Decentralized alternate for perpetuals buying and selling (perp DEX) JOJO utilized zero-files proof (zk-proofs) skills for funding charges of their platform to withhold perpetual contracts aligned with the situation market costs. In accordance with Jotaro Kujo, JOJO’s co-founder, here’s a conventional trend for on-chain derivatives buying and selling.

JOJO tapped into Brevis zk-proofs skills, which is a coprocessor in a build of abode to read from and form the most of the total historical on-chain files from any chain, and flee customizable computations in a in reality belief-free formula.

“With Brevis’ zk-proofs, we be succesful to plot any calculation essentially based on the transactions, the events, on any block time in any timeframe, and generate proofs validated on-chain. It’s somewhat moral for us on story of we have a extremely originate liquidity layer, which plot that folk can make diversified liquidity structures on top of JOJO and they also are going to moreover have their very catch affect on the get. Which plot if you calculate our charges on-chain, will seemingly be a extremely no longer easy work to plot,” explained Jotaro.

Ensuing from this truth, zk-proofs enable JOJO to calculate the funding charges off-chain and register them on-chain, warding off the very anxious route of of calculating it. The end result is an “ambiance friendly and net” technique to the enterprise.

This trend by JOJO and Brevis is critical given the significance of funding charges to the create of perpetual contracts, highlighted Jotaro. Funding charges withhold the perpetual contracts’ costs tied to the situation market, making them more moral for merchants.

“When our perpetual contract has the next get than the situation, the funding payment will get from the prolonged positions and pay to the rapid positions. So that creates an incentive for oldsters to shut their prolonged positions and originate rapid positions. Which plot folks will sell the perpetual contract and originate to amass, dumping the get and making the perpetual get aid to the the same because the situation get.”

As a end result, this mechanism encourages the arbitrageurs and the merchants to form de perpetual get withhold following the situation get. With out a funding payment, the perpetual contract is “lawful a shitcoin” and doesn’t form sense, added Jotaro.

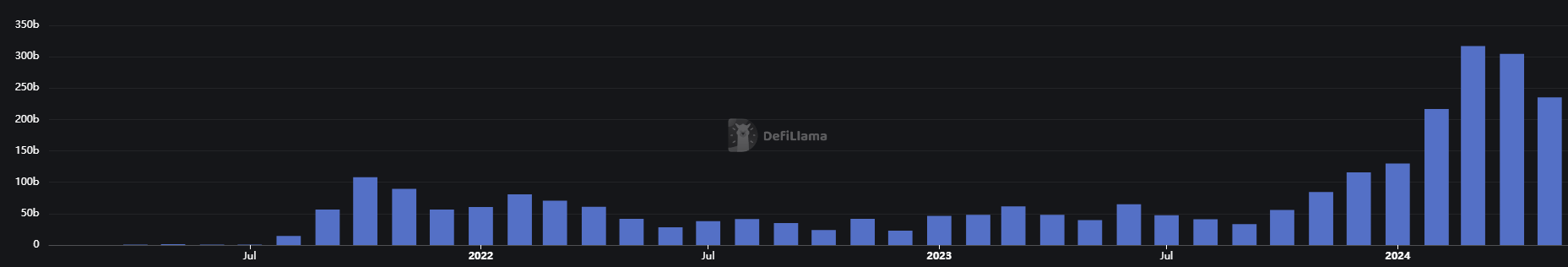

No topic a month-to-month 23% fall, the buying and selling volume of on-chain derivatives is mute at its top probably phases. The late increase of this decentralized finance sector is dependent upon capital effectivity, Jotaro stated, and developments comparable to moral funding charges are indubitably one of the standard contributions to this enterprise’s enlargement.

“The funding payment is extremely critical for decentralized exchanges, and we must calculate it efficiently, but on the the same time in a net formula. And now we watch different other exchanges showing that they calculate the final payment by centralized oracles. Effectively, that’s no longer the lawful formula to plot it, even if they’ll have faced some transient difficulties with the on-chain calculation. We deem this zk-proof model can form the on-chain derivatives advance loads, so we are able to form it verifiable by anybody.”