Bitcoin’s (BTC) weekend allotment of buying and selling volume has reached an all-time low in 2024, with a trending dominance of weekdays. This pattern highlights an vital shift for the leading cryptocurrency, drawing near near the historical finance market habits as establishments take over.

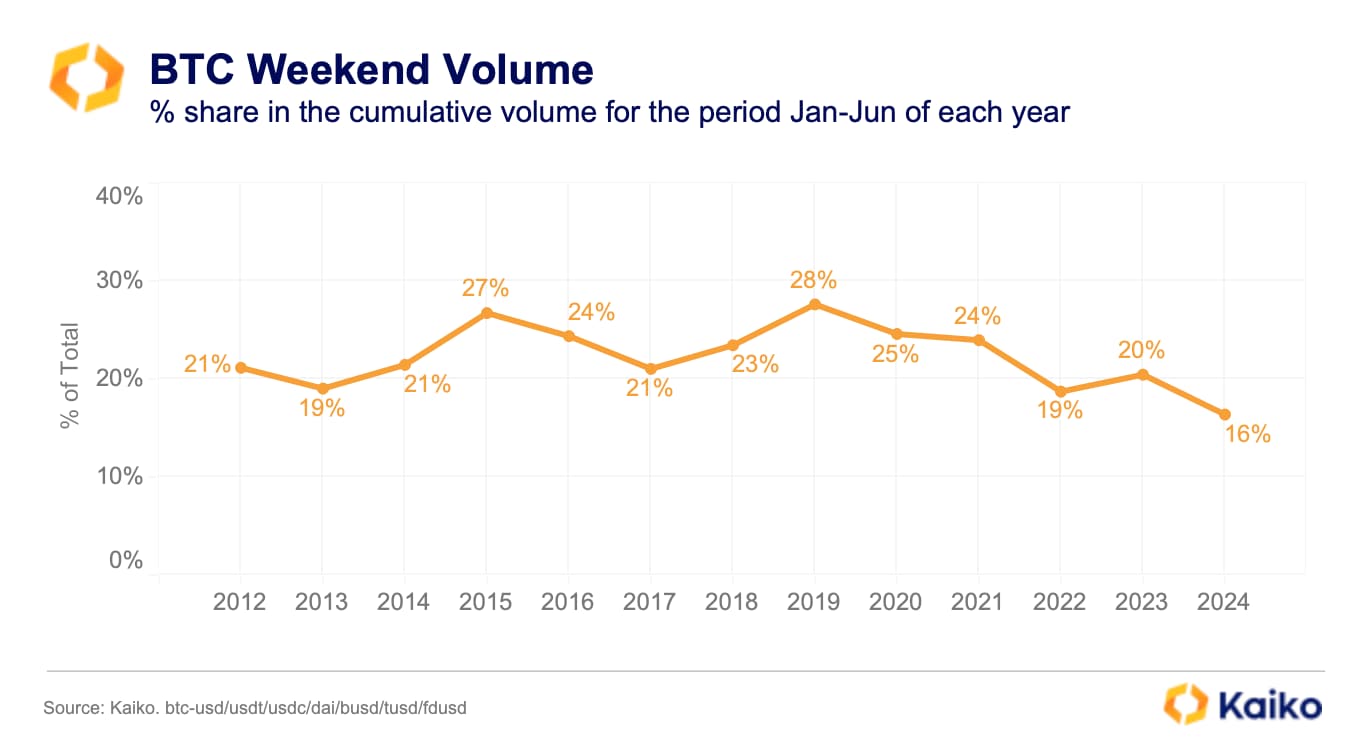

This recordsdata used to be no longer too long previously highlighted in a Kaiko tale comparing the buying and selling volume on weekends to weekdays. Notably, Bitcoin registered a 16% allotment of the buying and selling volume proper during the weekends from January to June. This marks an all-time low for an identical interval, with Kaiko taking a requirement at recordsdata from seven BTC pairs since 2012.

Beforehand, better lows had been in 2022 and 2013, both with 19% of the total buying and selling volume happening on weekends. Moreover, there has been a vital downtrend since 2019’s 28% peak, with weekend volume making lower highs every two years.

The tale suggests Bitcoin pickle ETFs is maybe partly blamed for the tale lows, driving the movement to weekdays. These monetary products feature below historical finance suggestions, in convey that they are restricted to Wall Boulevard’s weekday operations, no a bunch of from shares and other commerce-traded funds.

Bitcoin isn’t any longer demise, however its buying and selling habits has modified

Curiously, the weekend allotment downtrend is accurate one fragment of the puzzle that reveals Bitcoin’s changing habits.

The leading cryptocurrency once started in a tiny neighborhood of cypherpunks, following a imaginative and prescient of being an electronic undercover agent-to-undercover agent money scheme whose core value used to be in accordance with the non-reliance of intermediaries to repair the problems inner historical finance. A monetary scheme that never sleeps and an asset that its customers would possibly perhaps well enact self-custody and retain a long way from the monetary debasement from inflation and fractional reserves.

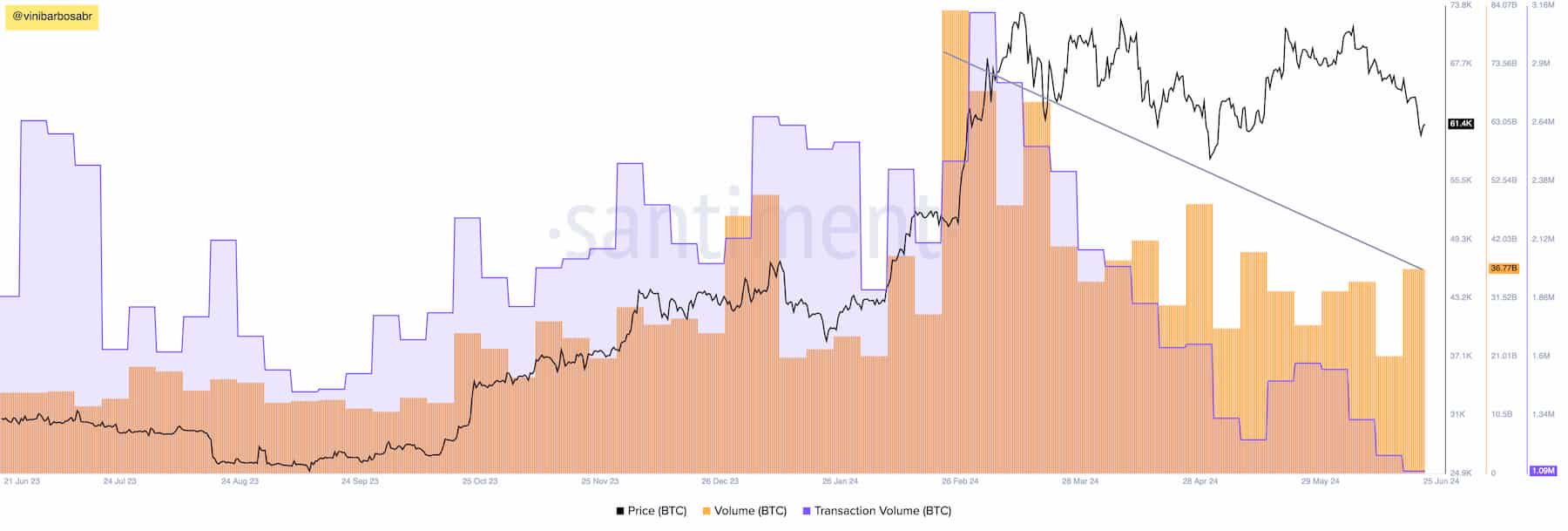

Then again, the market has considered diminishing on-chain and pickle buying and selling volumes. Conversely, derivatives and ETF volumes maintain been rising in the reverse direction of the first two, no longer easy the usual imaginative and prescient. Finbold reported the aforementioned divergence on June 2.

In preserving with recordsdata gathered from Santiment’s SanBase Legit on June 25, the scenario remains the same by press time. BTC trades in a label fluctuate, at display at $61,400, while buying and selling and transaction volumes gather lower highs.

Moreover, a huge section of this volume is made inner centralized databases from crypto exchanges, no longer utilizing the blockchain. As an example, a tale from Altcoinbuzz highlighted how BlackRock (NYSE: BLK) can borrow Bitcoin from Coinbase without offering a 1:1 preserving ratio, which would possibly perhaps well counsel the usage of what the market calls “paper bitcoin,” allowing unbacked immediate-selling.

You be taught it appropriate: BlackRock has been settling its BTC transactions with Coinbase without utilizing Bitcoin’s settlement community.

We’re no longer talking about “searching for a espresso,” however institutional settlements of a $18.5 billion fund.

The motive: Transaction slip and costs.

Got it now?… pic.twitter.com/SxzAcHyzlJ

— Vini Barbosa (@vinibarbosabr) Would possibly perhaps maybe maybe additionally honest 20, 2024

Simplest time will expose whether or no longer these modifications would possibly perhaps well positively or negatively impact the price of Bitcoin in the long bustle. Intriguing now, it is trail that BTC is going through a habits replace, and merchants must review these modifications to gather decisions accordingly.