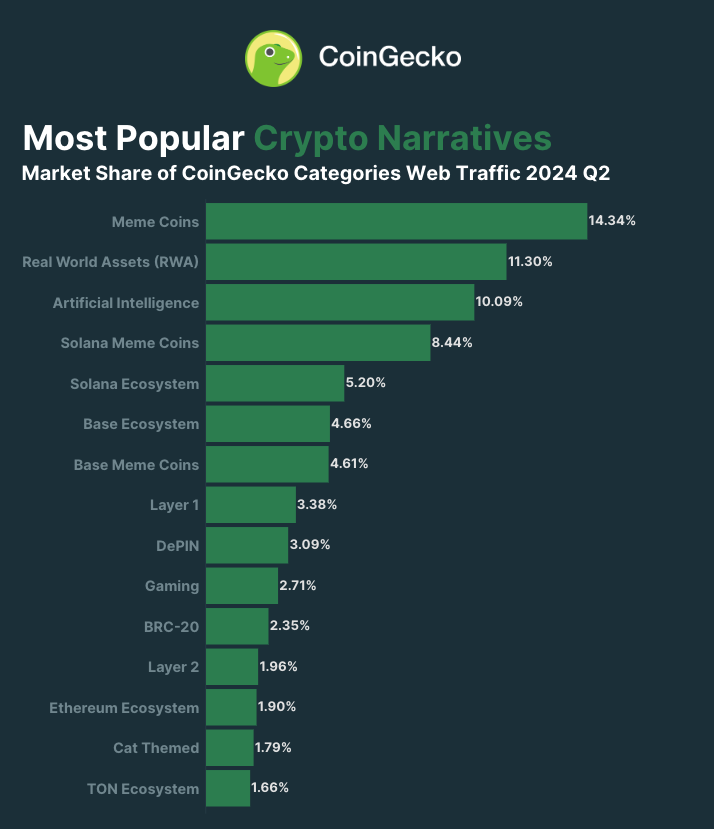

Dominant Crypto Narratives in Q2 2024

Meme money persevered to intrigue the market, with narratives centered round ‘cat-themed’ tokens climbing into the head 15 crypto narratives. Four out of the 15 most discussed crypto narratives were related to meme money. Particularly, blockchain ecosystems love Solana (SOL), Ethereum (ETH), Tainted, and TON also remained renowned, with Solana and Tainted collectively taking pictures 22.9% of market attention.

Be taught more: 7 Sizzling Meme Coins and Altcoins that are Trending in 2024

The spotlight also shone brightly on RWA and AI integration within blockchain ecosystems. DePin, a rather contemporary fable, garnered attention as it guarantees to revolutionize infrastructure by decentralizing physical sources, adding a layer of innovation to blockchain applications.

Despite the general market downturn, these narratives exhibited resilience and boost. This shift signifies a switch in investor preferences in opposition to thematic and speculative investments. Furthermore, the whole annualized volatility of the crypto market stood excessive at 48.2%, reflecting ongoing uncertainty and snappy shifts in investor sentiment.

The CoinGecko file also discusses other indispensable events in the fourth quarter of 2024. As an illustration, the Mt. Gox trustee started engaging a stash of 140,000 BTC and the German executive started promoting seized Bitcoin, coinciding with spicy market reactions.

Furthermore, Ethereum witnessed an inflationary shift in Q2, with a safe addition of 120,818 ETH to its circulating provide. This marked a foremost shift from its old deflationary pattern, influenced by a 66.7% good deal in burn charge as network exercise slowed.

Crypto exchanges observed divergent trends. Centralized exchanges (CEXs) love Binance and Bybit experienced diversified fortunes.

Binance’s market portion stood at forty five%, despite a decline in trading quantity. Meanwhile, Bybit’s market portion increased to 12.6%. Decentralized exchanges (DEXs) love Uniswap and emerging platforms Thruster and Aerodrome observed mountainous quantity will enhance. They benefited from the buoyancy in meme coin trading and airdrop actions.

Be taught more: Simplest Upcoming Airdrops in 2024

In an interview with BeInCrypto, Bobby Ong, the co-founding father of CoinGecko, shared that the outlook for the latter half of of 2024 remains cautiously optimistic.

“The crypto market entered a interval of publish-Bitcoin Halving consolidation amid combined trends in Q2, with token airdrops in particular coming below scrutiny. While the outlook for the 2nd half of of 2024 is murkier, we glimpse clear signs collectively with improving macroeconomic prerequisites, and groups continuing to make regardless of costs,” Ong on the spot BeInCrypto.