- Bitcoin mark is up practically 5% to impress $65,000, a level closing tested on Can also simply 6.

- CPI describe reveals inflation eased in April, falling to 3.4% after March studying at 3.5%.

- Core CPI got here in at 3.6% vs. 3.8% closing month, both aligning with expectations and clearly bullish for BTC.

Bitcoin (BTC) mark jumped by 5% on Wednesday, seeing the American session outperform the Asian session for the first time quickly. Tailwinds sprouted fron US inflation release.

On each day foundation digest market mover: CPI describe reveals inflation eased in April, Bitcoin jumps 5%

Bitcoin mark confirmed energy on Wednesday after the April inflation studying by the US Bureau of Labor Statistics (BLS).

Per the describe, inflation has declined from 3.5% to 3.4% on a yearly foundation in April, measured by the change in the User Ticket Index (CPI). Right here is in accordance to what markets anticipated. The annual core CPI furthermore dropped from 3.8% to 3.6% in the same duration.

#Bitcoin has pumped +3.5% since the CPI recordsdata for April printed some diminutive easing by inflation. pic.twitter.com/6MuMzSTmDM

— Satoshi Stacker (@StackerSatoshi) Can also simply 15, 2024

Economist and global strategist Peter Schiff says, “…all financial and numerous recordsdata point to principal better CPI will enhance in the long flee,” adding, “If the Fed desires a bogus excuse to reduce charges, traders are hoping this qualifies.”

There may be nothing to rejoice about at the current time’s April #CPI release. Up .3% annualizes to an #inflation price near 4%. However all financial and numerous recordsdata point to principal better CPI will enhance in the long flee. If the #Fed desires a bogus excuse to reduce charges, traders are hoping this qualifies.

— Peter Schiff (@PeterSchiff) Can also simply 15, 2024

On the assorted hand, with the surge in the Bitcoin mark, fifty three,079 traders occupy been liquidated, Coinglass experiences, adding that the total liquidations are accessible in at $120.55 million.

The surge in Bitcoin mark is ascribed to hypothesis and market sentiment. Merchants and traders interpret the news of softened inflation as a tag that central banks may maybe well presumably lend a hand free monetary protection, which may profit riskier resources worship Bitcoin.

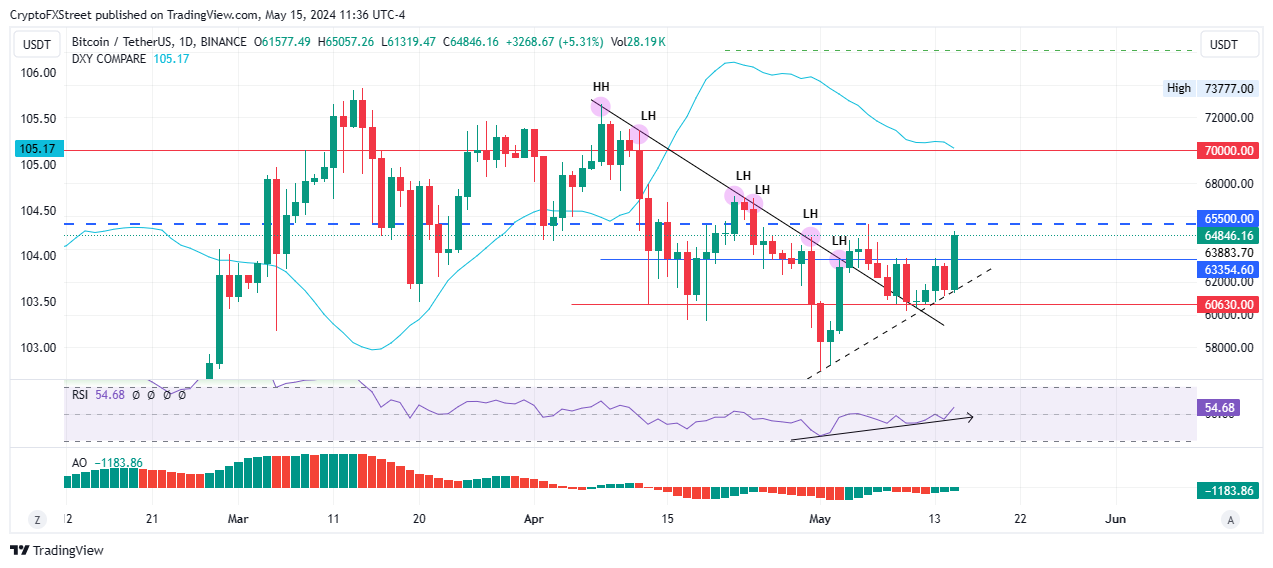

Technical diagnosis: Bitcoin mark must document an exact conclude above $65,500 for market construction change

Bitcoin mark has recorded a god candle in the one-day timeframe. Right here’s a enormous green candle, signaling a bullish pattern because it represents sturdy shopping tension. It comes after a sequence of decrease highs, which methodology the continuing rally may maybe well presumably culminate in a transformation in market construction.

For this to happen, nonetheless, Bitcoin mark must spoil and conclude above $65,500 on the one-day time body. The Relative Strength Index (RSI) is furthermore posting higher lows, suggesting rising bullish momentum. This coupled with the Awesome Oscillator (AO), whose histogram bars are green and pulling toward particular territory, suggests bullish sentiment is rising.

Further, the DXY Compare indicator continues to nosedive, which is interpreted as traders being extra provocative to device conclude on riskier resources worship Bitcoin as soon as they gaze much less uncertainty in the US dollar (USD).

BTC/USDT 1-day chart

Conversely, a rejection from the $65,500 threshold may maybe well presumably trigger a retraction in Bitcoin mark. A experience below $60,630 would assist dread promoting, doubtlessly sending BTC decrease to $58,000 or, in a dire case, the Can also simply 1 lows of $56,552. This would denote a tumble of practically 13% below recent stages.