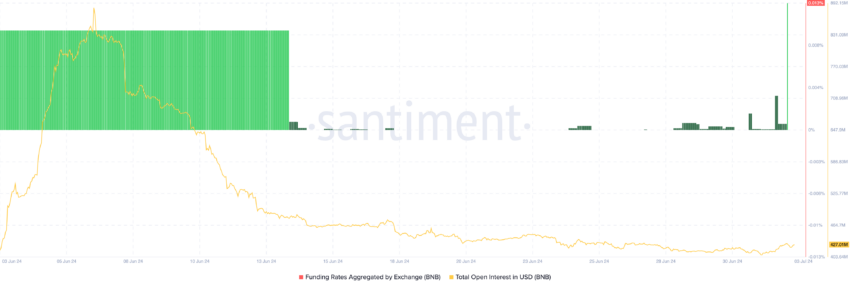

The Funding Fee reflects sentiment within the derivatives market. Oftentimes, it gives hints about shifting market moves, with Binance Coin (BNB) changing into basically the most up-to-date cryptocurrency to experience a spike.

As a key indicator of merchants’ positions, the Funding Fee for BNB jumped to 0.013% on July 3. While the reasons within the support of this deviation remain unclear, right here’s how it may well maybe maybe well impact the worth.

Investors Tag Self belief in Binance Coin

On the entire, the Funding Fee gives a steadiness between longs and shorts. On the opposite hand, when anomalies savor this arise, merchants’ habits shifts toward one aspect as a replacement of the opposite.

In straightforward phrases, highly obvious funding coincides with boosting self belief in a coin’s save lengthen. On the opposite hand, sporadic moves to the detrimental territory imply bearish.

At press time, BNB’s save is $565.91. Therefore, the rise within the metric talked about above implies that the perpetual save is for the time being at a premium to the diagram worth. Though BNB’s save is a 2.06% decrease within the closing 24 hours, the worth has risen throughout the closing hour.

If this sample continues, the reasonable inference is that the coin will continue to upward push. Particularly, the pattern displayed by the Funding Fee is such as the futures Originate Passion (OI), Which is the worth of prominent contracts available within the market.

This indicator will enhance or decreases per uncover positioning. If it will enhance, it implies that merchants are adding extra liquidity to the market. On the opposite hand, a decrease diagram that merchants are closing new positions.

In step with Santiment, BNB’s Originate Passion had within the origin dropped to $420.31 million. But as of this writing, the worth is $429.29 million, indicating a leap in speculative job.

Read Extra: How to Purchase BNB and The entirety You Must Know

From a buying and selling perspective, a upward push within the OI may well maybe well support a save lengthen for the coin as it has finished within the past. On the opposite hand, it stays predominant to take be conscious of the cryptocurrency’s potential from a technical attitude

BNB Imprint Prediction: No Extra Downturn?

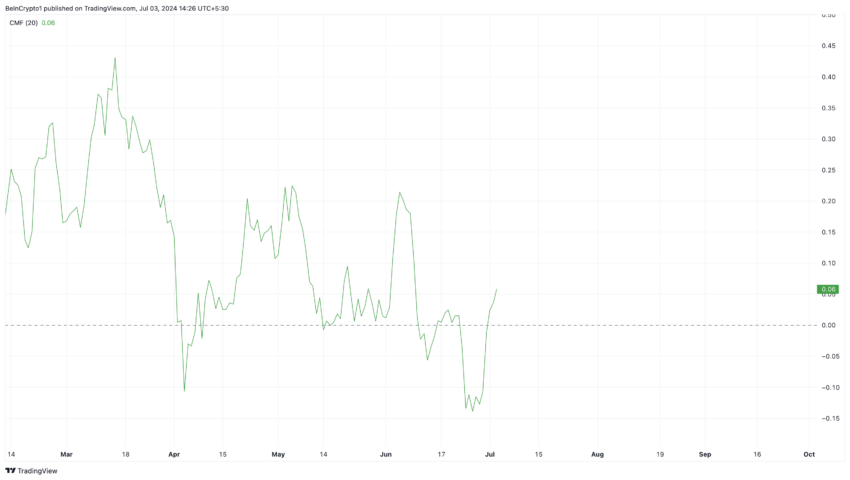

In step with the day-to-day chart, BNB may well maybe well furthermore continue to pass toward $600. One indicator fueling this chronicle is the Chaikin Money Float (CMF), which differentiates between sessions of accumulation and folks of distribution.

When the CMF rises, it diagram accumulation is occurring. On the opposite hand, a descend within the indicator’s reading implies that merchants are distributing. As of this writing, the CMF is 0.06, indicating that BNB is leaving the distribution zone and must head toward a increased save.

BeInCrypto also examines the Fibonacci Retracement indicator, which spots reinforce and resistance parts. As of this writing, BNB appears to maintain hit a bottom at $566.40. Therefore, increased buying stress may well maybe well send the coin to $576.40.

If sustained, the worth can reach $590. On the opposite hand, if distribution takes over, this may well maybe maybe well be invalidated, and the worth of BNB may well maybe well furthermore tumble to $544.40.

Also, if the Funding Fee will enhance whereas the worth goes decrease, the capability will be a tumble toward the underlying reinforce on the aforementioned save.