- 1 Despite staunch market presence, UNI faces low liquidity and instability, with excessive instant liquidations and vital outflows to wallets.

- 2 Uniswap’s (UNI) market cap surged 11% to $4.67 Billion, nonetheless trading volume dropped sharply, with a forty eight% decline in dilemma volume and 62.82% in derivatives.

Uniswap (UNI) ranked Twenty second in the case of market capitalization, whereas its market cap dominance stood at 0.22% spherical the time of writing.

Despite the staunch market presence, a lower in its trading volume modified into noticed right thru the last 24-hours. It resulted in a forty eight% decline in dilemma volume, followed by a 62.82% lower within the volume of derivatives.

UNI Spinoff Knowledge Ragged

About a unsettling eventualities together with excessive instant liquidations of spherical $146.2K in opposition to long liquidations of about $24.98K, confirmed that UNI mark pivoted to bearish. Its market cap had developed by on the sphere of 11% within the past 24 hours, amounting to $4.67 Billion.

Its volume-to-market cap ratio stands at 3.25%, signifying low liquidity within the UNI market, which makes the markets much less staunch. The circulating present highlights that on the sphere of 60% of tokens are in of us’s hands out of 1.0 Billion UNI token.

What Does On-Chain Highlights In Uniswap (UNI)?

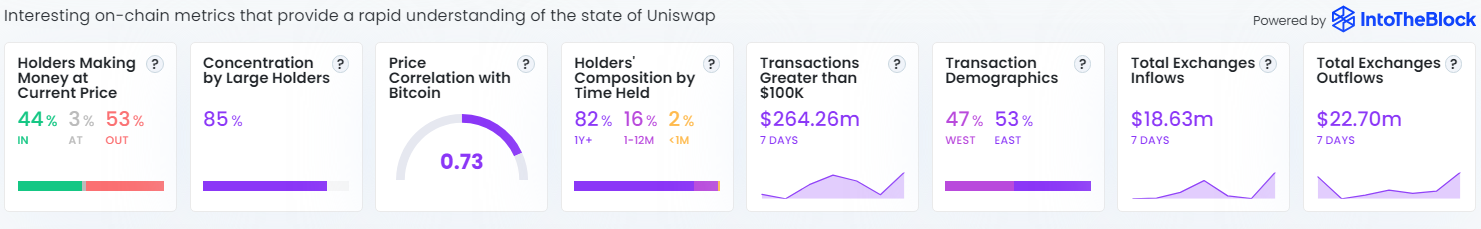

Essentially based on Intotheblock, within the past 7 days, an extend within the outflows modified into recorded from the exchanges to wallets, which resulted in a $22.70 Million. In the period in-between, the inflows saw a surge, from wallet to exchanges, that stands at $18.63 Million.

Token Summary | Source: Intotheblock.com

As per the demographics transactions, the east timings (10 pm-10 am) were utilized extra for trading and investing in UNI, which stands at 53%. The increased transactions furthermore took dispute that were above $100K, and within the past 7 days, it has recorded $264.26 Million.

Moreover, it has furthermore advance into peek that the colossal holder’s focus stands heavy at 85%, which owns extra than 1% of the circulating present. In the same vogue, 82% of holders beget the UNI for extra than 1 yr, and its mark correlation with Bitcoin (BTC) stands at 0.73 (will get affected when the market leader increases and reduces).

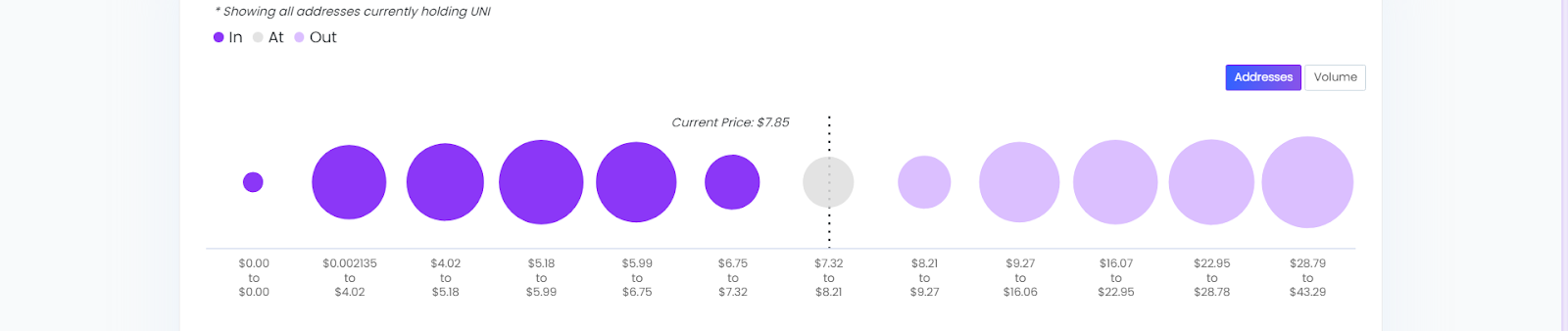

In/Out Of Money | Source: Ixfi.com

Essentially based on the In/Out of the money data, reveals that the Uniswap addresses which will be within the money beget 44.14% share with 159.81K Addresses, Out of the Money holds 53.12% with 192.32K addresses, and On the money share is 2.75% with 9.94K addresses.

Decoding Uniswap (UNI) Impress

The Uniswap had a mountainous open in January 2024 and flew extra than 200%, from $5.50 to $17.00 by March sixth, 2024. UNI mark good points were unstable and price fell to safe a crimson meat up at a excessive volume stage spherical $11.08.

After sustaining the stage for a whereas above $10.25, UNI mark gave a breakdown of a bearish flag sample in correlation with the BTC dip on April ninth, 2024.

The UNI mark fell and fashioned crimson meat up at $6.86 by April thirteenth, consolidated for some days, after which gave a breakout from a descending triangle sample up to $11.85, where the resistance posed a chance.

Thereon, the worth did handiest to beget, nonetheless by June twenty first, the worth gave a breakdown of ascending channel and reached $6.85 by July fifth.

At press time, as BTC tries to beget its mark, UNI continues to wrestle. The present mark traded at $7.911 with an intraday accomplish of 1.61%.

If the worth rises, surpassing $9.0 it will probably perchance perchance reach $11.0. Quite the opposite, if the worth slips $6.86, it will probably perchance perchance deteriorate extra.

Summary

Uniswap (UNI) ranks Twenty second by market cap at $4.67 billion, with a 0.22% market cap dominance. Despite an 11% market cap upward thrust, trading volume dropped, signaling low liquidity. Distinguished modified into $146.2K briefly liquidations versus $24.98K in long liquidations. UNI’s mark is currently $7.911, with a unstable improvement and staunch colossal-holder focus.

Disclaimer

On this article, the views, and opinions acknowledged by the author, or any of us named are for informational functions handiest, and they don’t place the funding, financial, or any diversified advice. Trading or investing in cryptocurrency assets comes with a chance of economic loss.