Currently, approximately $1.96 billion price of Bitcoin (BTC) and Ethereum (ETH) alternatives are location to expire, creating indispensable anticipation within the crypto market.

Expiring crypto alternatives might maybe most frequently lead to principal model volatility. Subsequently, merchants and merchants carefully video show the inclinations of this day’s expiration.

Ancient Developments Signal a Rebound as Crypto Recommendations Shut to Expiry

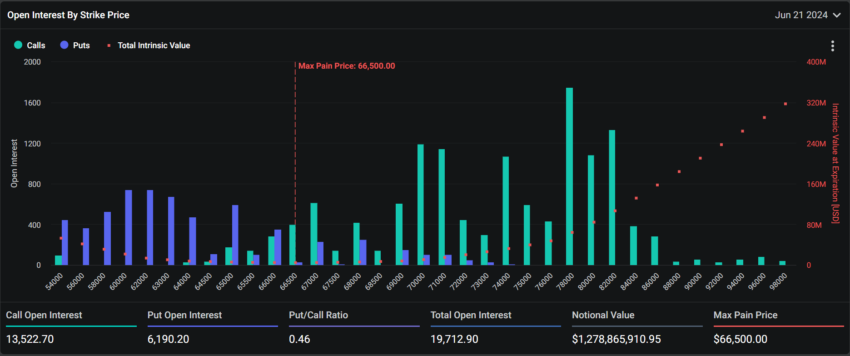

Currently’s expiring Bitcoin alternatives win a notional price of $1.27 billion. These 19,712 expiring contracts win a put-to-name ratio of 0.46 and a maximum anxiousness point of $66,500.

Within the context of alternatives buying and selling, the maximum anxiousness point represents the price stage causing maximum monetary anxiousness to option holders. Within the meantime, the put-to-name ratio suggests a prevalence of aquire alternatives (calls) over gross sales alternatives (places).

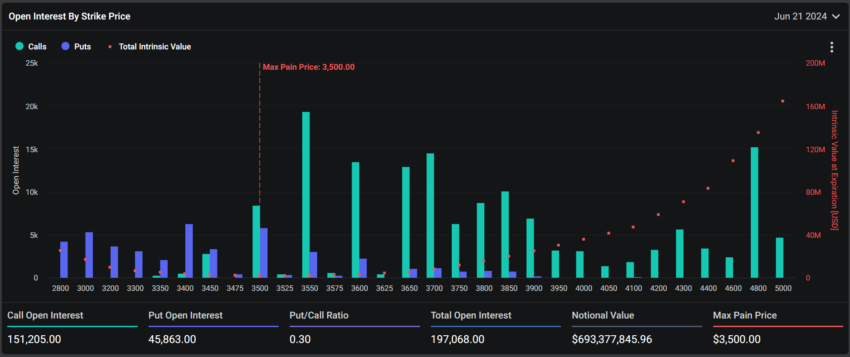

On the assorted hand, Ethereum has 197,068 contracts with a notional price of $693.37 million. These expiring contracts win a put-to-name ratio of 0.30 and a max anxiousness point of $3,500.

Analysts at Greeks.Stay eminent an enlarge in forward alternatives volume, especially in block calls. Despite excessive realized volatility (RV), the implied volatility (IV) has remained trusty. This disaster indicates no principal market scramble is expected forward of the quarterly provide.

“The pattern within the 2d quarter this year became weaker, aligning with ancient experiences. The third quarter most frequently struggles, with the tip of the quarter most frequently marking the market rebound,” analysts at Greeks.Stay acknowledged.

This week, Bitcoin fluctuated between $64,258 and $66,782, whereas Ethereum traded all the plan by the $3,387 to $3,632 range. At the time of writing, Bitcoin trades at $64,924, a 2.7% decrease over the previous seven days. Ethereum trades at $3,526, marking a 1.5% enlarge.

While alternatives expirations can reason short market disruptions, they in overall lead to stabilization. Analysts’ latest insights spotlight the ancient patterns merchants can also merely assign in mind when strategizing their positions. Eventually, merchants must dwell vigilant, examining technical indicators and market sentiment to navigate the predicted volatility successfully.