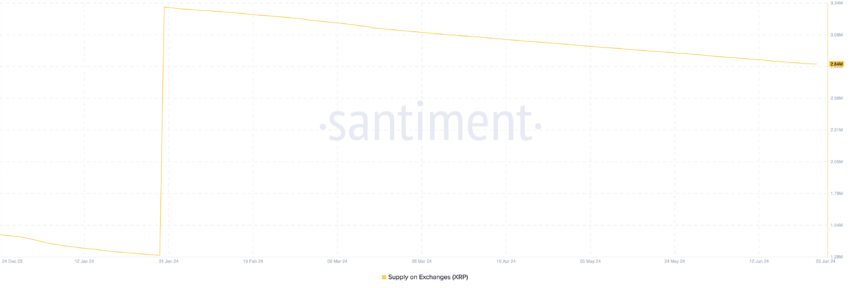

The sequence of Ripple (XRP) tokens held across cryptocurrency exchanges totals 2.84 million XRP, which is valued at $1.34 million at recent market prices.

This represents the bottom amount of XRP tokens held on exchanges since the foundation of the year.

Ripple Facts Low Sell-offs

At press time, the token’s provide on exchanges used to be 2.84 million XRP, the bottom level since January 1. When an asset’s provide on exchanges drops, its total amount held on cryptocurrency exchanges decreases.

This would perchance perchance be due to the investors preserving their tokens in a hardware pockets, staking on decentralized finance platforms (DeFi), or on the total refraining from selling their holdings in expectation of a future trace rally.

Alternatively, XRP’s most current trace action has now not shown any doable for a indispensable rebound in the with regards to duration of time. As of this writing, XRP trades at $0.47. In the closing month, the altcoin’s trace has plummeted by 12%.

Read Extra: All the pieces You Need To Know About Ripple vs SEC

For context, the altcoin revisited its year-to-date low of $0.46 on June 24, marking its 2d time this month by myself.

The consistent decline in XRP’s trace is partly attributable to how considerable losses its holders own incurred now not too long in the past. To illustrate, its each day ratio of transaction quantity in income to loss (assessed the convey of a 30-day bright moderate) is 0.88 at press time.

This implies that for every XRP transaction ending in a loss, fully 0.88 transactions return a income.

XRP Tag Prediction: The Bears Are in Control

Readings from XRP’s trace efficiency on a each day chart boom the decline in the question for the altcoin. To illustrate, its Chaikin Cash Waft (CMF), which measures money float into and out of its market, is currently 0.06.

A unfavorable CMF trace is a demonstration of market weak point. It’s a bearish label that means liquidity exit from the market. Merchants on the total interpret it as a label of a extra decline in an asset’s trace.

XRP’s Transferring Moderate Convergence Divergence (MACD) setup confirms the bearish sentiment. As of this writing, the token’s MACD line (blue) rests under the label (orange) and zero strains.

The indicator identifies adjustments in an asset’s strength, trace direction, and momentum. When the MACD line falls under the label line, it is a bearish label, which implies that selling strain is more indispensable than procuring convey.

If the question for XRP continues to plummet, its trace will fall to $0.42.

Read Extra: Ripple (XRP) Tag Prediction 2024/2025/2030

Alternatively, if sentiment shifts from bearish to bullish, the token’s trace will rise to $0.49.