Render (RNDR) is poised to interrupt above the higher line of an ascending triangle in continuation of its most most modern uptrend.

Logging a 10% trace hike in the last two days, the bulls can push above this resistance degree if the most modern customary market vogue is sustained.

Render Also can Face Some Difficulties

Render’s double-digit trace rally in the previous 24 hours would possibly perchance well well perhaps seek a pullback as one of the most most token key indicators showed that bearish influence stays dominant.

At press time, the dots that invent up RNDR’s Parabolic SAR indicator exceed its trace. This indicator identifies seemingly vogue course and reversals in the token’s trace.

When its dots are above an asset’s trace, the market is claimed to be in decline. This means that that the asset’s trace has been falling and would possibly perchance well well perhaps continue to arrangement so. Market participants train this as a trace to exit long positions and originate rapid positions.

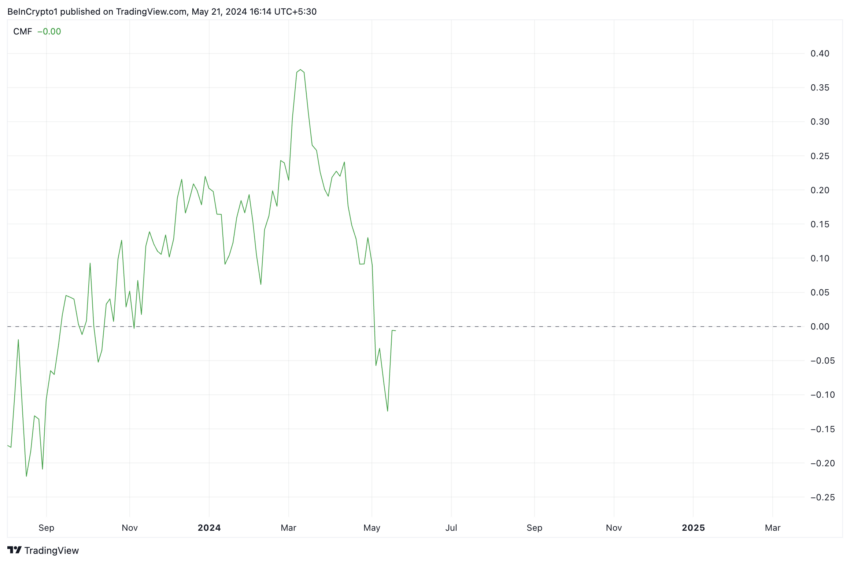

Also, the worth of RNDR’s Chaikin Cash Float (CMF) used to be -0.01 on the time of writing. This indicator measures cash mosey along with the high-tail into and out of the RNDR market.

Learn Extra: Render Token (RNDR): A Manual to What It Is and How It Works

A bearish signal, indicating a weakening uptrend or a growing downtrend, appears to be like to be when its worth falls beneath zero

RNDR Mark Prediction: Destructive Sentiments Meet Excessive MVRV Ratio

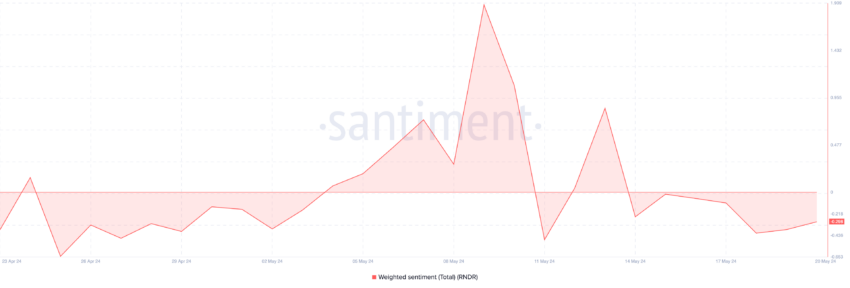

The dejected sentiment presently trails RNDR is depicted in its detrimental weighted sentiment spotted on-chain. Subsequently, at -0.29 at press time, this metric exhibits a dominant detrimental bias in the on-line discourse surrounding the asset.

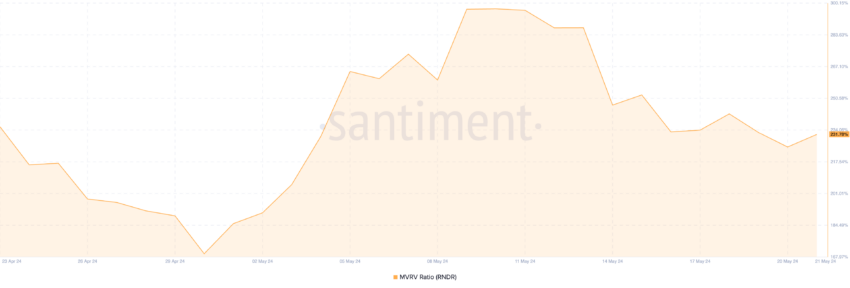

This detrimental sentiment comes at a time when the token’s Market Fee to Realised Fee (MVRV) ratio is high. As of this writing, this used to be 231.78%

A high MVRV ratio already suggests a seemingly correction if the trace turns into unsustainable. Which means that of this truth, a detrimental sentiment reinforces this grief, highlighting seemingly selling rigidity that can perhaps well perhaps drive the trace down.

Conversely, if selling rigidity positive aspects momentum, the token would possibly perchance well well perhaps procure it impossible to interrupt above the higher line of the ascending triangle and tumble in direction of $9.8.

Learn Extra: Render Token (RNDR) Mark Prediction 2024/2025/2030

On the opposite hand, if this bearish projection is overturned, the token’s trace would possibly perchance well well perhaps exceed $12.