This day, catch pleasure from the On the Margin newsletter on Blockworks.co. The following day, catch the tips delivered straight to your inbox. Subscribe to the On the Margin newsletter.

The Fed pivot no one’s talking about

Regardless of the motion-packed June FOMC assembly closing week, there became as soon as small or no discuss the fundamental shift in stability sheet coverage by the Fed that started this month.

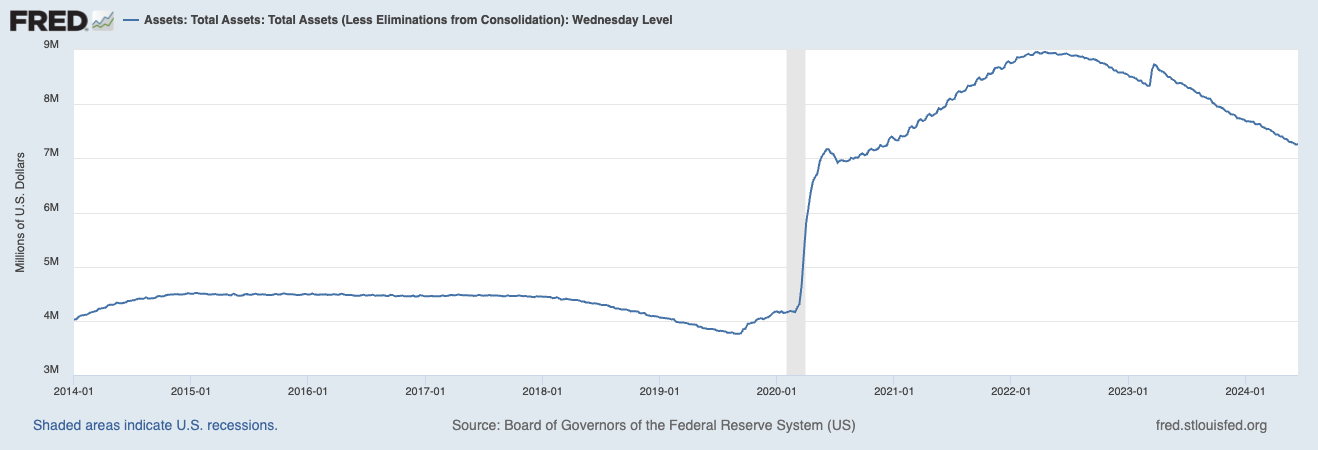

After running the stability sheet up from $4 trillion to $8.9 trillion right by arrangement of the COVID-era quantitative easing marketing and marketing campaign, the Fed has been employing quantitative tightening since 2022 to diminish the dimensions of its stability sheet and decrease the full amount of bank reserves genuine by arrangement of the system.

There are two methods QT can work: “soft” or “hard.”

QT “soft” is when the Fed doesn’t in actuality sell the sources on its stability sheet to a market participant, but quite lets the securities (a combo of Treasurys and mortgage-backed securities) passe and “roll off” its stability sheet. They steal the proceeds of the safety and retire that money in solution to reinvesting the proceeds into extra of the identical security that matured to be in a position to “preserve even.”

QT “hard” is when a central bank in actuality sells its securities to dealers and somewhat about a market members. It’s a mighty extra potent and effective version of QT because it leads to elevated sell strain, inflicting better yields in turn. The Bank of England currently employs this means, however the Fed never has.

The Fed has a straightforward framework for working out reserve ranges: We are currently in a regime of “ample reserves,” characterized by extra reserves than what is required for the monetary system to effectively operate. The Reverse Repo Facility has a $100 billion+ stability sheet, i.e., ample reserves.

The Fed desires to catch to an “extensive reserve regime,” which permits a buffer to the reserve stage so that no hiccups occur within the deep substances of the Fed’s plumbing system.

In 2019, the closing time the Fed did QT, reserves hit $3.7 trillion and the Repo market blew up since there were now not enough reserves genuine by arrangement of the system to effectively operate. The recount is identified as a “scarce reserve regime.” Repo rates exploded better, forcing the Fed to whole QT in a single day and open lending in Repo markets.

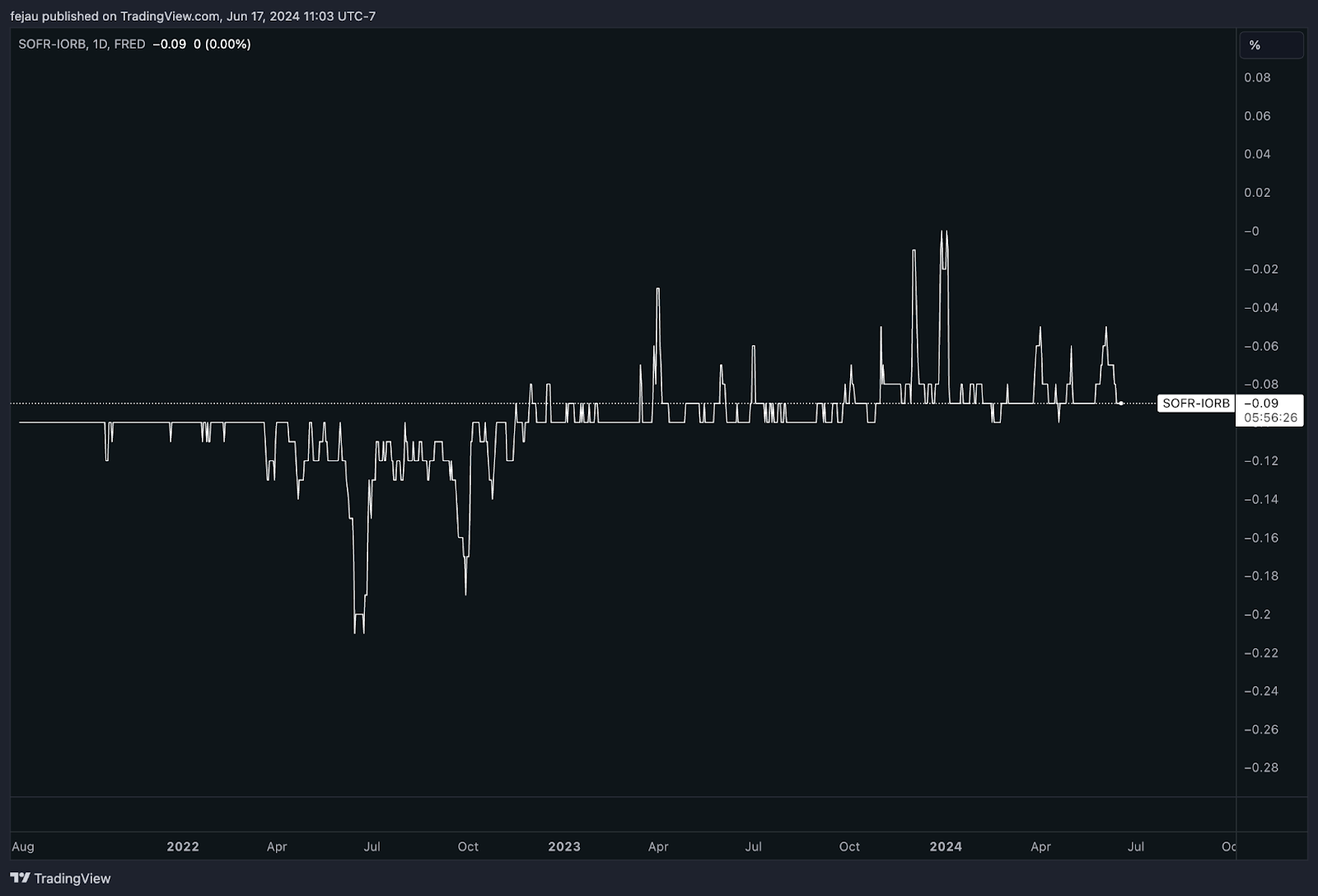

To lead certain of this happening yet yet again, the Fed is preemptively tapering the tempo of its QT despite no signs of stress within the plumbing markets of the Fed. A straightforward approach to seem for this “stress” is having a peek on the unfold between SOFR and IORB — as long because it’s destructive, there is never this type of thing as a subject for reserve ranges:

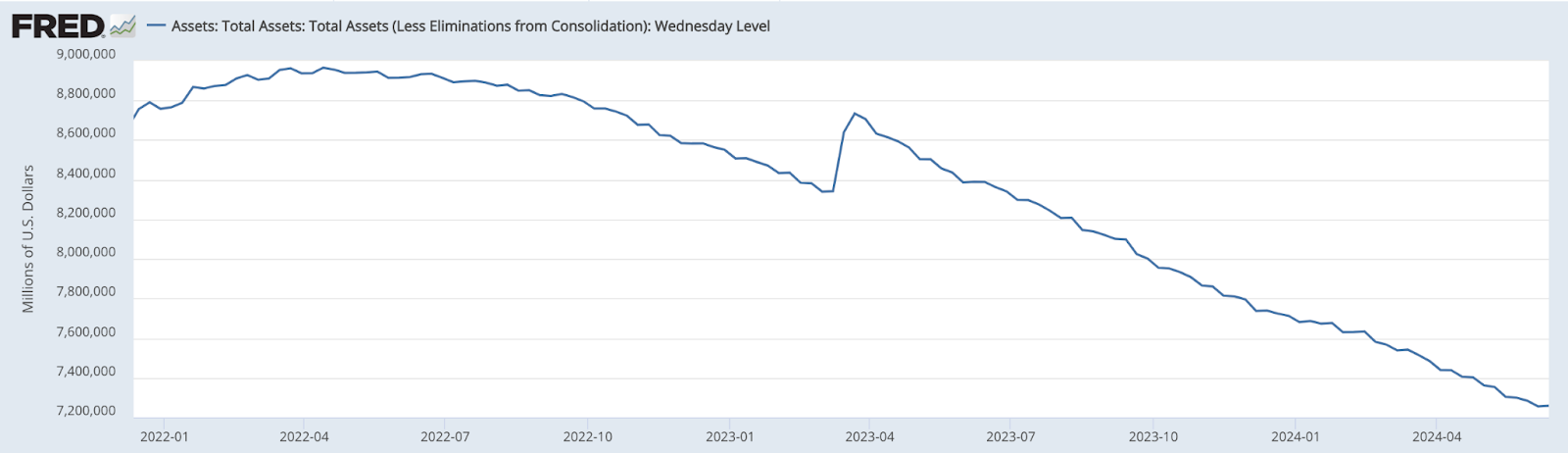

Regardless of this lack of stress, the Fed is slowing down its QT vastly. Initiating this month, the Fed is lowering the runoff from $60 billion per month down to $25 billion per month.

This taper within the tempo of QT will result within the Fed’s stability sheet pulling down out after nearly two years of down-only, easing strain on liquidity.

Releasing up this amount of strain on danger sources is constructing for a mighty extra particular liquidity atmosphere than the one from the previous couple of years. Buckle up.

— Felix Jauvin

3

The sequence of virtual forex-related purposes Unique York’s Division of Financial Services has to this point licensed this year. The most up-to-date of which came about on Monday, when crypto shopping and selling firm Cumberland acknowledged it secured a coveted BitLicense.

“As indubitably one of the important single major shopping and selling companies to aid a BitLicense, we stumble on forward to stable shopping and selling relationships with institutional Unique York counterparties,” the company licensed in an X put up. It didn’t return a quiz for further comment.

WisdomTree and PayPal were granted what is identified as slight cause belief charters in March and Would possibly perhaps well honest, respectively. Though related to a BitLicense, those charters (below the Unique York Banking Regulation) embody somewhat about a advantages, comparable to allowing recipients to have interplay in money transmission in Unique York without obtaining a separate license.

In any other case, the closing BitLicense recipient sooner than Cumberland became as soon as eToro in February 2023. Coin Cafe also bought one the month sooner than that.

All it takes is one particular comment…

Coinbase-initiated nonprofit Stand With Crypto unveiled its endorsement of 18 unique US Dwelling and Senate candidates the day prior to this. The 510(c)(4), which launched its like PAC closing month, now backs 22 Congressional hopefuls.

Stand With Crypto is taking a guess by backing six beginners this election season. Among these non-incumbents are Democrats Shomari Figures (running for the US Dwelling in Alabama’s 2nd district) and Sarah McBride (having a peek to signify Delaware within the identical chamber).

Regardless of talking small about crypto, McBride and Figures have efficiently caught the industry’s consideration — and their tests (a minimal of for Figures). McBride’s Stand With Crypto profile notes she “strongly supports crypto,” yet cites only a single commentary about digital sources.

The commentary came in April, when McBride acknowledged “embracing” blockchain technology and crypto could perhaps result in better monetary inclusion. Props to her (or her speech author) for hitting the total keywords there.

Figures, per Stand With Crypto, has also made a solitary commentary about digital sources. He licensed on his marketing and marketing campaign web set up of residing in March that crypto could perhaps advance industries by arrangement of “provide chain administration, healthcare and identity verification.”

If the bar is that low to catch some further marketing and marketing campaign money from an industry that appears to be chomping on the bit to use, we’d indicate every Congressional hopeful (especially those that don’t have federal balloting records yet) catch on board.

As of the head of April, crypto desirable PAC Provide protection to Growth has spent $2.4 million backing Figures, per Federal Election Fee files.

McBride had now not bought nice bucks from the crypto industry, as of March 31. But it indubitably’s quiet early, and the Stand With Crypto PAC has now not yet filed any FEC experiences — so there will most likely be money that correct hasn’t been tracked.

— Casey Wagner

BTC/ETH fund submitting makes waves

Hashdex, after now not exactly rising as a winner within the US location bitcoin ETF fight, has no plans to open a single-asset location ETH fund.

However the Brazil-based asset manager has made some waves by plotting an ETF that could well support each and every BTC and ETH.

The key US location bitcoin ETFs got the SEC’s long-awaited blessing in January. Draw ether ETF launches appear coming near because the company works with issuers to finalize the planned funds’ registration statements.

It became as soon as only a subject of time sooner than we saw a proposal for a US fund having a peek to spend money on each and every sources.

The Hashdex Nasdaq Crypto Index US ETF would at the starting up correct support the head two cryptos, plus money. The index it tracks currently weights BTC and ETH at roughly 70% and 30%, respectively.

The submitting by Nasdaq — the change on which the fund would change — is careful, noting the product would “now not spend money on crypto securities, tokenized sources or stablecoins.”

But its language signals Hashdex would have the option, down the toll road, to allocate to somewhat about a crypto sources within the kill added to the aforementioned Nasdaq index. Such sources would favor to meet obvious criteria, comparable to shopping and selling on a US-regulated platform or being the underlying asset for a spinoff instrument listed on the type of venue.

Bitwise senior crypto analyst Ryan Rasmussen urged Blockworks closing month that crypto index ETFs are at some point soon more likely to play a foremost characteristic in crypto investing. Though it’s unclear when such merchandise could perhaps checklist, they’d peer “foremost inquire” from advisers now not searching for to prefer to make your mind up successful sources within the home, he added.

The SEC is slated to rule on this proposed Hashdex ETF by March 2025 — per chance serving as a catalyst for yet one other year of crypto product innovation.

— Ben Strack

Bulletin Board

- Crypto prices slipped Tuesday afternoon, with bitcoin and ether each and every dropping by about 3% on the day, at time of writing. Bitcoin became as soon as below $65,000, extending a two-week decline that has considered the biggest crypto asset change below doubtlessly the most important $70,000 stage.

- Trusty after the Supreme Court docket agreed to hear Nvidia’s allure in its swimsuit provocative alleged crypto mining gross sales fraud, the AI powerhouse turned the arena’s most essential company Tuesday with a market cap of $3.3 trillion.

- Talking of mining, bitcoin miner CleanSpark expects to soon cease its deal to in discovering 5 extra facilities in Georgia for nearly $26 million. Be taught extra about the acquisitions right here.