The world cryptocurrency market cap this day is $2.25 trillion, reflecting a 0.2% amplify within the final 24 hours.

Despite this microscopic uptick, the market sentiment stays notably bearish, as evidenced by the Crypto Apprehension & Greed Index plummeting to “impolite dread” – a stage now not seen since January final year, in step with sources.

This decline in sentiment is largely attributable to Bitcoin’s recent struggles to ruin above the $60,000 be conscious.

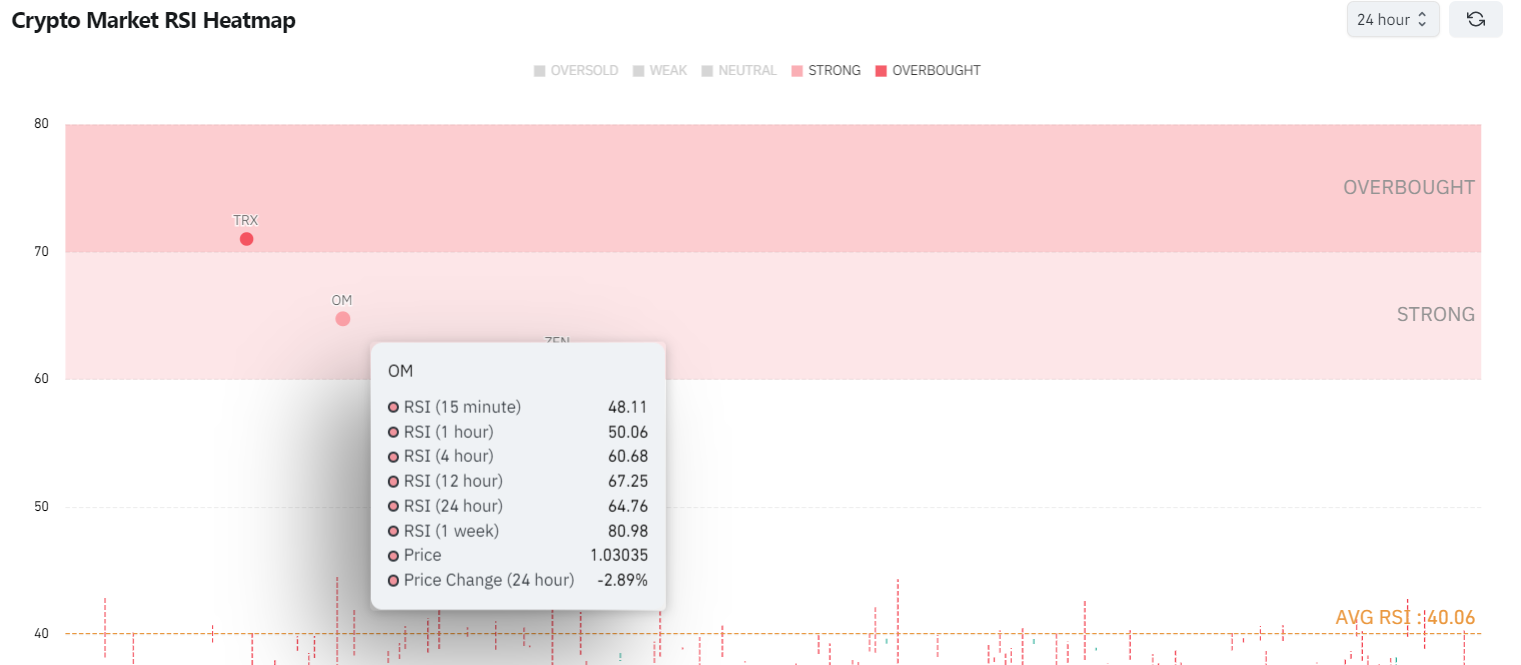

On this context, Finbold analyzed the Relative Strength Index (RSI) heatmap from CoinGlass and varied technical indicators on July 12 to name seemingly purchase indicators.

The in style day to day RSI is at display conceal at 40.046, indicating fair market conditions. On the opposite hand, certain resources will also be regarded as as purchase candidates in response to their RSI values and technical outlook.

MANTRA (OM)

MANTRA (OM) is exhibiting accurate purchase indicators in response to its RSI values and varied technical indicators. The RSI values across varied timeframes for OM are impressive, with a 15-minute RSI of forty eight.11, a 1-hour RSI of fifty.06, and a 4-hour RSI of 60.68, suggesting rising shopping interest.

The extra well-known 12-hour RSI of 67.25 and 24-hour RSI of 64.76 signifies a sturdy upward momentum. The weekly RSI of 80.98 underscores the sustained shopping pressure. Despite a 24-hour tag tumble of two.89%, this decline will also be seen as a shopping opportunity, because the final RSI trend stays particular.

Beyond RSI, varied technical indicators additionally display conceal a bullish outlook for OM. The Transferring Moderate Convergence Divergence (MACD) indicator shows a bullish crossover, suggesting that the associated fee trend is upward.

The Exponential Transferring Averages (EMAs) on varied timeframes, such because the ten-day and 50-day EMAs, be conscious a accurate purchase signal, reinforcing the chance of an upward tag motion.

Additionally, the Commodity Channel Index (CCI) and Moderate Directional Index (ADX) additionally counsel a bullish trend, supporting the actual outlook for OM.

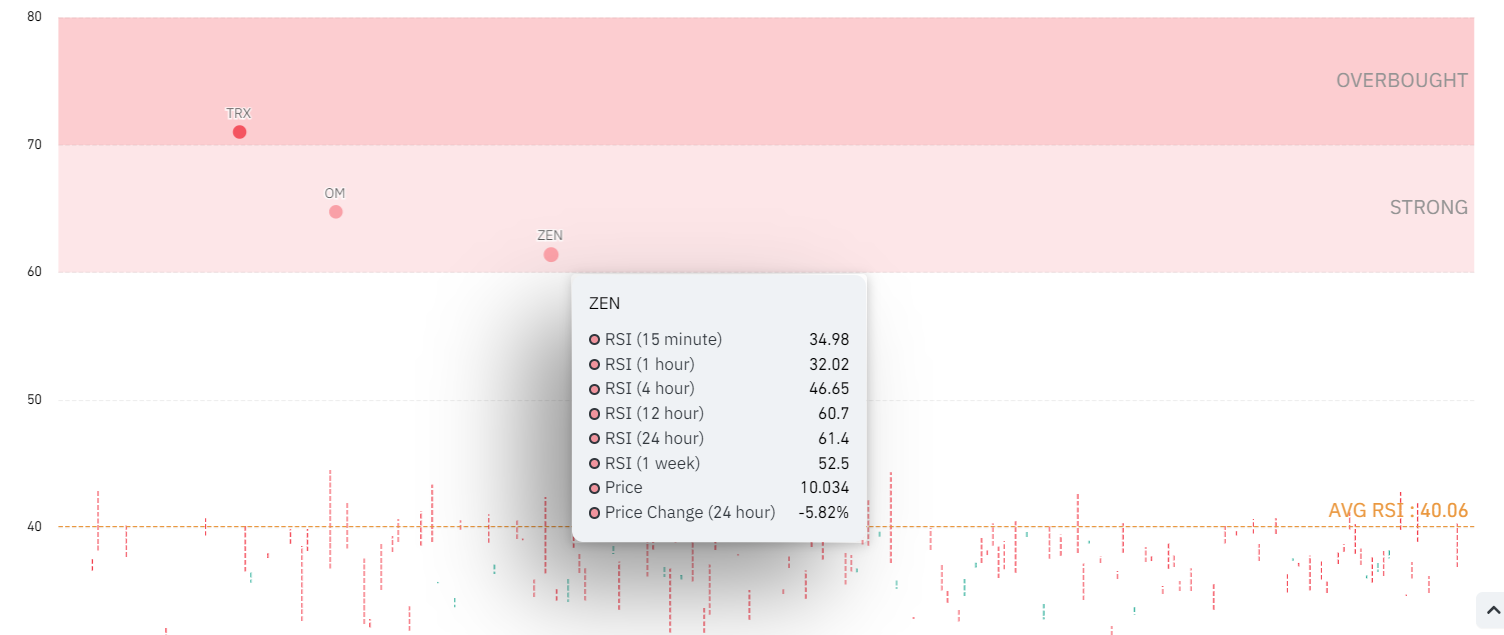

Horizen (ZEN)

Horizen (ZEN) additionally shows accurate purchase indicators in response to its technical indicators. The short-time frame RSI values, such because the 15-minute RSI of 34.98 and the 1-hour RSI of 32.02, be conscious that ZEN is at display conceal oversold, suggesting a that you might possibly maybe keep in mind rebound.

The 4-hour RSI of 46.65 and 12-hour RSI of 60.7 highlights increasing shopping interest. The 24-hour RSI of 61.4 and the weekly RSI of 52.5 extra verify an everyday shopping trend. Although ZEN experienced a 5.82% tag tumble within the final 24 hours, the RSI values be conscious a likely restoration.

Further technical indicators bolster this particular outlook for ZEN. The MACD shows a bullish crossover, indicating a seemingly tag amplify.

The EMAs across varied timeframes counsel a accurate purchase signal, because the shorter-time frame EMAs are above the longer-time frame ones. Moreover, the CCI and ADX indicators display conceal a strengthening trend, which supports the bullish case for ZEN.

In short, each Mantra and Horizen state accurate purchase indicators, supported by comprehensive technical prognosis.

Whereas the aforementioned indicators counsel seemingly tag increases, the cryptocurrency market stays unsafe. Consistently habits thorough compare, including predominant prognosis, earlier than making any funding choices

Disclaimer:The snarl material on this location must quiet now not be regarded as funding recommendation. Investing is speculative. When investing, your capital is in menace.