KAS, the altcoin that powers the Kaspa proof-of-work blockchain, observed its worth climb to an all-time high of $0.19 on June 30. Exchanging fingers at $0.18 at press time, the token’s worth has since declined by 7%.

An on-chain assessment of KAS’ rate efficiency confirms that merchants proceed to position a question to the altcoin.

Kaspa’s Brief Decline Triggers Surge in Long Liquidations

As of this writing, the worth of Kaspa’s (KAS) Relative Power Index (RSI) is 68.52. It is additionally in an uptrend. This indicator measures an asset’s overbought and oversold market stipulations.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. In distinction, values below 30 point to the asset is oversold and can soon notion a rebound.

At 68.52, KAS’ RSI signals high trying for stress among market participants. It confirms that the token rate hike is backed by proper build a question to, which shall be valuable to bring collectively the rally.

Read More: How To Buy KASPA And All the pieces You Must Know

After KAS rallied to an all-time high yesterday, many futures market merchants opened several short positions. This used to be gleaned from the negative weighted funding rate (-0.0085%) recorded yesterday.

Funding charges are a mechanism aged in perpetual futures contracts to be sure the contract rate stays discontinuance to the obtain 22 situation rate.

When an asset’s funding rate is negative, more merchants build a question to short positions. This implies that more merchants build a question to the asset’s rate to fall than folks that purchase it with the expectation of marketing and marketing at a higher rate.

A variety of prolonged positions were liquidated when KAS at closing corrected from its all-time high. On June 30, the worth of prolonged positions liquidated totaled $586,220, its single-day highest since March 16.

Long liquidations happen when an asset’s worth drops with out warning, forcing merchants with initiate positions in favor of a rate rally to exit.

KAS Rate Prediction: There is Room For More

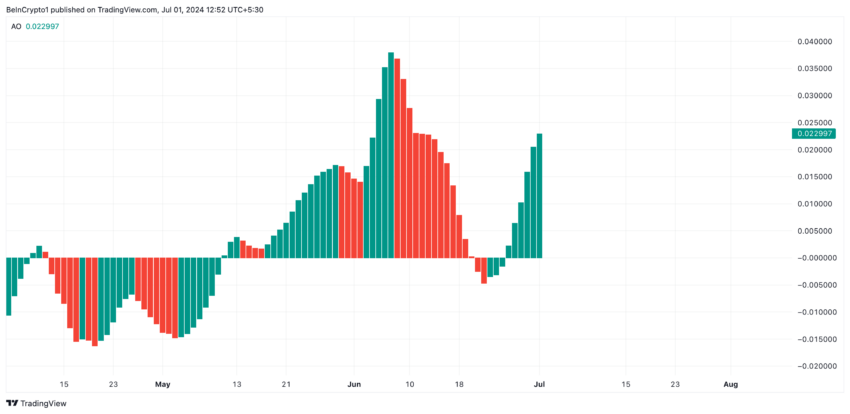

KAS’ worth can even upward push additional as the bullish bias towards it remains important. As an instance, readings from its Superior Oscillator display that the indicator has returned highest green histogram bars since June 23.

This indicator measures an asset’s rate traits and identifies reversal capabilities. When it posts green bars, it is a bullish signal, indicating that there shall be upward breeze or power within the continuing trend.

If the present trend continues, KAS’ rate will reclaim its all-time high and can quit up trading above it at $0.2.

On the other hand, a decline can even ensue if profit-taking state gains momentum, invalidating the bullish projection above. KAS’ rate can even fall to $0.17.