Supreme esteem oscillators, bright averages (MAs) are essential tools in technical evaluation, providing merchants with insights into ticket traits and likely market reversals. In this discovering out and insights article, we’ll delve into the history, forms, and application of bright averages leveraged in bitcoin trading, highlighting their significance and utility in the crypto market.

The Historical past of Transferring Averages

The belief that of bright averages (MAs) became developed in the early twentieth century by American statistician Robert Rhea. On the inspiration applied to inventory prices, MAs gained prominence in the mid-twentieth century with the appearance of extra refined computing technology. Identical to oscillators, the widespread command of MAs in technical evaluation became extra prevalent in the Seventies as merchants and analysts sought tricks on how to soft out ticket data and title traits.

Straightforward Transferring Common (SMA) vs. Exponential Transferring Common (EMA)

Transferring averages plot in two predominant kinds: the Straightforward Transferring Common (SMA) and the Exponential Transferring Common (EMA). Every lend a hand to soft ticket data over a specified duration, but they differ in calculation and sensitivity to most up-to-date ticket changes.

Straightforward Transferring Common (SMA):

The SMA is calculated by summing the closing prices of a particular amount of intervals and dividing by that quantity. For instance, a 10-day SMA of bitcoin is the sum of the closing prices over the closing 10 days divided by 10. The SMA offers equal weight to all intervals, making it much less sensitive to most up-to-date ticket changes.

Exponential Transferring Common (EMA):

The EMA assigns extra weight to most up-to-date prices, making it extra attentive to fresh recordsdata. The calculation entails a extra complex system, incorporating a smoothing component. In bitcoin trading, the EMA is liked for its potential to react extra like a flash to price fluctuations, providing neatly timed signals for merchants.

Key Transferring Averages in Bitcoin Procuring and selling

MAs of assorted intervals present diverse insights into market traits. Here are the ceaselessly passe MAs and their significance in bitcoin trading:

- 10-Day MA: The ten-day bright moderate is in total passe for temporary trading. It helps title most up-to-date traits and likely entry or exit facets for trades. bitcoin merchants may maybe maybe maybe presumably command the 10-day MA to gauge the immediate market sentiment.

- 20-Day MA: This bright moderate is a shrimp longer and helps soft out the volatility seen in the 10-day MA. It’s vital for figuring out rapid to medium-timeframe traits and confirming the strength of most up-to-date ticket actions in bitcoin.

- 30-Day MA: The 30-day MA is a stability between rapid and long-timeframe evaluation. It offers a broader point of view on ticket traits and is in total passe to confirm signals generated by shorter MAs.

- 50-Day MA: This intermediate-timeframe MA is widely followed by merchants. It helps title presumably the most well-known pattern of bitcoin and serves as a well-known level of beef up or resistance. Crossovers interesting the 50-day MA in total signal important market shifts.

- 100-Day MA: The 100-day MA is passe to investigate long-timeframe traits. It smooths out great of the market noise and helps merchants title the overarching pattern route in bitcoin.

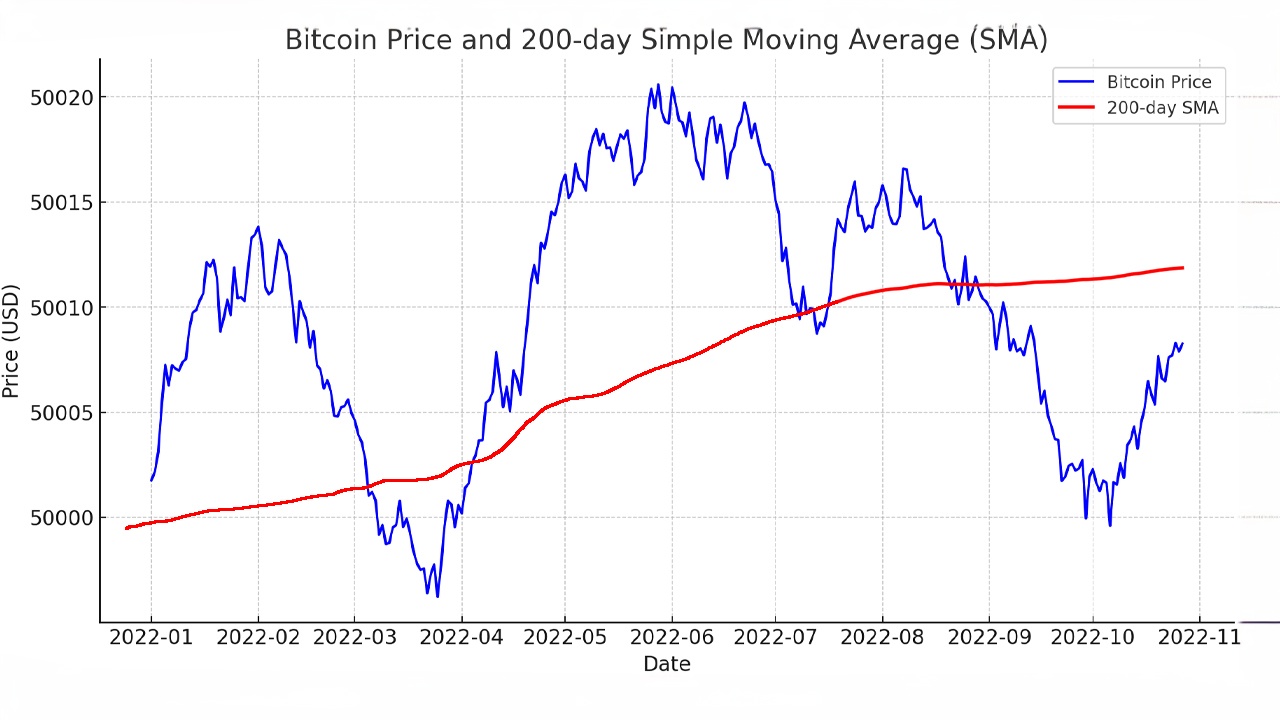

- 200-Day MA: The 200-day MA is a key indicator of long-timeframe market traits. Bitcoin’s ticket relative to the 200-day MA is in total seen as a barometer of the asset’s neatly being. When bitcoin is above the 200-day MA, it’s belief to be to be in a protracted-timeframe uptrend, and vice versa.

Developed Transferring Averages

Besides to the archaic MAs passe by analysts each and daily, progressed bright averages supply extra insights into bitcoin’s charted actions:

Ichimoku Cloud: The Ichimoku Cloud, or Ichimoku Kinko Hyo, consists of diverse lines, in conjunction with the Atrocious Line (Kijun-sen), which represents the midpoint of the 26-duration excessive-low vary. It offers a total uncover of beef up, resistance, and pattern route, serving to bitcoin merchants construct extra told choices.

Quantity Weighted Transferring Common (VWMA): The VWMA takes into fable the amount of trades, giving extra weight to intervals with better trading activity. This may maybe maybe maybe also be critically vital in bitcoin trading, where quantity spikes in total precede important ticket actions.

Hull Transferring Common (HMA): The HMA targets to lower dash while asserting smoothness, providing a extra responsive and appropriate form representation of ticket traits. It’s helpful for bitcoin merchants seeking to diminish delays in signal generation.

Transferring averages are well-known tools in bitcoin trading, providing readability amidst market volatility. Working out the differing kinds of MAs and their applications may maybe maybe maybe also lend a hand merchants construct told choices, bettering their potential to navigate the dynamic cryptocurrency market. From temporary SMAs to progressed Ichimoku Clouds, mastering these indicators can a great deal beef up trading suggestions and outcomes on this planet of bitcoin.

On the an analogous time, bright averages (MAs) are now now not a ultimate science for predicting market actions. Anomalies and surprising shifts in bitcoin’s ticket can happen, rendering even presumably the most official technical indicators much less effective. Merchants must command MAs as fraction of a broader plot, combining them with different tools esteem recordsdata signals, social sentiment, oscillators, and different forms of evaluation to navigate bitcoin’s volatile panorama successfully.