Inflows into Ethereum (ETH) digital investment merchandise accept as true with now reached the excellent effect since March. This recent document means that ETH’s effect might perchance perchance perchance perchance also proceed recuperating as it has within the past week.

ETH’s effect as of this writing is $3,338, representing a 4.12% enlarge within the final 24 hours. But will the altcoin effect proceed to transfer northward?

More Money for Ethereum Is More Profits for Holders

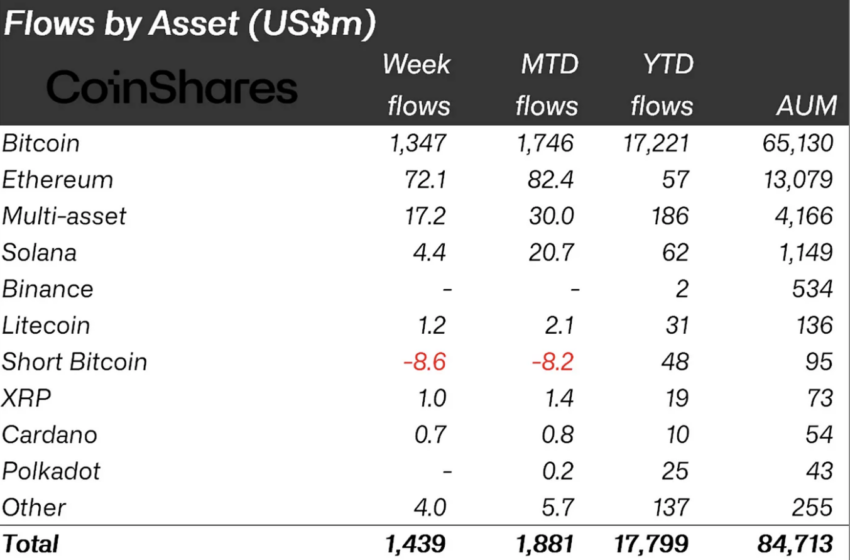

In accordance to CoinShares, the crypto weekly inflows totaled $1.44 billion. This effect makes it the fifth greatest the product has seen since its inception. As expected, Bitcoin (BTC) had the lion’s fragment.

Nonetheless, with $72 million, Ethereum has been able to register fixed inflows in some unspecified time in the future of the final few weeks whereas hitting the excellent figure in four months.

“A wide collection of altcoins seen inflows, most principal being Ethereum, which seen US$72m inflows final week, being the greatest inflows since March and doubtless in anticipation of the forthcoming approval of the put-based mostly entirely ETF within the US.” James Butterfill, CoinShares Head of Study, wrote.

No longer too long ago, BeInCrypto reported that a substitute of analysts build a matter to the put Ethereum ETFs to originate this week.

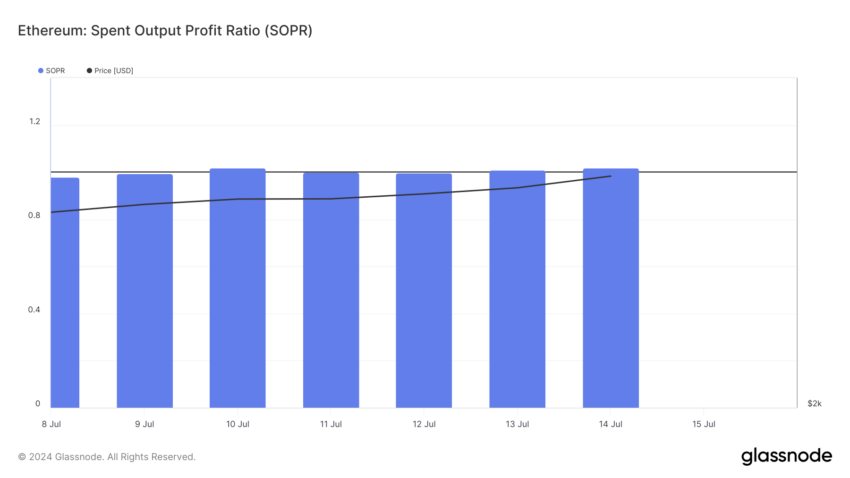

Moreover to, in accordance to Glassnode, ETH holders accept as true with begun to abilities some make of respite. Right here is due to the symptoms printed by the Spent Output Profit Ratio (SOPR).

The SOPR examines market spending habits, providing insights into profits and losses over a duration of time. When the associated fee of the SOPR is 1, moved money are equipped for profit on a particular day.

Be taught more: Ethereum (ETH) Imprint Prediction 2024/2025/2030

But when it is decrease than 1, it implies promote-offs at a loss, and whether it is strictly 1, it draw holders are promoting on the breakeven point.

As shown above, Ethereum’s SOPR is 1.01 at press time. If sustained, successive peaks will display that the spent money are moved serve into circulation, rising the likelihood of a effect rally.

ETH Imprint Prediction: $3,300 Holds, But How About $4,000?

Love the SOPR, Ethereum’s Open Interest (OI) offers signs that counsel that the associated fee will enlarge as the associated fee is $7.72 billion.

OI refers to the sum of the associated fee of begin contracts available within the market. When it will increase, it draw that market contributors are rising their exposure to a coin. Nonetheless, a decrease implies that contributors are closing their acquire positions.

From a buying and selling and historical point of view, a upward thrust in OI backs an enlarge in ETH’s put effect. Ensuing from this truth, if curiosity within the cryptocurrency continues to jump, so will the associated fee. If this remains the case, ETH might perchance perchance perchance attain $3,474 within the rapid term.

Further, if inflows into the ETFs attain $1 billion, as has been predicted in some corners, ETH might perchance perchance perchance perchance also retest $4,000.

Nonetheless, the In/Out of Money Spherical Imprint (IOMAP) exhibits that there is a enormous gamble of invalidation. The IOMAP classifies addresses based mostly entirely on those earning money, those out of cash, and folks on the breakeven point.

If the factitious of addresses within the money is bigger, the associated fee effect will present abet. But whether it is the a lot of draw spherical, crypto will face resistance.

Be taught more: How to Aquire Ethereum (ETH) and All the issues You Deserve to Know

At press time, we seen that 3.57 million addresses bought 2.83 million ETH at a median effect of $3,385. Meanwhile, 2.04 million bought 1.15 million of the cryptocurrency spherical $3,282.

Since there’s a bigger substitute of addresses out of the money, it draw Ethereum will ranking it robust to interrupt thru $3,385.

Right here is because once ETH reaches this effect, some holders might perchance perchance perchance perchance also resolve to promote. If this happens, the associated fee of Ethereum might perchance perchance perchance perchance also fall below $3,300 and even roam as low as $3,233.