Space Bitcoin alternate-traded funds (ETFs) within the US registered $1.3 billion in inflows throughout the last two weeks, shared Bloomberg ETF analyst Eric Balchunas on X. This changed into passable to gain greater entirely from April’s obtain outflows of over $343 million.

The Bitcoin ETFs traded within the US now defend greater than $12.3 billion below management, which Balchunas considers a key number for thinking about inflows and outflows.

The bitcoin ETFs personal place apart together a stable two weeks with $1.3b in inflows, which offsets everything of the adverse flows in April- striking them relief around excessive water designate of +$12.3b obtain since birth. This key number IMO bc it nets out inflows and outflows (which are standard) pic.twitter.com/tdnZOKEocM

— Eric Balchunas (@EricBalchunas) Might perchance well 17, 2024

Furthermore, Balchunas highlighted that those numbers develop some degree of no longer getting “emotional” over Bitcoin ETF flows, sharing his perception that the on-line flows will flip out as certain within the long time frame and that the drift amounts are pretty tiny when put next to the total below management.

As reported by Crypto Briefing, legit investment companies confirmed a excessive curiosity in Bitcoin ETFs within the first quarter, with 937 of them reporting publicity to those investment instruments of their 13F Kinds.

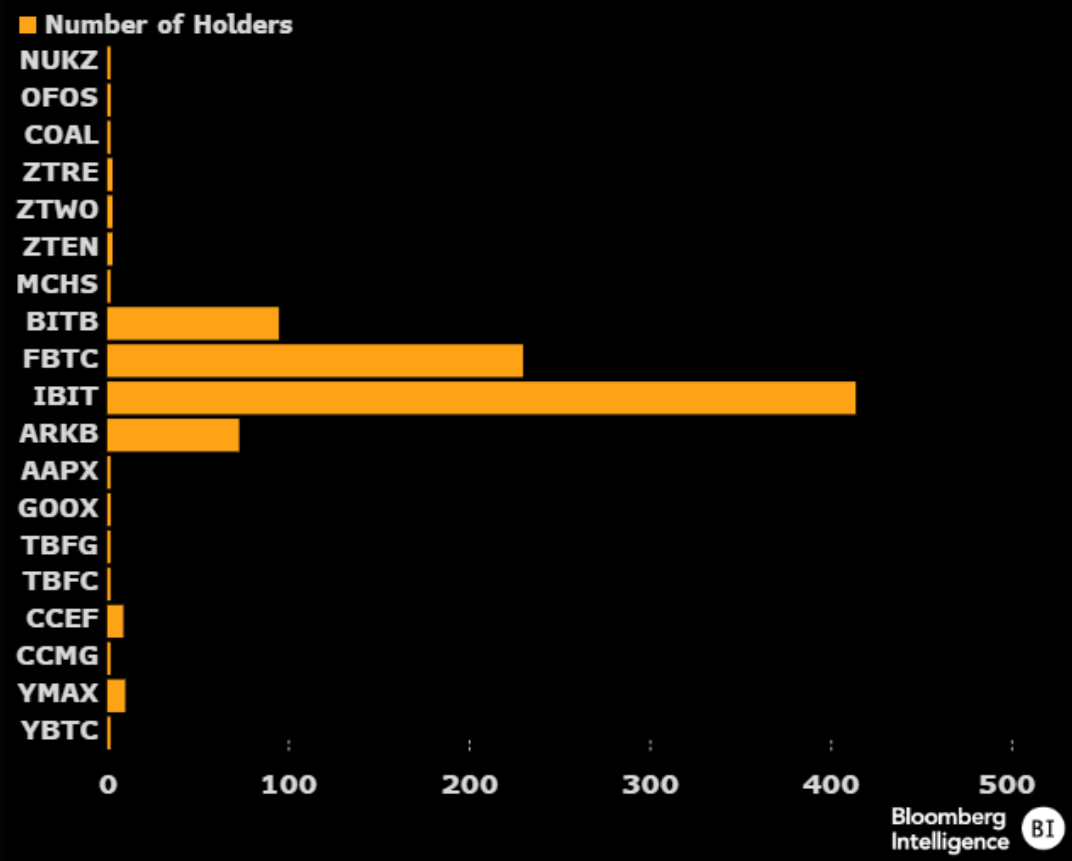

Balchunas doubled down on that, highlighting that BlackRock’s IBIT got 414 reported holders in Q1. He provides that having 20 holders for a lately launched ETF is “extremely rare,” showing that no lower than four Bitcoin funds surpassed that designate with ease.

In the last 24 hours, 9 Bitcoin ETFs within the US added 3,743 BTC to their holdings, as reported by X user Lookonchain, which is an such as over $250 million. Grayscale’s GBTC added 397 BTC, whereas BlackRock’s IBIT added 1,435 BTC.

Galaxy’s BTCO changed into the glorious Bitcoin ETF showing day-to-day obtain outflows, with 543 BTC leaving their chest.

Regulatory actions

Furthermore, most up-to-date regulatory traits within the US can also warmth up even more the Bitcoin ETF panorama. The earlier day, the Senate passed a vote to overturn the SEC’s Group Accounting Bulletin No. 121 (SAB 121), which makes it more dear for banks to defend up digital assets for their clients.

Nonetheless, US President Joe Biden has already manifested himself contrary to the bill, and a presidential veto is amazingly seemingly.