Bitcoin (BTC) remains a highlight of interest because it experiences fundamental consolidation, quite above the $60,000 designate.

As the market anticipates Bitcoin’s next dart, crypto trading expert Alan Santana shared his insights on the most modern label movements in a TradingView put up on June 30, offering likely correction targets.

Santana’s prognosis published that the toughen vary for Bitcoin’s upcoming tumble termed the “most be troubled level,” lies between the Fibonacci retracement ranges of 0.618 and zero.786. This vary is calculated based on the most modern bullish wave, indicating a broader survey of the market movements.

Bitcoin’s next low

The fundamental ranges to stumble on are the 0.618 Fibonacci retracement level at $42,855 and the 0.786 Fibonacci retracement level at $34,900. Santana emphasized that Bitcoin’s label is now doubtlessly to now not tumble below $30,000, asserting that this kind of scenario would be unparalleled.

“Bitcoin shall by no plan, ever, in the history of humanity’s form exchange below $30k. Imagine the backside of the correction, most be troubled level in-between this label vary. Might additionally be the low of the vary appropriate form because it might probably well perhaps also also be the excessive or the center,” the expert said.

The analyst truly helpful that the backside of the correction might perhaps well perhaps even fall wherever within the specified vary, whether or no longer at the decrease cease, the upper aid, or someplace in the center.

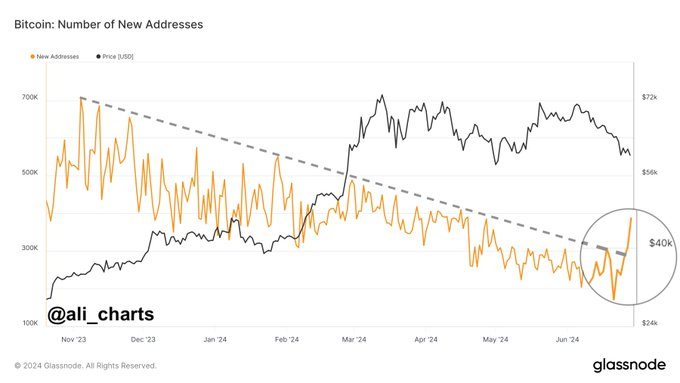

It’s value noting that Bitcoin continues to consolidate but increasingly more faces the specter of shedding below the $60,000 toughen zone. Amid this consolidation, Bitcoin’s community is witnessing a fundamental resurgence of retail investors, as indicated by the surge in sleek BTC addresses.

In accordance to records shared by crypto analyst Ali Martinez on June 29, the sequence of most modern Bitcoin addresses has surged to 352,124, marking the ideal level since April.

The resurgence of retail investors might perhaps well perhaps even trace renewed self perception in Bitcoin’s likely, even amidst its unique label corrections.

Bitcoin label prognosis

By press time, Bitcoin changed into as soon as trading at $61,470, with day-to-day beneficial properties of nearly 1%. On the weekly chart, Bitcoin is down over 4%.

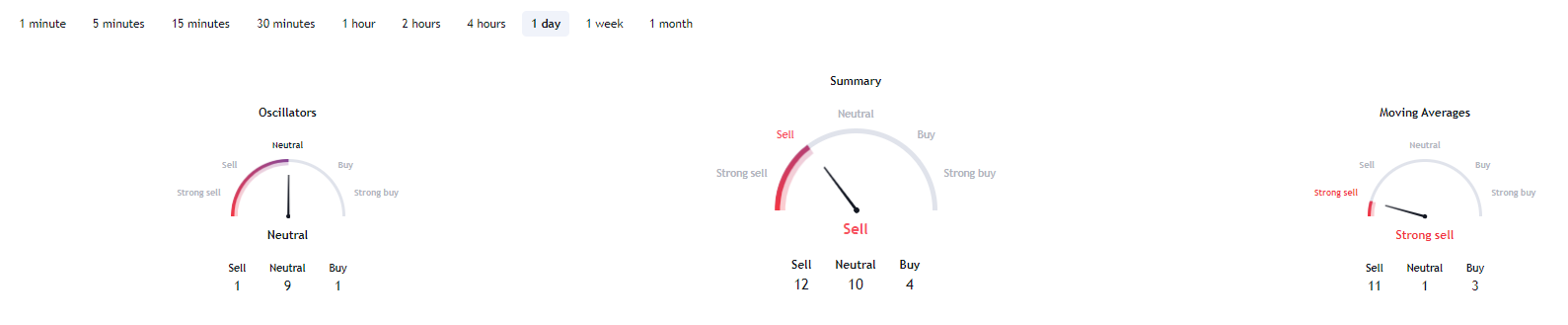

On the numerous hand, the one-day technical prognosis for Bitcoin signifies blended signals. Oscillators are primarily neutral, with nine neutral, one promote, and one aquire indicator. Nice looking averages recommend an exact promote, with 11 promote, one neutral, and three aquire indicators. Total, the summary recommends selling Bitcoin, with 12 promote, 10 neutral, and four aquire indicators.

For the time being, with Bitcoin having reclaimed the $61,000 level, the asset must abet beneficial properties above this designate to preserve a ways from further correction.

Disclaimer: The bellow material on this design will salvage to quiet no longer be regarded as funding advice. Investing is speculative. When investing, your capital is at threat