The Tom Demark (TD) Sequential has given a promote signal for Bitcoin after the asset broke previous the $71,000 level within the day prior to this.

Bitcoin TD Sequential Is Giving A Sell Signal Correct Now

As defined by analyst Ali Martinez in a brand contemporary put up on X, a TD Sequential signal has looked within the 1-hour designate of Bitcoin. The “TD Sequential” refers to a trademark in technical diagnosis (TA) that’s on the whole aged for discovering potential system of reversal in any commodity’s designate.

The TD Sequential involves two phases: setup and countdown. For the length of the principle of these, candles of the identical polarity (that is, whether or no longer red or inexperienced) are counted to 9. After these 9 candles are in, the asset will likely be assumed to hang encountered a turnaround.

Naturally, if the candles leading as much as the setup’s completion were red, the TD Sequential would give a aquire signal for the asset. On the many hand, inexperienced candles would indicate a doubtless reversal towards the design back.

After the setup is over, the countdown segment begins. This 2d segment of the indicator is mighty love the principle one, excluding for the reality that the need of candles to be counted here is thirteen rather then 9. The countdown’s completion implies that the cost has encountered one more likely level of reversal.

A TD Sequential segment of the feeble form has no longer too long ago been performed within the 1-hour designate of Bitcoin. Beneath is the chart shared by Ali that shows this sample in cryptocurrency.

From the graph, it’s visible that TD Sequential has no longer too long ago performed its setup segment with inexperienced candles for Bitcoin. This signal comes as the coin has surged previous the $71,000 level for the principle time since mid-Might per chance even.

This TD setup would indicate that the birthday party could per chance already be over for now as the coin could per chance hang reached a local high, and a reversal to the down course will likely be coming.

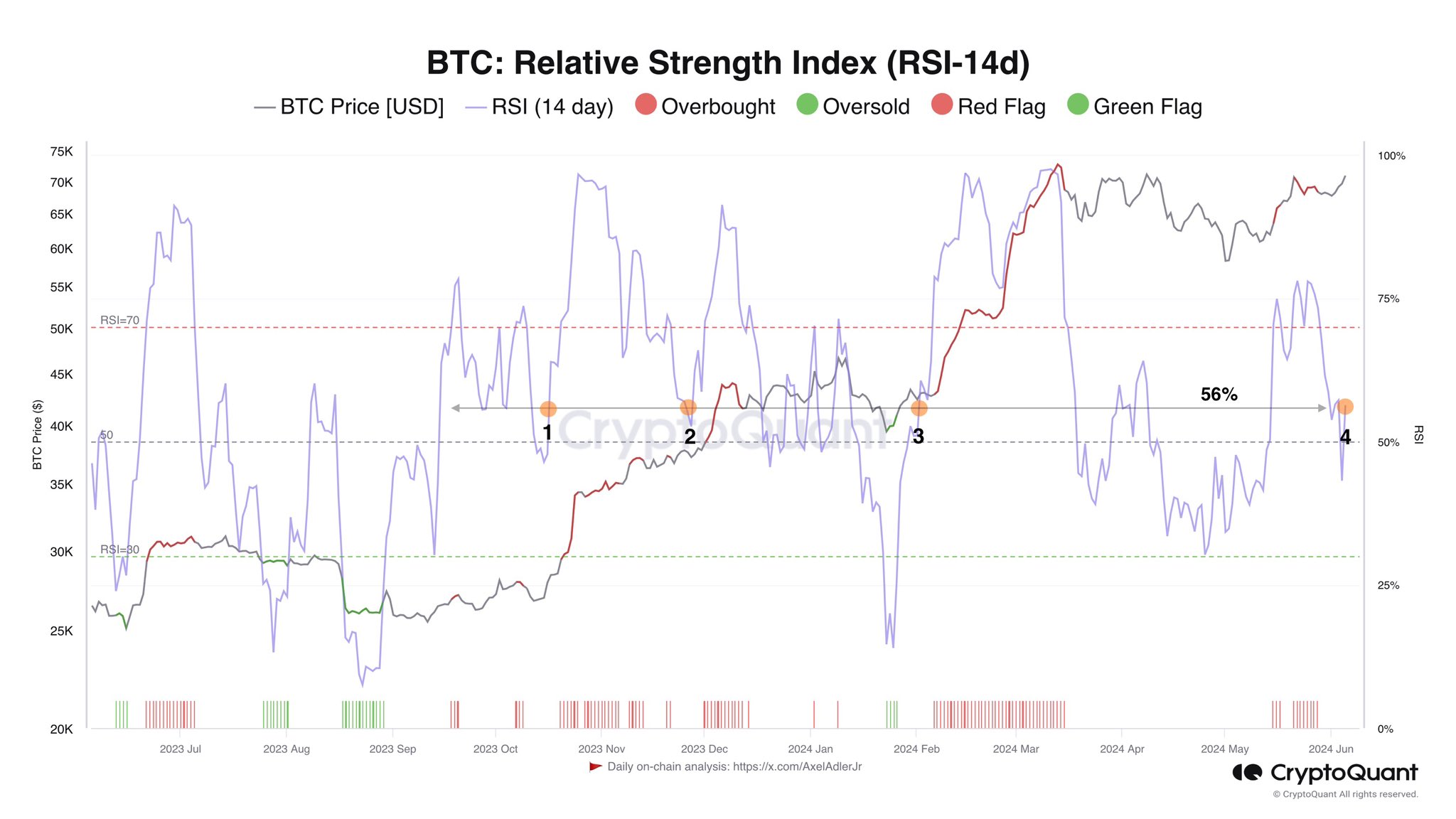

While the TD Sequential could per chance spell a apprehension for BTC within the non everlasting, one more TA indicator could per chance level towards a bullish outcome for the asset as an alternative. As CryptoQuant author Axel Adler Jr has identified in an X put up, the Bitcoin Relative Energy Index (RSI) is at a level the set up most traditional uptrends hang begun.

Most frequently, the cost is believed to be to be undervalued when this metric drops below 30%. Surprisingly, the final three major uptrends in BTC started when the RSI had a worth of 56%. This will likely be a coincidence, nonetheless BTC could per chance gaze a animated surge quickly if it’s really a sample.

BTC Worth

Despite the appearance of the TD Sequential, Bitcoin hasn’t let off yet, as the asset has climbed previous $71,600.