Bitcoin model fell as low as $66,865 on Wednesday, June 13, as the US Federal Reserve dashed investors’ hopes of an H1 2024 rate reduce; on-chain data trends expose how BTC managed to preserve above the serious $65,000 toughen level.

Bitcoin Label Tumbled 7% After US Fed Fee Terminate Resolution

The crypto market slipped extra into is on-going consolidation phase, as bulls failed construct on the obvious starting up to June 2024, amid hawkish shifts in US macro financial indices.

No topic the slowing CPI inflation signalling an forthcoming financial mushy-touchdown, the US Federal Reserve has opted to raise ardour charges at elevated levels after essentially the most neatly-liked FOMC meeting on June 12.

As expected, threat sources markets including the cryptocurrency sector reacted negatively to the Fed rate dwell decision.

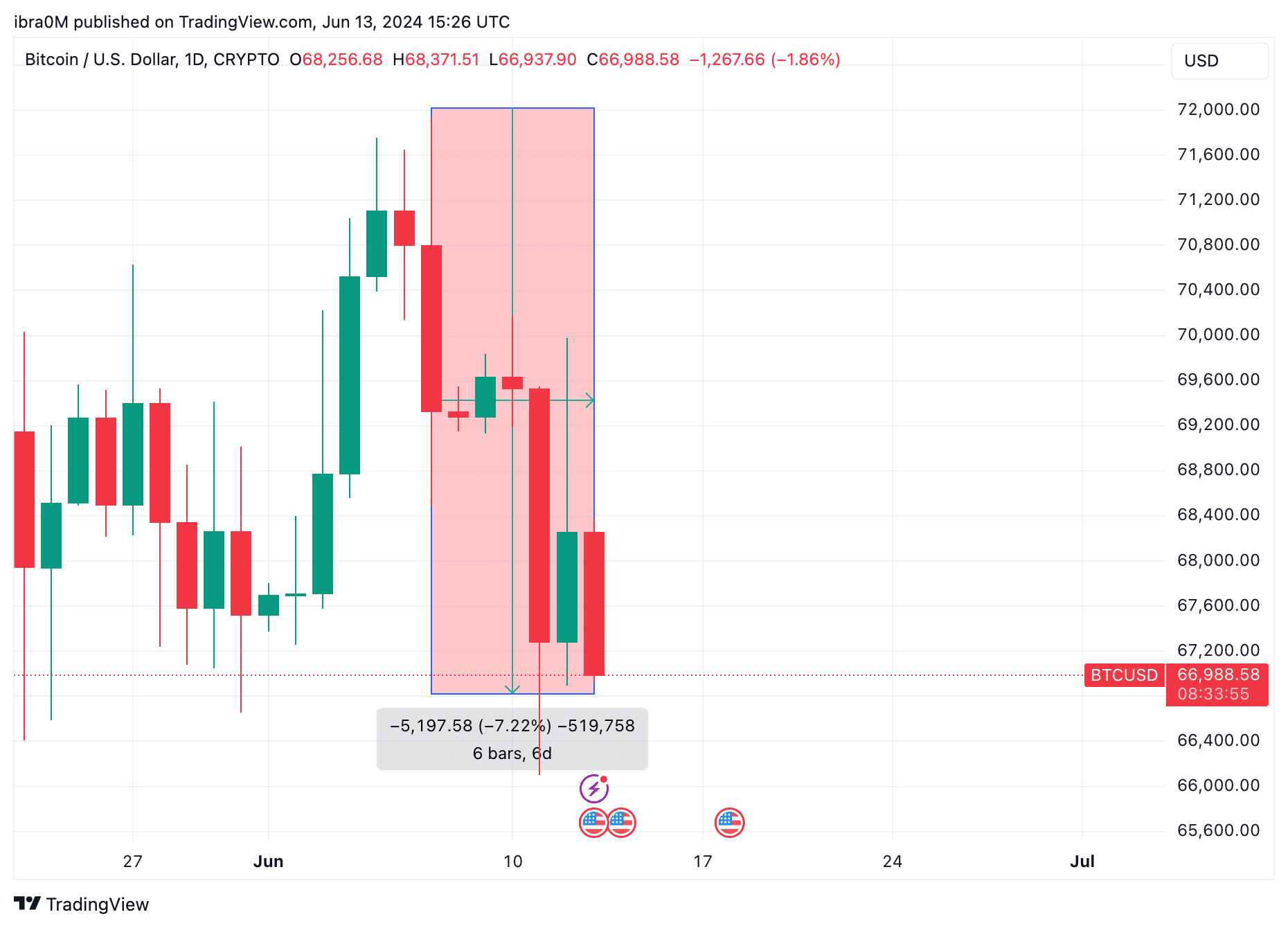

As viewed above, Bitcoin model fell as to a day-to-day timeframe backside of $66,896 after the US Fed rate decision hit the guidelines reels on Wednesday, June 12. This marks 7.22% decline in BTC prices for the length of the 7-day timeframe.

But tantalizing, no topic the destructive momentary market sentiment, Bitcoin bulls managed avert a reversal below the serious $65,000 psychological resistance.

Prolonged-time period Investors Unwilling to Sell Bitcoin

After nearly about a weeks of rising market volatility, Bitcoin sellers are in actuality showing early signals of fatigue. If it persists, this pass could per chance well spark a relaxed BTC model rebound phase in the approaching weeks.

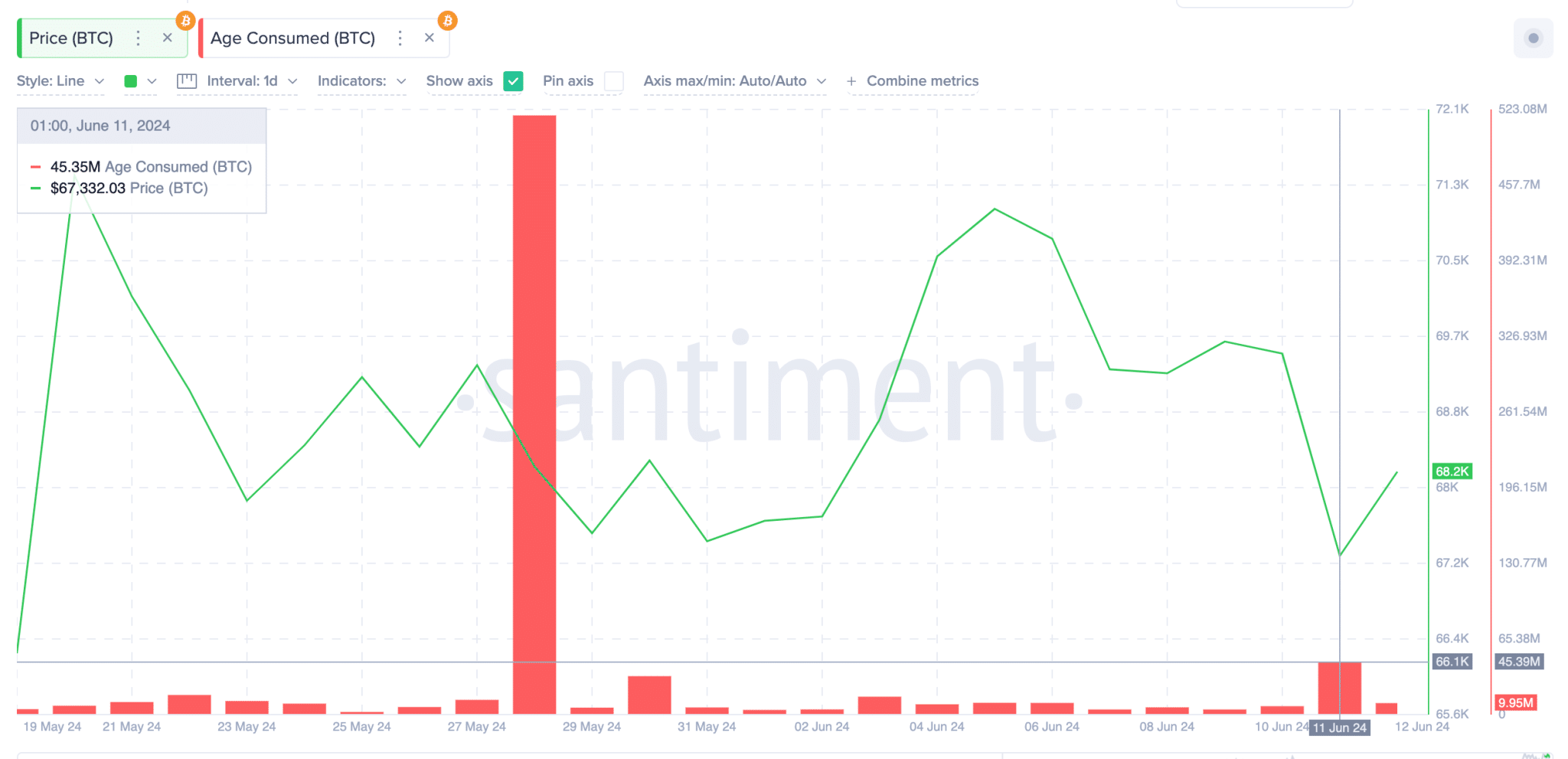

Santiment’s Age Consumed chart below monitors the level of promoting stress among lengthy-time period investors. In actual fact, it is miles derived by multiplying the likelihood of BTC cash traded on a given day by the likelihood of days since they had stayed unmoved.

Whenever a likelihood of lengthy-time period BTC investors are in promote-off mode, a necessary spike reveals up on the Age Consumed chart, and vice versa.

Bitcoin Age Consumed handiest a monthly time frame peak of 45.35 million on June 11, as merchants entered a mercurial selling frenzy in the aftermath of essentially the most neatly-liked US Federal Reserve’s rate dwell decision.

But having a perceive carefully at the snapshot above, essentially the most neatly-liked BTC Age Consumed spike is 91% decrease than final month’s peak seen on Can also 28. Because of this the majority of Bitcoin lengthy-time period investors are unwilling to attain one other trim-scale promote-off for the length of essentially the most neatly-liked market dynamics.

In combination with rising inflows from Bitcoin ETFs, this decline in selling traits among lengthy-time period holders largely explains why BTC model avoided a reversal below $65,000, in its place consolidating above the $68,000 territory on Thursday June 13.

Bitcoin Label Forecast: $65,600 Enhance to the Rescue

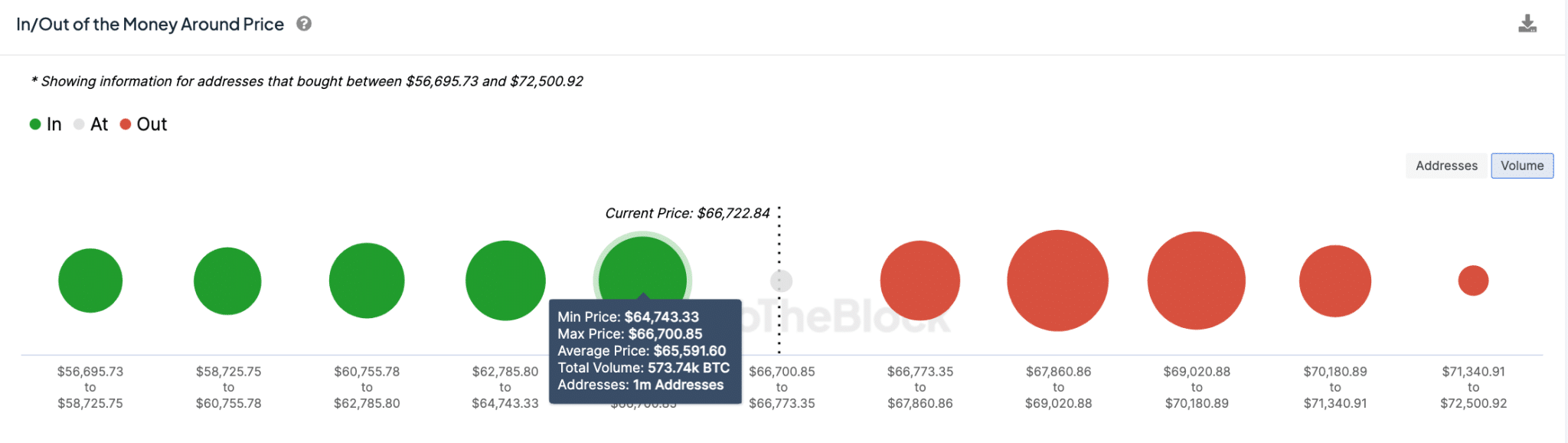

Drawing inferences from the on-chain data prognosis above, Bitcoin model looks spot to consolidate above the $65,000 level no topic essentially the most neatly-liked destructive market sentiment. IntoTheBlock’s IOMAP data extra affirms of this optimistic Bitcoin model forecast.

As viewed below, there’s trim cluster of 1 million addresses, that got 573,740 BTC at the average model of $65,591.

To raise away from slipping to a uncover-loss impartial, majority of these holders could per chance well decide to manufacture conserving purchases if BTC model tumbles shut to the $65,600 in the near-time period, there by triggering a rebound.

Likewise, in the occasion of one other upward model breakout, Bitcoin bull will face a scary resistance at the $69,000 territory.

In finish, without any outlier catalyst, BTC model now looks likely to consolidate for the length of the $66,000 to $70,000 channel as the week draws to a shut.