- Bitcoin plan ETFs got $294.8 million in inflows on Tuesday, the absolute best since June 6.

- The German Authorities’s switch of 6,306.9 BTC, valued at $362.12 million, to exchanges on Tuesday might additionally negatively affect Bitcoin’s price.

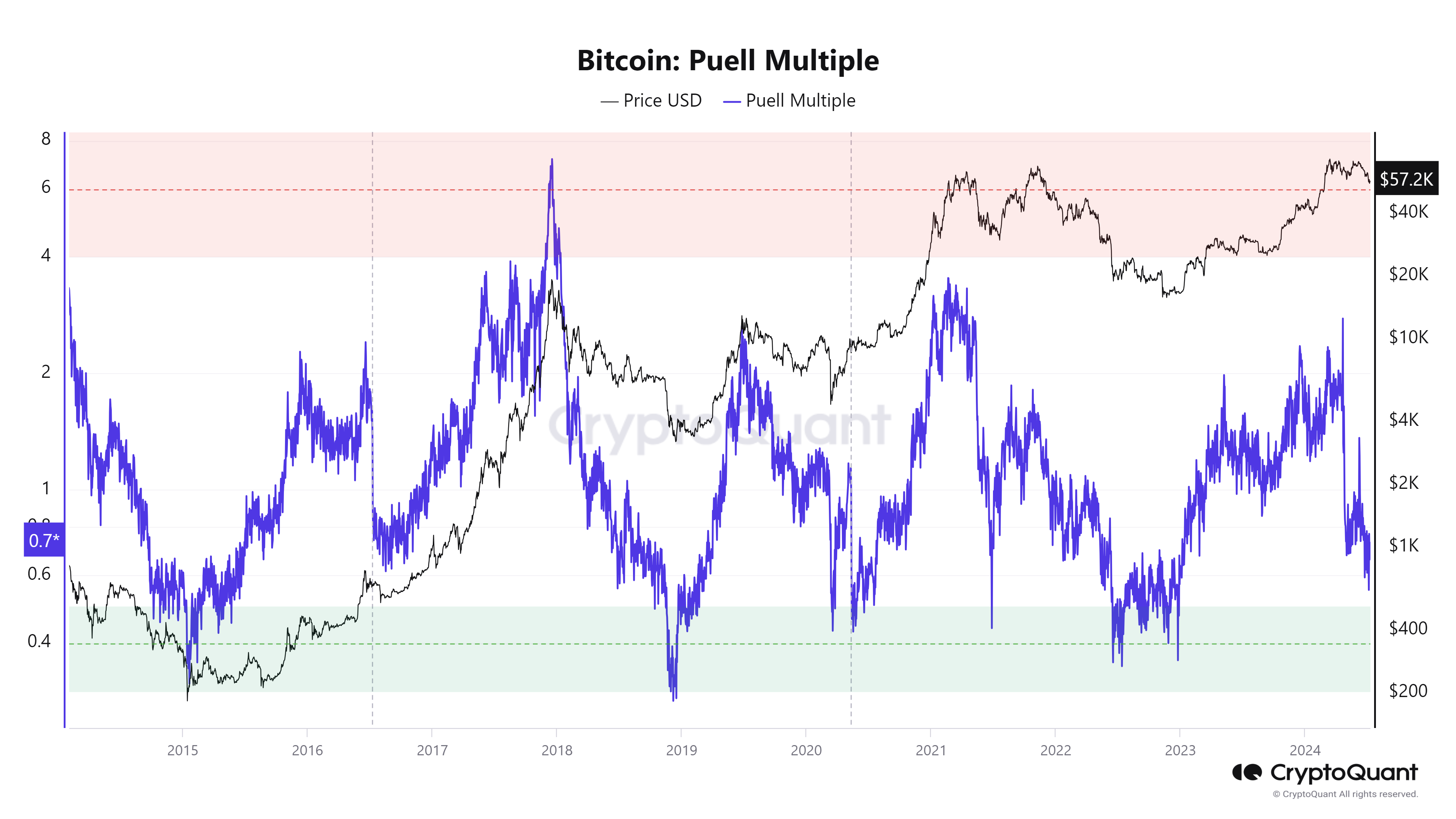

- On-chain data shows miners get dangle of much less than the historic life like, indicating diminished profitability or much less selling tension.

Bitcoin (BTC) price has encountered resistance near the weekly level of $58,375 over the final three days, at the moment buying and selling lawful beneath at spherical $57,339, marking a 1.12% expand on Tuesday. On-chain data indicates miners get dangle of much less than the historic life like, suggesting diminished profitability or diminished selling tension. Bitcoin plan ETFs noticed inflows of $294.8 million on Tuesday, the absolute best since June 6. Technical analysis shows bullish divergence indicators from the Relative Energy Index (RSI) and the Awesome Oscillator (AO) indicators, suggesting capacity momentum for an upward rally.

On each day foundation digest market movers: Bitcoin plan ETF got $294.8 million in inflows on Tuesday

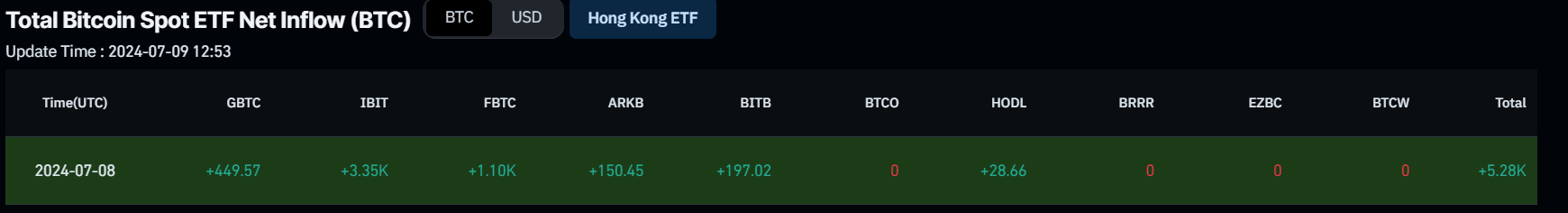

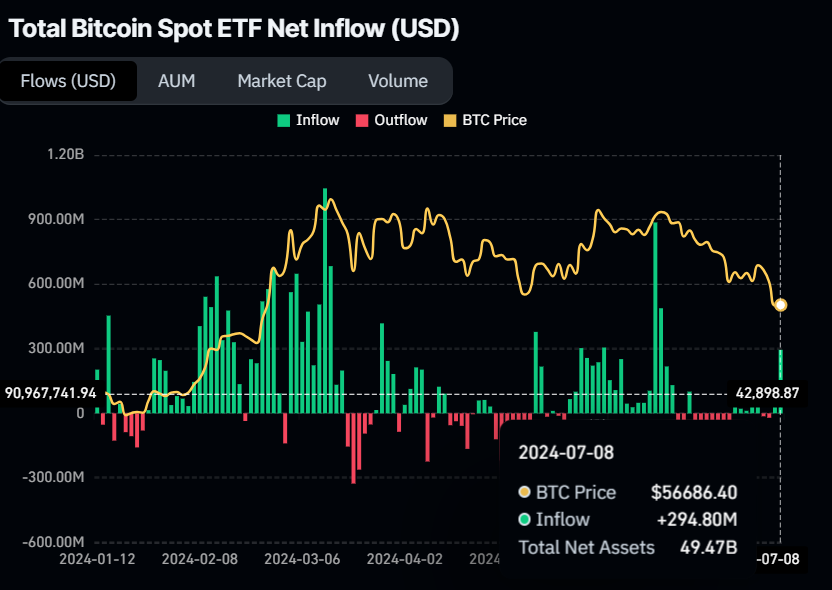

- On Tuesday, US plan Bitcoin ETFs noticed inflows of $294.8 million, the absolute best since June 6.

- This uptick suggests rising investor self belief, hinting at a most likely non permanent expand in Bitcoin’s price. The rating influx data from ETFs is mandatory for gauging investor sentiment and thought market dynamics. Combined, the 11 US plan Bitcoin ETFs at the moment shield reserves totaling $49.47 billion in Bitcoin.

Bitcoin Set ETF Rep Inflow chart

- In retaining with data from Arkham Intelligence, the German Authorities transferred 6,306.9 BTC, valued at $362.12 million, from its pockets to Kraken, Cumberland, 139Po (most likely an institutional deposit/OTC provider), and address bc1qu on Tuesday. This main switch exercise might additionally get dangle of precipitated FUD (Wretchedness, Uncertainty, Doubt) among traders, doubtlessly contributing to a decline in Bitcoin’s price. As of latest actions, the German Authorities has got 5,366 BTC wait on from exchanges, at the side of Kraken, Bitstamp, and Coinbase. For the time being, the German Authorities holds 22,847 BTC, valued at $1.32 billion.

TODAY: German Authorities selling as much as 6306.9 BTC ($362.12M)

Within the past 3 hours, the German Authorities has despatched 6306.9 BTC ($362.12M) to Kraken, Cumberland, 139Po (most likely institutional deposit/OTC provider) and address bc1qu.

Of this, 3206.9 BTC ($184.58M) has been despatched inside… pic.twitter.com/6SmhMDElNZ

— Arkham (@ArkhamIntel) July 9, 2024

- In retaining with data from Lookonchain, a whale has deposited 809 BTC price $forty five.18 million to Binance. Depositing BTC on an exchange increases the provision, thereby leading to a cost decline. Since June 27, this whale has deposited 7,790 BTC, price $468 million, to Binance and at the moment holds 6,559 BTC, price $379 million.

The whale deposited 809 $BTC($forty five.18M) to #Binance again 1 hour ago.

He has deposited 7,790 $BTC($468M) to #Binance since June 27 and at the moment holds 6,559 $BTC($379M).

Take care of: 3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhNhttps://t.co/kqDPbHy4ue pic.twitter.com/RtqpUiXwGc

— Lookonchain (@lookonchain) July 8, 2024

- In retaining with CryptoQuant, Bitcoin’s Puell A total lot of indicators offer treasured insights into the cryptocurrency’s mining profitability cycles by measuring the ratio between Bitcoin’s day-to-day issuance rate in USD and its 365-day shifting life like.

- When the Puell A total lot of is high, it indicates that Bitcoin miners are incomes greater USD-denominated rewards than historic averages, doubtlessly leading to increased coin sales to hide costs or capitalize on earnings. Conversely, a low Puell A total lot of suggests that miners get dangle of much less than the historic life like, which would perhaps additionally point to diminished profitability or much less selling tension from miners.

- For the time being, Bitcoin’s Puell A total lot of stands at 0.7, signaling lower USD-denominated rewards for miners than historic averages and doubtlessly indicating a length of diminished profitability or diminished selling tension.

- Moreover, the metric noticed valuable declines throughout the bull cycles of 2016 and 2020, coinciding with Bitcoin’s colossal upward traits. An identical patterns are at the moment observed, suggesting a most likely adjustment length nearing its conclusion. Whereas pinpointing the particular terminate of this adjustment phase is intelligent, indications demonstrate a most likely begin of a bullish rally by the third quarter of 2024.

Bitcoin Puell A total lot of chart

Technical analysis: BTC faces resistance all the arrangement in which throughout the $58,500 level

Bitcoin’s price encountered resistance at the weekly resistance level of $58,375 within the past three days and trades beneath it spherical $57,339, 1.12% up on Tuesday.

Moreover, the formation of a lower low within the day-to-day chart on July 5 contrasts with the Relative Energy Index’s (RSI) greater high throughout the identical length. This building is termed a bullish divergence and most incessantly results within the reversal of the building or a non permanent rally.

If BTC closes above the $58,375 weekly resistance level, it will most likely additionally upward push 9% to revisit the day-to-day resistance at $63,956.

BTC/USDT day-to-day chart

On the opposite hand, if BTC closes beneath the $52,266 day-to-day enhance level and kinds a lower low within the day-to-day time-frame, it will most likely additionally point to that bearish sentiment persists. This form of building might additionally trigger a 4% decline in Bitcoin’s price to revisit its day-to-day low of $50,521 from February 23.