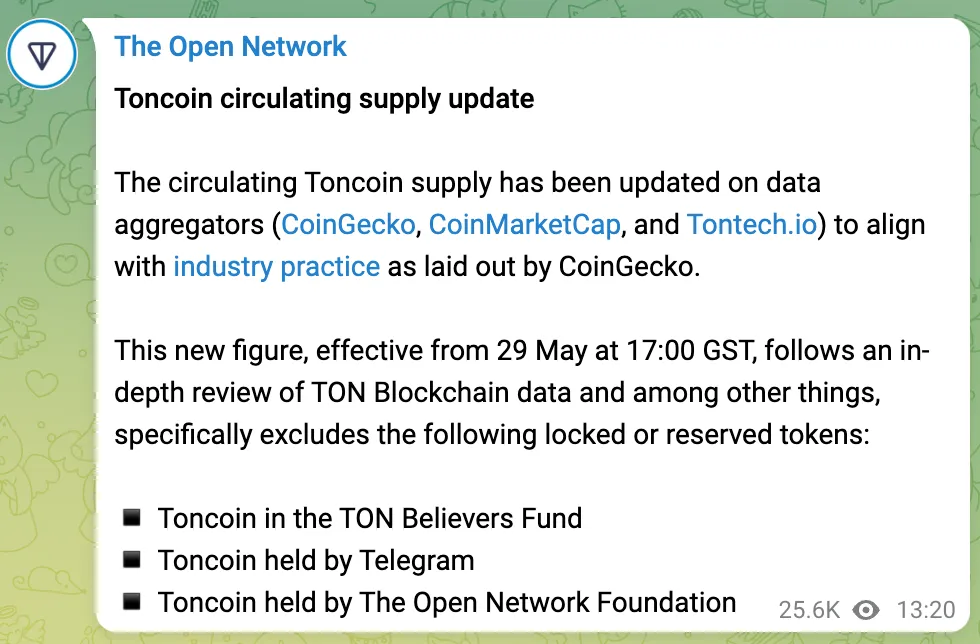

In a Telegram message on Wednesday, the mission urged users that data aggregators would tune the coin’s market capitalization differently spicy ahead. They would exclude Toncoin held by Telegram, The Commence Network Foundation, and the TON Believers Fund, it acknowledged.

As the swap went effective, Toncoin’s market capitalization dropped better than $7 billion instantaneously, in step with CoinGecko data. Within the period in-between, the cryptocurrency Cardano (ADA) reclaimed its location because the 10th most treasured cryptocurrency, currently valued at $15.8 billion. TON, as of this writing, isn’t very a ways at the motivate of at about $15.6 billion.

The facts reported by CoinGecko will be linked to tontech.io, among assorted stats. In its message, The Commence Network acknowledged the factitious to TON’s circulating supply used to be made to align with “alternate be conscious” and followed an in-depth overview of the TON blockchain’s data.

As of this writing, it used to be unclear what entity manages tontech.io. Nonetheless, the procure page does consist of a hyperlink directing users to ton.org, where the neighborhood accountable for TON is broken down into the TON Foundation, TON Society, and several assorted subgroups.

After TON flipped ADA earlier this week, participants of the Cardano neighborhood wondered how TON would possibly perchance hang its tag following its tall tumble in market cap. Chris O’Connor, co-founding father of the DAO Cardano Ghost Fund, then claimed on Twitter (aka X) that The Commence Network had been “caught crimson handed [while] artificially pumping” its market capitalization.

The Commence Network did not at as soon as acknowledge to a quiz for commentary from Decrypt.

As competing layer-1 ecosystems, the stress between TON and ADA captures how projects price their portrayal by data aggregators, including CoinMarketCap. Amid 14,500 cash tracked by CoinGecko, to illustrate, a high-ten location is extremely coveted.

The U.S. Securities and Commerce Price brought charges against Telegram in 2020 over the Telegram Commence Network. The regulator accused the messaging app of violating securities prison pointers by providing the network’s native token “Grams,” securing an $18.5 million civil penalty alongside $1.2 billion in funds returned to merchants.

The Commence Network these days is built the spend of skills designed by Telegram, even supposing the mission used to be not at as soon as persevered by the open air neighborhood of builders after Telegram abandoned it in 2020.

Nonetheless, Telegram has more openly embraced TON over the last several months. Final September, the messaging platform acknowledged it had adopted TON as its “legitimate Web3 infrastructure.” That same month, the TON Foundation offered its registration as a Swiss non-profit group. These days, Telegram has began the spend of TON to allotment channel ad income with users.

All around the last twelve months, TON’s tag has skyrocketed better than 240% to $6.49. And the asset’s tag has been bolstered lately by the recognition of Notcoin (NOT), a Telegram-primarily primarily primarily based sport and cryptocurrency where users were rewarded for many situations tapping a digital gold coin.