A lengthy-standing Ethereum investor known by their pockets address 0x2ce honest no longer too lengthy within the past transferred a predominant amount of Ethereum (ETH) to Coinbase.

This jog eager 4,153 ETH, valued at roughly $12.17 million, in accordance to the most up-to-date alternate charge of $2,931 per ETH.

Are Prolonged-Interval of time Ethereum Traders Cashing Out?

In the beginning, 0x2ce sent the funds to an intermediary pockets – 0x1d9, before the closing switch to the centralized alternate, Coinbase. Such movements to platforms like Coinbase on the complete hide a understanding to sell, contrasting with withdrawals to self-custody wallets, which counsel an intent to respect.

Concerning profitability, in accordance to the on-chain evaluation platform Sing On Chain, the crypto whale has realized sizable gains. He within the beginning obtained 12,423 ETH from Poloniex at a mean cost of ideal $11.03 per ETH, amounting to an estimated total of $137,000 between July 26 and August 8, 2016.

Since that preliminary acquisition, this investor has deposited 9,436 ETH to exchanges like Coinbase and Luno at a mean tag of $2,245, totaling about $21.2 million.

“The crypto whale soundless holds 2,566 ETH ( ~ $7.forty eight million) in a sub-pockets 0x2e3,” Sing On Chain talked about.

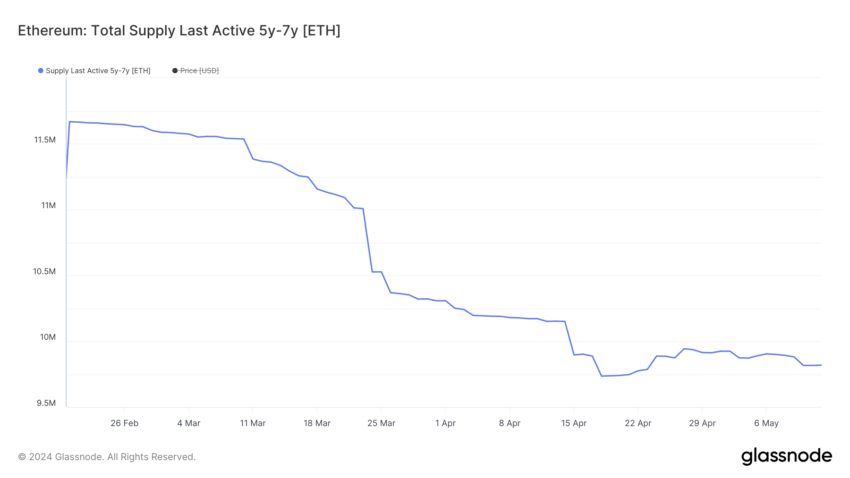

This transaction is fragment of a broader sample observed amongst Ethereum lengthy-timeframe holders. Files from the on-chain evaluation platform Glassnode unearths a decline within the complete present of ETH that had remained unmoved for five to seven years. Specifically, this metric has lowered by over 15%, dropping from 11.6 million ETH tokens at some stage in leisurely February to the most up-to-date 9.8 million ETH.

Read extra: Ethereum (ETH) Label Prediction 2024/2025/2030

No topic this trend of broad-scale disposals, consultants stay optimistic about Ethereum’s market outlook. Hitesh Malviya, the founding father of the on-chain evaluation platform – DYOR, facets out plenty of determined signals.

“ETH is terminate to finding a backside,” Malviya talked about.

These determined signs include the sexy tag mannequin on DYOR, which honest no longer too lengthy within the past modified into bullish. Moreover, the TVL (Total Price Locked) to market cap ratio has elevated by 16.91% within the closing 30 days, and the moderate on-chain seek recordsdata from has begun to upward thrust.