Arbitrum’s (ARB) sign is in for a valuable drawdown now not truthful the chart sample however additionally the investors’ habits.

Whether ARB ends up dropping to $0 or keep pores and skin earlier than then is one thing to glimpse out for.

Arbitrum Buyers Ready for Losses

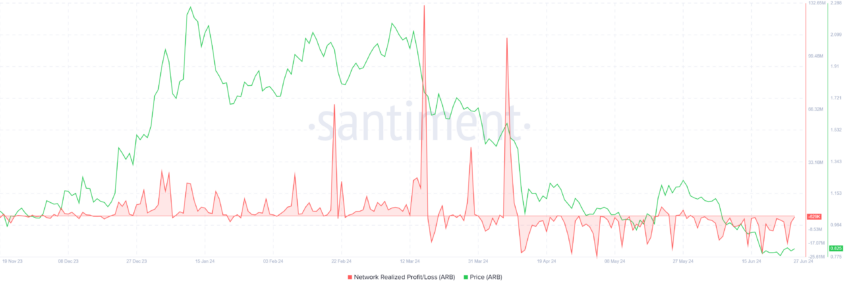

Arbitrum’s sign will be a brand fresh all-time low as the optimism among ARB holders has totally vanished. Arbitrum investors indulge in been experiencing constant losses on their transactions since mid-April. This ongoing pattern is clearly highlighted by the Realized Earnings/Loss metric, which underscores the monetary challenges confronted by the investors.

The chronic losses indulge in tremendously impacted investor sentiment, main to a noticeable shift in habits. Previously, many investors adopted a HODLing strategy, keeping onto their property in anticipation of prolonged-term beneficial properties.

On the opposite hand, the sentiment of HODLing among Arbitrum investors has totally disappeared. The extended period of losses has eroded their self assurance on this kind.

As a result, investors are really specializing in distribution strategies, as indicated by the mean coin age metric. Imply coin age measures the typical age of all coins in a community, reflecting how prolonged they’ve been held with out being moved.

An rising mean coin age suggests accumulation and keeping, while a reducing age signifies increased trading job. This shift suggests a preference for liquidating property as adverse to keeping onto them, reflecting a extra cautious and reactive investment arrangement.

Read More: Easy Aquire Arbitrum (ARB) and Every thing You Must Know

ARB Designate Prediction: Forming New Lows

Arbitrum’s sign is watching the formation of a head and shoulders sample. The head and shoulders sample is a bearish chart formation indicating a ability pattern reversal. It includes three peaks: a increased center height (head) between two decrease peaks (shoulders).

Per the technical sample, the capability drawdown may well per chance also ship the altcoin down to $0 as the target is 100% below the neckline at $0.92. On the opposite hand, right here’s very now potentially not since even at some stage in the FTX collapse, its native token, FTT, did now not scoot to $0.

Thus, the extra excellent is Arbitrum’s sign hitting a brand fresh all-time low. The sizzling ATL lies at $0.73 and marking a decrease low below this is able to now not be surprising.

Read More: Arbitrum (ARB) Designate Prediction 2024/2025/2035

But when by the mercy of ARB holders, the altcoin manages to win better Arbitrum’s sign may well per chance also win better. Doubtlessly breaching the neckline at $0.92 will allow restoration and reclaiming $1.0 will invalidate the bearish thesis.