Avalanche (AVAX), the token of the orderly contract blockchain, has been swinging toward decrease tag phases for almost a month. Which capability, merchants within the derivatives market are bright from a old bullish thesis to a bearish bias.

AVAX had a dauntless performance in 2023 and essentially the most necessary quarter of 2024. But currently, the token looks to non-public lost its stroke of luck.

Bulls Are Staying Away From Avalanche

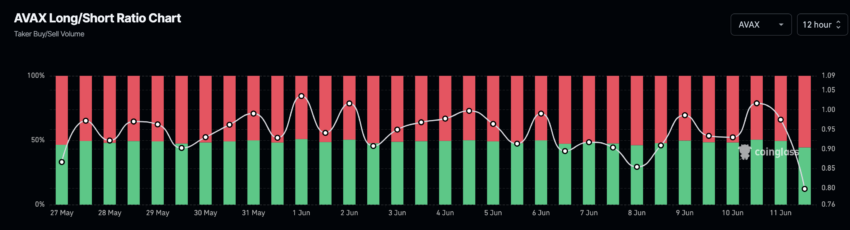

AVAX trades at $31.Fifty three. On the replacement hand, the Long/Short Ratio shows merchants attach a query to the price to tumble with out reference to the 8.66% 7-day decrease. Evidence of this sentiment is reflected within the Long/Short Ratio.

The Long/Short Ratio measures merchants’ expectations toward a cryptocurrency. Values of this indicator above 1 brand that there are extra prolonged positions than shorts. Conversely, a Long/Short Ratio ratio decrease than 1 suggests elevated bearish predictions.

A prolonged is a market participant searching at for the price of a token to expand whereas filling the allege on a contract. On the totally different hand, a rapid is a trader betting on a tag decrease.

In step with the derivatives knowledge portal Coinglass, AVAX’s Long/Short Ratio used to be 0.seventy 9. This reinforces the aforementioned perception within the market.

Be taught More: 11 Only Avalanche Wallets to Steal brand of in 2024

Apart from the ratio, Initiate Ardour aligns with the ability tag decrease. Initiate Ardour refers back to the price of outstanding contracts within the market.

This indicator decreases or increases in maintaining with win positioning. Unlike the Long/Short Ratio, Initiate Ardour would not brand whether there are extra longs or extra shorts. As a change, an expand in Initiate Ardour refers to an influx of liquidity and launch contracts.

On the replacement hand, a decrease suggests a rise in closed positions and elevated outflow of cash. As of this writing, AVAX’s launch hobby used to be $211.64 million. On June 7, when the price of AVAX used to be $35, Initiate Ardour used to be worthy elevated.

For the token’s price, the decrease can even unbiased confirm a downward pattern as against the upward strength an expand in Initiate Ardour can even unbiased supply.

AVAX Label Prediction: Long Aspect toll road From Rally

Within the intervening time, AVAX’s market structure on the every day chart suggests a attainable tumble. The Exponential Transferring Common (EMA) is a a will deserve to non-public indicator that corroborates this bias.

EMA measures pattern direction and displays how prices can alternate inside a given duration. On the AVAX/USD every day chart, the 20 EMA (blue) crossed below the 50 EMA (yellow) since April 13.

This region known as a death wicked and is a bearish pattern. It occurs when the longer EMA crosses above the shorter EMA. The reverse is the golden wicked that occurs when the shorter EMA crosses above the longer EMA.

This region locations AVAX prone to a decline to $29.38. Extra, the Directional Stride Index (DMI) supports the ability tag decrease.

The chart below shows that the -DMI (red) used to be 27.58, whereas the +DMI (blue) used to be 11.85. DMI measures every strength and direction. Which capability truth, the adaptation between the +/-DMI suggests a downward direction for AVAX.

Additionally, the Common Directional Index (ADX) traits upward. The ADX (yellow) shows the strength of the direction. If the ADX spikes, it technique that the direction has strength within the help of the motion.

On the replacement hand, a low DMI reading technique that the directional strength is dilapidated. In AVAX’s case, it used to be the extinct.

Be taught More: Aquire Avalanche (AVAX) with a Credit rating Card: A Step-by-Step Data

Which capability truth, the price can even unbiased fall below $30 within the rapid term. On the replacement hand, the prediction would possibly perchance likely be null and void if the broader market begins to recover, as AVAX can even unbiased apply the instructions of totally different altcoins.