Dogecoin (DOGE) seems poised to search spherical out a decline in cost as bullish stress begins to wane.

The elevated volatility noticed within the coin’s market locations it at risk of serious brand swings. Particularly downward, as search data from for the meme coin declines.

Dogecoin Holders Can’t Conceal Their Pessimism

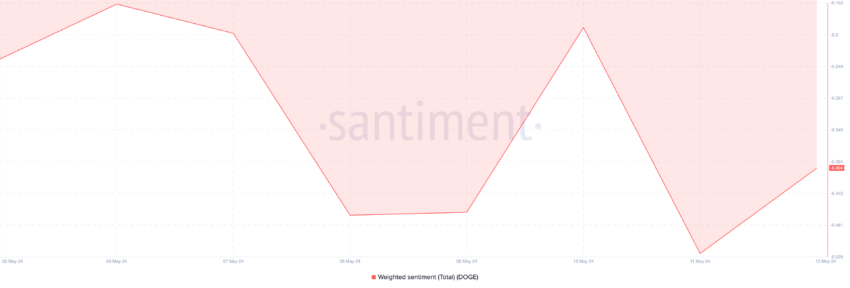

Whereas DOGE’s brand has risen by 7% within the previous 24 hours, it continues to be trailed by antagonistic weighted sentiment. As of this writing, the coin’s Weighted Sentiment returned a worth of -0.404. This metric has returned a antagonistic cost since Can even 5.

An asset’s Weighted Sentiment measures the overall market sentiment surrounding it. The metric improves upon the easy sure and antagonistic sentiments by entertaining about the significance of every sentiment talked about.

When it returns a antagonistic cost, the asset’s market is overwhelmed by antagonistic sentiment. Its brand is therefor expected to plunge. Conversely, when the cost is sure, the bulls are as a lot as the set up.

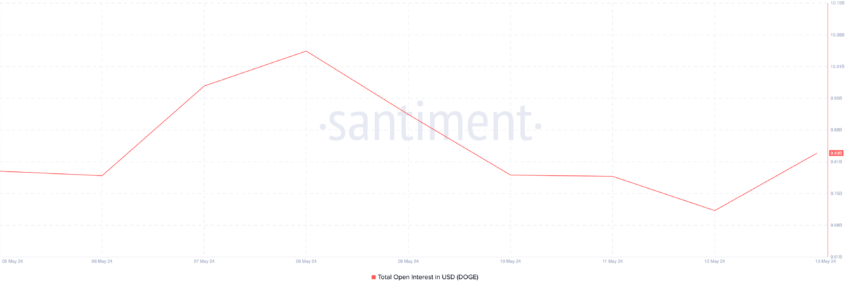

The bearish development within the DOGE market is confirmed by the actual fact that its futures market beginning hobby across exchanges has trended downward since Can even 8. At $9.83 billion at press time, it has since fallen by 7%.

Read Extra: Dogecoin (DOGE) Mark Prediction 2024/2025/2030

DOGE’s futures beginning hobby refers again to the full series of its futures contracts that believe yet to be settled or closed. When it declines in this scheme, it indicates an increase within the series of market contributors exiting their alternate positions with out opening new ones.

DOGE Mark Prediction: A Decline Ahead

As of this writing, DOGE is procuring and selling on the red meat up stage of $0.15. Its Parabolic SAR indicator, as noticed on a weekly chart, rests above its brand, hinting on the assorted of a breach below this stage.

This indicator is historical to title capability development direction and reversals. When its dotted lines are placed above an asset’s brand, the market is acknowledged to be in decline. It indicates that the asset’s brand has been falling and must proceed.

If these bearish projections retain, the meme coin’s cost might well well presumably dip below $0.1 to bring together red meat up at $0.08.

The widening gap between the upper and decrease bands of its Bollinger Bands indicator heightens the risk of this vital brand swing, as it signals the recount in market volatility.

Nonetheless, if the bulls get grasp of build watch over and DOGE’s brand swings in an uptrend, it will also provoke a rally toward resistance at $0.17.