Despite prevailing bearish sentiments surrounding Bitcoin (BTC), a shopping and selling professional has infamous that there stays a wager for the asset to rally within the quick term.

In an insightful prognosis shared on June 21 on TradingView, Alan Santana examined the Bitcoin month-to-month chart, revealing mixed indicators for merchants.

Despite previous bullish traits, fresh actions fill confirmed bearing on signs. Closing month, Bitcoin’s label closed beneath the peak of November 2021, suggesting a fight to surpass previous highs.

The professional infamous that this month started bullishly, evident from the long better shadow on the session, but it has was bearish within the 2d half. On the identical time, Bitcoin has been tormented by low shopping and selling quantity, indicating a shortage of unique gamers entering the market, which can maybe well point out reduced enthusiasm.

Next step for Bitcoin label movement

Santana’s prognosis additional highlighted the unheard of nature of Bitcoin’s three-month sideways length following an all-time high. This deviation from previous patterns suggests the market may maybe well swing in any direction. Santana estimated an 80% likelihood that Bitcoin will face a correction sooner than reaching unique highs, indicating exiguous room for enhance within the come term.

On the replacement hand, despite the bearish indicators, Santana infamous a 20% likelihood that Bitcoin may maybe well defy the percentages and surge to $100,000 and even $150,000. He emphasized the importance of being challenging for all outcomes pretty than relying totally on hope.

“The chart shows exiguous room for enhance yet it is miles silent a likelihood. We would pronounce 80 percent likelihood for a correction sooner than a novel high, with a 20% a likelihood to proceed without end up; 100K, 150K,” the analyst talked about.

Even though dominated by bearish sentiments, the overall market consensus is that Bitcoin is at likelihood of rally, with $100,000 closing a imaginable aim. For the time being, bearish sentiments are additionally reflected within the asset’s on-chain data.

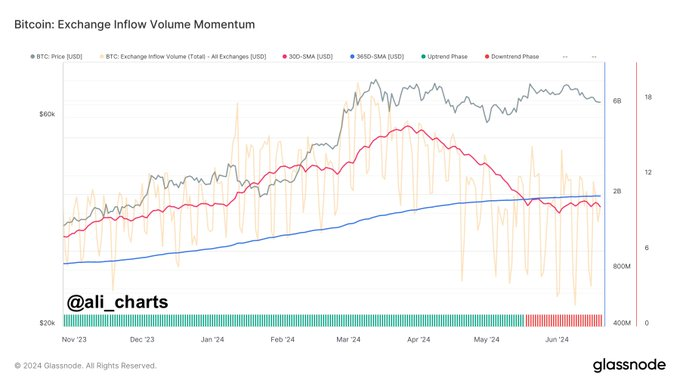

As an instance, data shared by crypto analyst Ali Martinez on June 21 indicated a predominant downturn in replace-associated on-chain project for Bitcoin, signaling a tumble in investor curiosity.

Total, Bitcoin’s volatility is influenced by indispensable market events, such as the German executive’s Bitcoin movement. Earlier within the week, Bitcoin showed stability around $66,000, adopted by a pointy decline beneath $63,000.

Bitcoin label prognosis

As of press time, Bitcoin was once shopping and selling at $64,267, having obtained nearly 1% within the final 24 hours. On the weekly chart, Bitcoin is down over 3%.

Currently, $64,000 is a wanted enhance for cryptocurrency. The next imaginable aim is the $65,000 resistance impress, which can maybe well anchor the next high. Conversely, dropping beneath $64,000 may maybe well lead Bitcoin to fall to $60,000.

Disclaimer: The inform material on this net site ought to silent not be thought to be funding advice. Investing is speculative. When investing, your capital is in peril. Love (166)