Regardless that Bitcoin has reclaimed the $56,000 imprint level within the previous few hours, its unexpected descend beneath $54,000 on July 5 has reminded merchants of the intense volatility associated with the market. Within the greater timeframe, Bitcoin has been down by 7% and 20.25% within the previous seven and thirty days, respectively.

Whereas many crypto merchants and analysts are serene within the spirit of a bullish cycle within the very lengthy time frame, the unexpected imprint descend wasn’t comely to some. Significantly, crypto dealer @TheFlowHorse published that the descend to $Fifty three,000 resonated with his target of $52,000. Equally, Ki Young Ju, CEO of CryptoQuant, eminent the chance of Bitcoin losing to $47,000.

Bitcoin May doubtless Smash To $47,000

Fixed with Ki Young Ju, Bitcoin is serene in a bull market within the greater timeframe, which would possibly proceed except early 2025. This college of concept resonates with many various imprint outlooks for Bitcoin, especially within the very lengthy time frame. Despite this bullish projection, market participants are currently battling short-time frame bearish prerequisites.

As Ki Young Ju eminent, this uncertainty opens up the chance of the realm’s leading digital forex plummeting to a chilling $47,000 before discovering its footing again. With the crypto market in a chronic trudge for the reason that initiating build of June, this bearish case field appears to be increasingly plausible. Bitcoin, particularly, has shed billions in imprint, and investor self perception is wavering.

$112K on the height of the cycle.https://t.co/beKpUVkNXL pic.twitter.com/Esj02BYms4

— Ki Young Ju (@ki_young_ju) July 5, 2024

Young Ju admonishes merchants no longer to originate high-leverage lengthy or short positions based fully on his lengthy-time frame bullish projections as a result of the existing uncertainty. When requested what his lengthy-time frame imprint target for Bitcoin became, he eminent an expand to $112,000 on the height of the cycle. This prediction relies on the BTC realized market cap since July 2010.

Bearish Case For Bitcoin

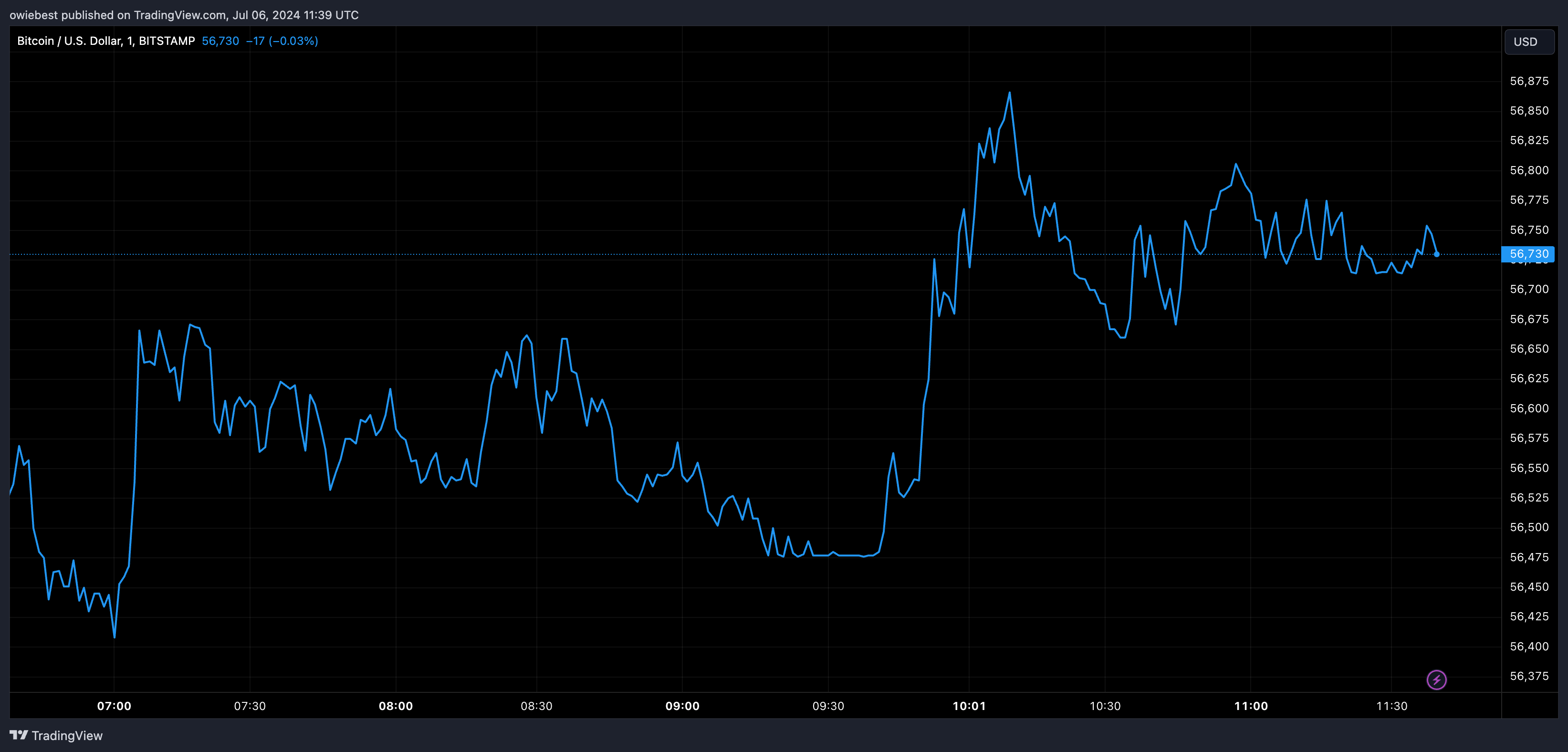

On the time of writing, Bitcoin is trading at $56,520 and has rebounded by 4.67% since its recent descend beneath $54,000. Alternatively, despite this imprint restoration, the crypto faces a important risk of falling extra amid whale selloffs, which hold amounted to over $1.7 billion in BTC within the previous 30 days. Defunct crypto exchange Mt. Gox will more than likely be initiating to repay its creditors in BTC after 10 years of tell of being inactive. That is anticipated to unleash a $2.71 billion supply of Bitcoin onto the market, per chance intensifying selling rigidity.

A reversal to the blueprint back isn’t any longer out of the books but. If Bitcoin were to descend to $47,000, it would possibly per chance well truly per chance signify a 16% decline from the recent imprint level. Market participants proceed to wait for how Bitcoin’s imprint circulate plays out in July, which has historically been a definite month.